More Australians are choosing ‘rentvesting’ as an alternative route to homeownership, a recent Mozo analysis shows.

Rentvesting involves purchasing an investment property as your first home while continuing to rent elsewhere.

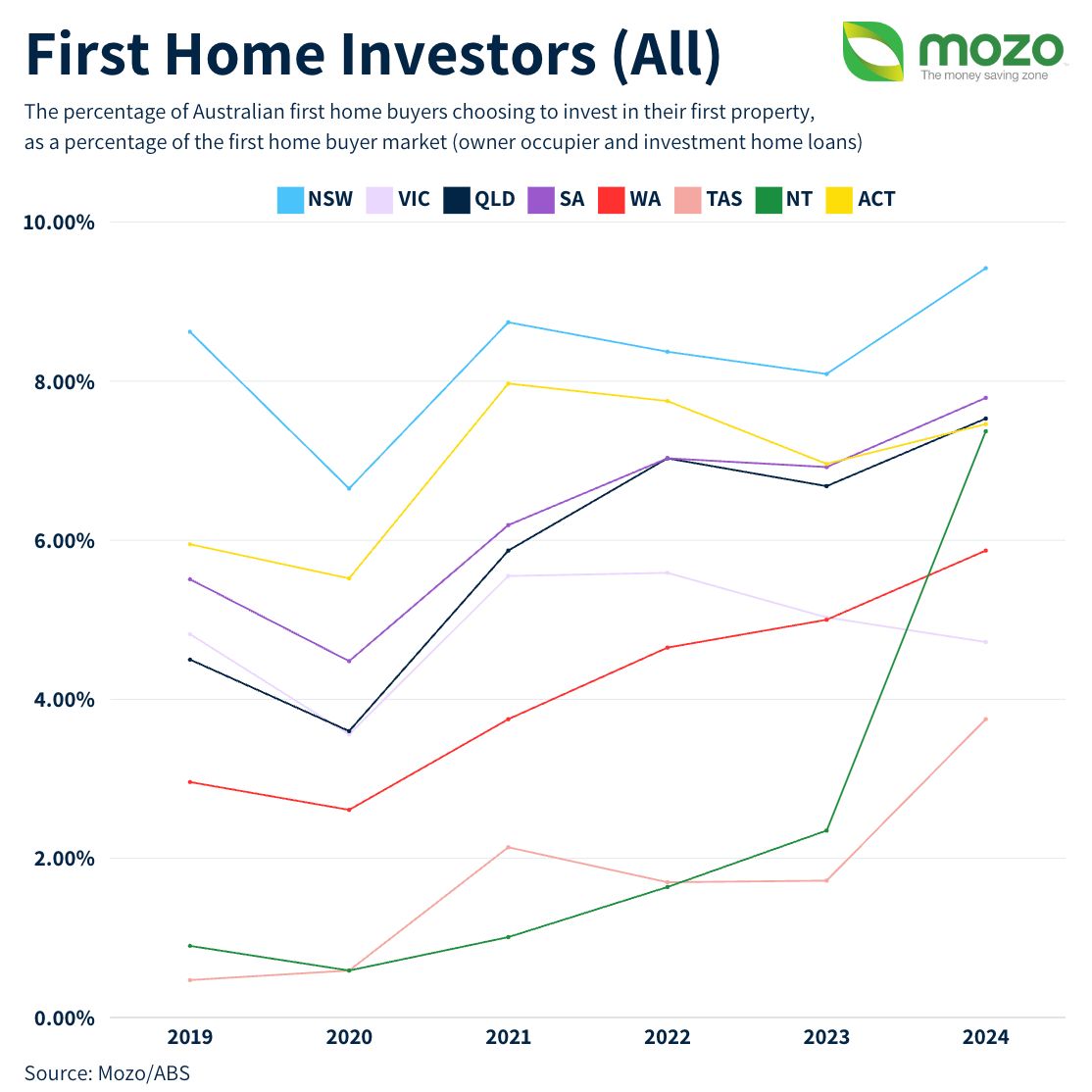

Mozo’s examination of the latest Australian Bureau of Statistics lending data shows a 25% increase in first home buyers opting for investment home loans since July 2019.

Back then, only 5.54% of first home buyers were investors. But fast-forward to July 2024, this figure rises to 6.85%.

As the graph below shows, New South Wales, Queensland, and South Australia have the highest share of people choosing to invest for their first property rather than occupy it.

Rentvesting has its benefits, including:

* Flexibility to live where you prefer while investing where you can afford.

* Potential for rental income to cover some of your loan repayments.

* Opportunity to build wealth and benefit from potential property value increases.

.. and drawbacks, including:

* Missing out on first home buyer grants and stamp duty concessions.

* Potential risks and costs associated with being a landlord.