Unit owners are holding onto their properties longer due to weak capital gains and rising transaction costs, according to a report in the Australian Financial Review (AFR).

CoreLogic data shows unit owners now stay put for 8.6 years on average, a six-month increase since interest rates began rising two years ago. This trend contrasts with houses, where the hold period has shortened by three months to 9.1 years, driven by strong price growth.

CoreLogic’s head of research Eliza Owen explained to the AFR that unit owners, particularly in high-end inner-city markets, may be waiting for better capital growth before making a move.

Units have seen modest price increases, with values rising only 15.1% since the pandemic, compared to a 40.6% surge in house prices.

“Those who want to upgrade may not make enough on the sale to buy a bigger property if their unit has not increased in value,” she said.

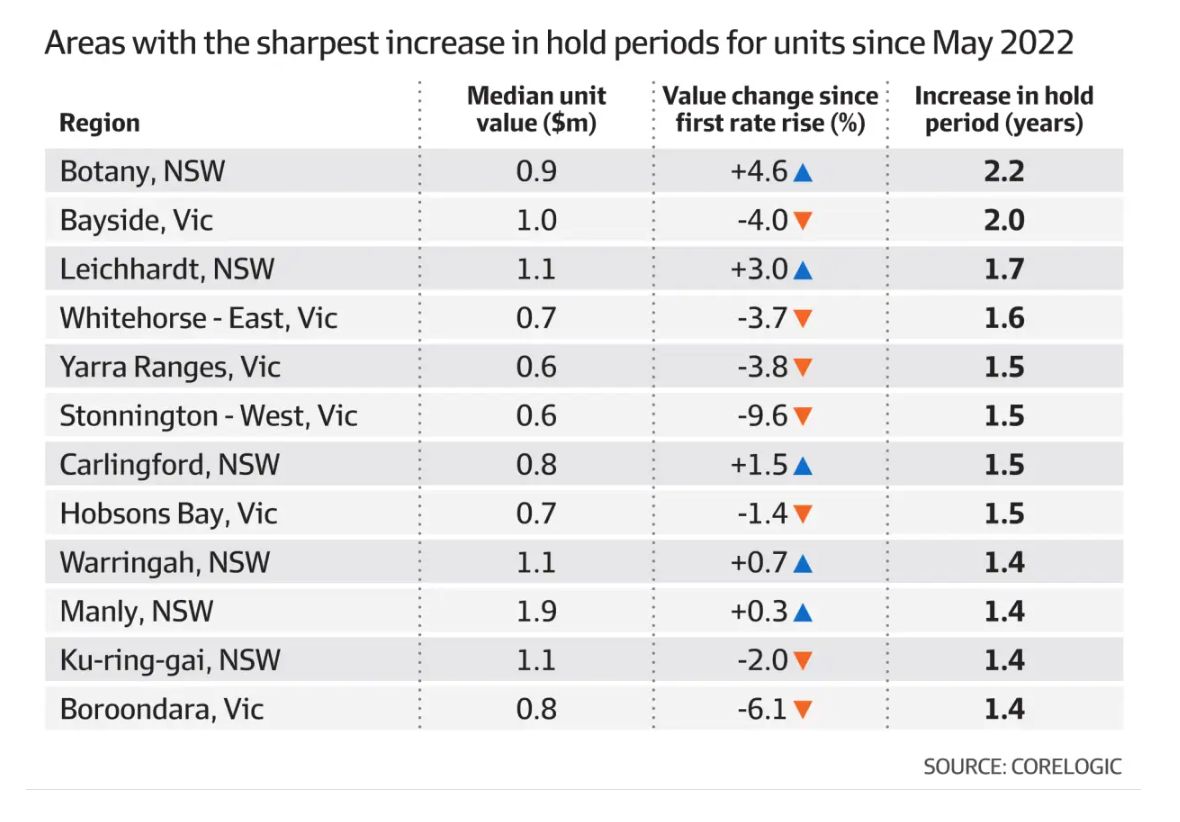

The below AFR chart shows the areas with the sharpest increase in hold periods for units since May 2022.