Westpac has lowered select fixed-rate home loans by up to 0.80% p.a., making it the second major bank to do so in the past month. Fixed interest rates at Westpac now start at 5.89% p.a. for owner-occupiers with a loan-to-value ratio (LVR) of up to 70%.

The specific reductions include:

• 1-year term reduced to 6.09% p.a.

• 2-year term reduced to 5.89% p.a.

• 3-year term reduced to 5.89% p.a.

• 4-year term reduced to 5.89% p.a.

• 5-year term reduced to 5.89% p.a.

These changes mean that most of Westpac’s fixed rates are now below 6%, which could make these loans more attractive to borrowers. However, to qualify, borrowers must meet certain conditions, including an LVR of 70% or less and an annual fee of $395.

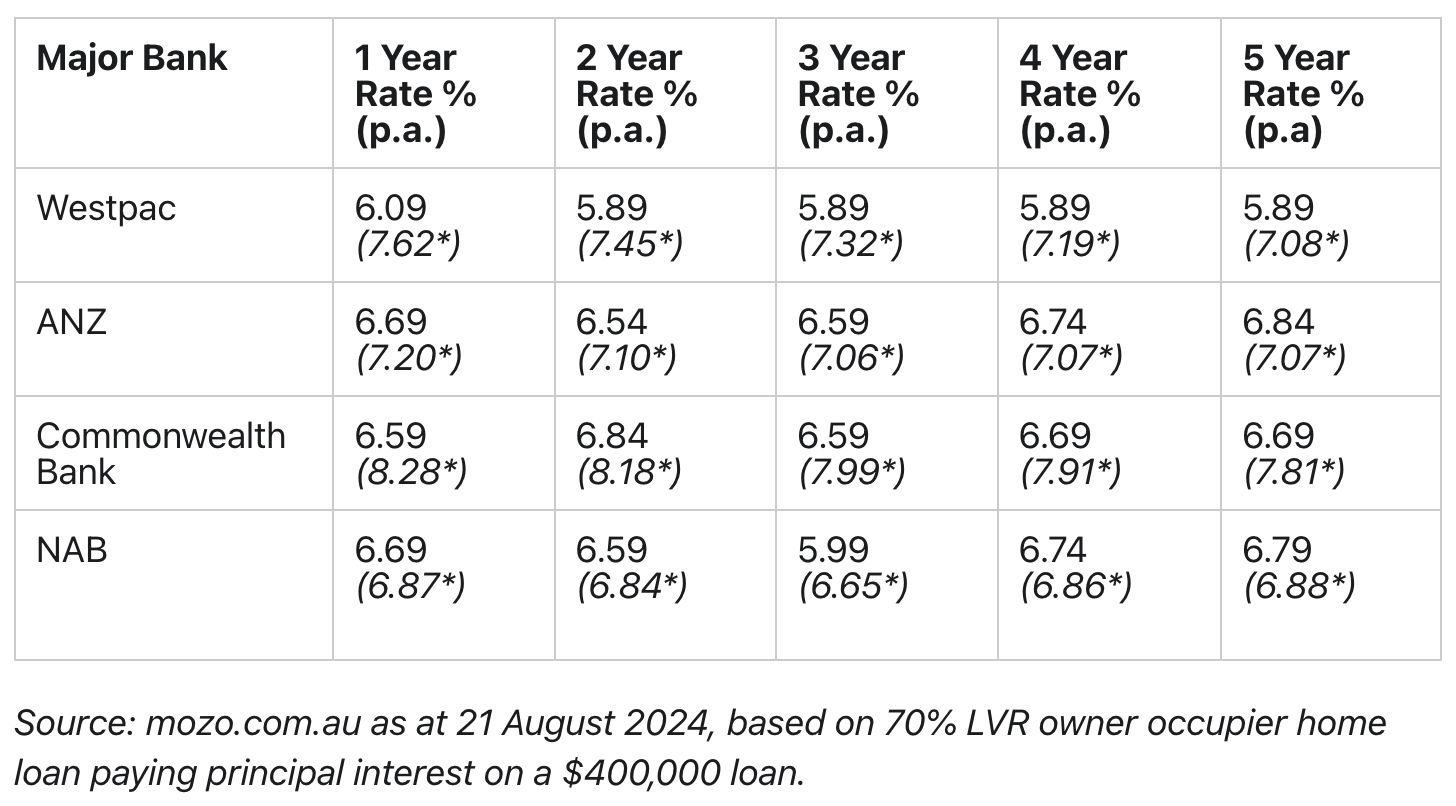

See a snapshot of fixed-rate home loans from the big four banks below.

As Rachel Wastell from Mozo notes, “The downward trend for fixed rates is making these home loan products increasingly attractive for mortgage holders.” However, she cautions that “borrowers need to consider the impact of locking in a comparably ‘low’ rate now, given the RBA is predicted to start cutting the cash rate in the next year.”

While locking in a fixed rate offers protection against potential rate hikes, there is also the risk of missing out on savings if rates decrease. Borrowers are advised to carefully compare their options before making a decision.