The Reserve Bank of Australia has highlighted a concerning rise in the number of homes being sold due to financial distress, as sustained high interest rates continue to pressure borrowers. Despite this, higher property prices are providing some cushioning for many, reducing the financial impact for those forced to sell.

Assistant Governor Chris Kent explained that “borrowers experiencing persistent difficulties servicing their mortgages, and with no further options to adjust their finances, may decide to sell their homes.” He noted that, while these decisions are undoubtedly difficult, most borrowers are not facing negative equity, which has eased some of the financial strain.

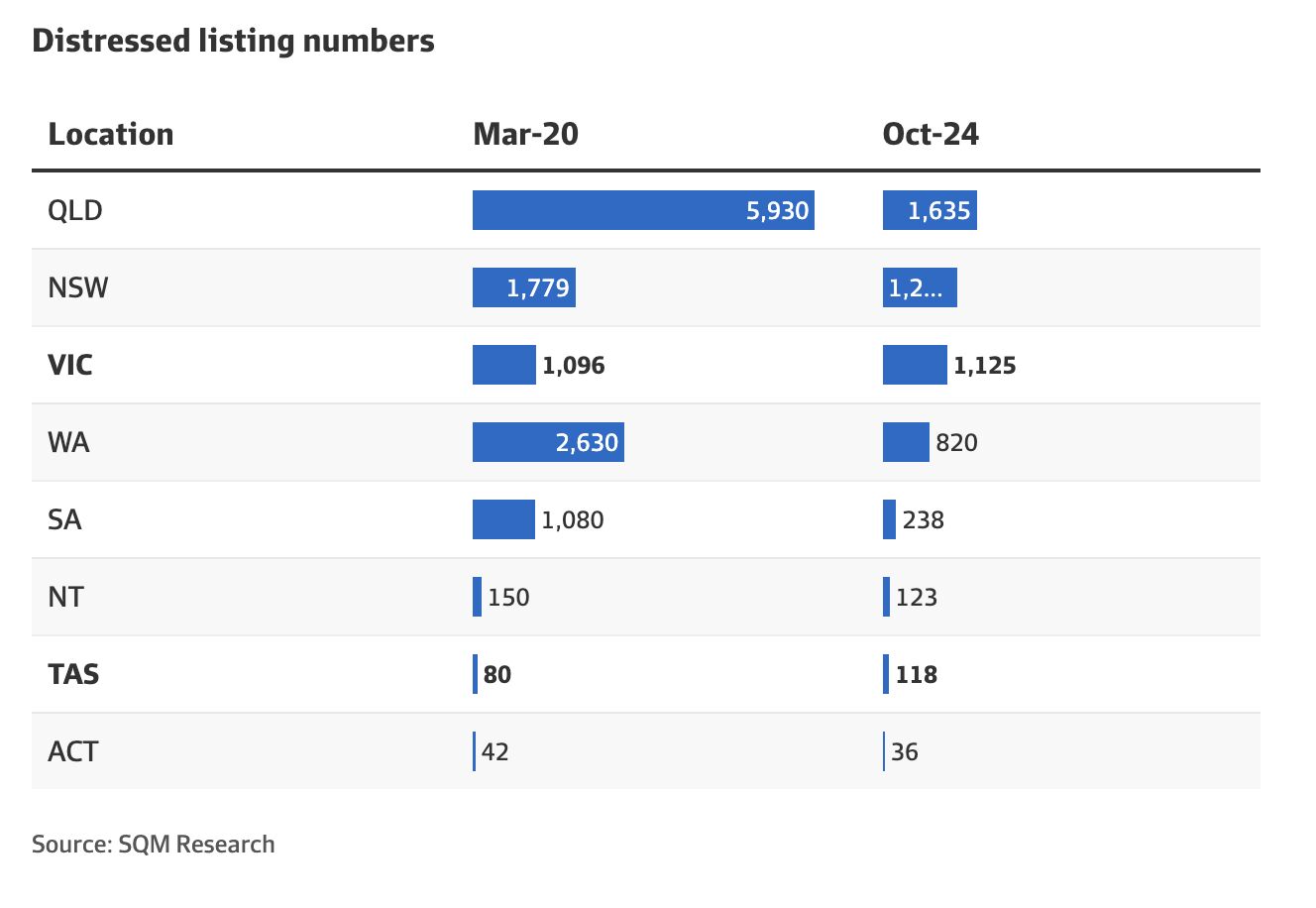

Distressed property listings remain most concentrated in Queensland, particularly around the Gold Coast, according to SQM Research. Victoria’s hotspots include Melbourne’s CBD, the city’s southeast, and Gippsland, while northern NSW and western Sydney have also seen higher activity.

In southeastern Melbourne, sales agent Marcus Washington noted a slight increase in distressed listings since mid-year. However, he observed divorce as a more common reason for sales than financial distress in some cases. Mortgagee sales, where lenders take control of properties, are also rising, though unevenly across regions.

Interestingly, capital growth during the pandemic has helped many owners build equity, which some leverage to prepare properties for sale or transition to renting. Ray White Burleigh Group CEO Tiger Malan explained that this has enabled some borrowers to navigate challenging circumstances by borrowing against their home’s value to fund necessary preparations.

The situation underscores the complex dynamics of Australia’s property market, where rising costs are met with varying degrees of resilience across regions and demographics.