A recent report from Helia, based on research by CoreData, reveals the growing impact of cost-of-living pressures on aspiring home buyers in Australia.

Rising inflation has significantly hindered individuals’ ability to save for home deposits. The Australian Bureau of Statistics reported a 3.8% increase in the consumer price index over the 12 months to June 2024, with housing being a notable contributor at 1.1% in the June quarter.

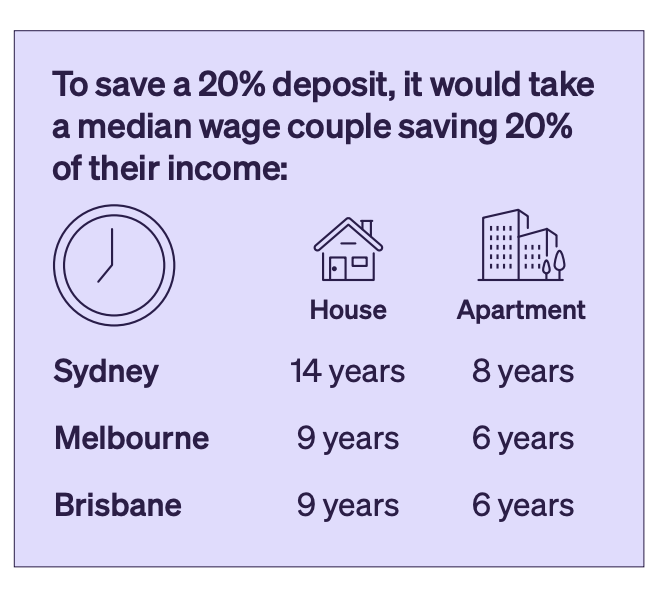

Currently, 54% of respondents cite “cost of living pressures” as the primary barrier to home ownership, surpassing concerns about housing affordability (43%) and finding suitable properties (42%). Many first-home buyers (FHBs) struggle to save, with 24% saving less than 10% of their take-home pay. For a household earning $65,000 each, it would take nearly 14 years to save a 20% deposit for a median-priced house in Sydney.

The willingness of FHBs to save a full 20% deposit has dropped to 15%, while 36% are now targeting deposits of 10% to 14%. In response, 70% of home buyers consider properties in different areas, particularly outer suburbs.

Despite these adaptations, housing affordability remains a significant hurdle, exacerbated by ongoing cost-of-living challenges. It’s crucial to stay informed about available options and market conditions.