The Australian home loan landscape continues to be dominated by the Big Four Banks: Commonwealth Bank, NAB, ANZ, and Westpac, which collectively issue the majority of home loans across the country.

While these banks are well-known and widely used, it is crucial to note that they do not always offer the most competitive interest rates. Since May 2022, all four institutions have responded to the Reserve Bank of Australia’s monetary policy by increasing their variable interest rates a total of 4.25% p.a., affecting owner-occupied properties.

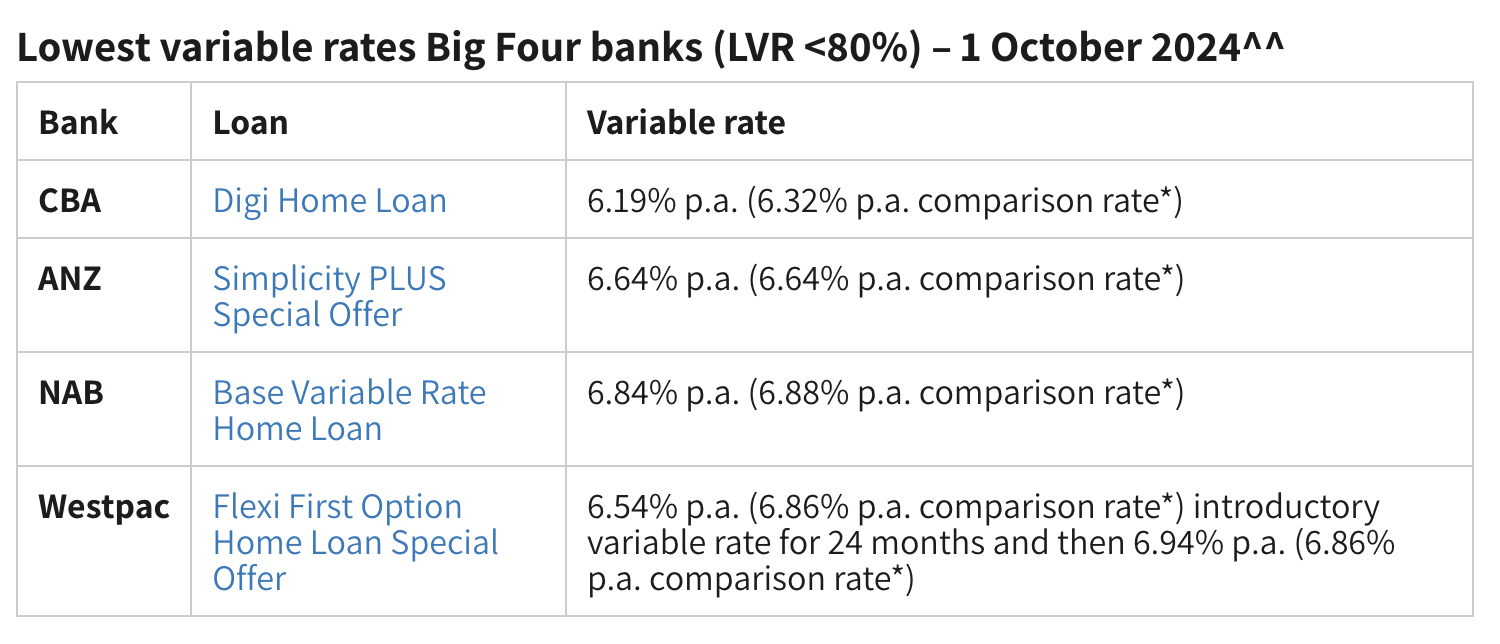

This raises the question: If you have a home loan with one of the Big Four, is there an opportunity to save? A recent comparison of home loan rates reveals that smaller lenders often provide lower interest rates than the major banks.

Current trends among the Big Four indicate a shift in their approach. We are seeing movements such as the raising or elimination of introductory interest rate discounts for new customers, small out-of-cycle rate adjustments, and the removal of special offers like refinancing cashback.

As you evaluate your options, it may be worthwhile to explore offers from smaller lenders, especially if you’re looking for more competitive rates.