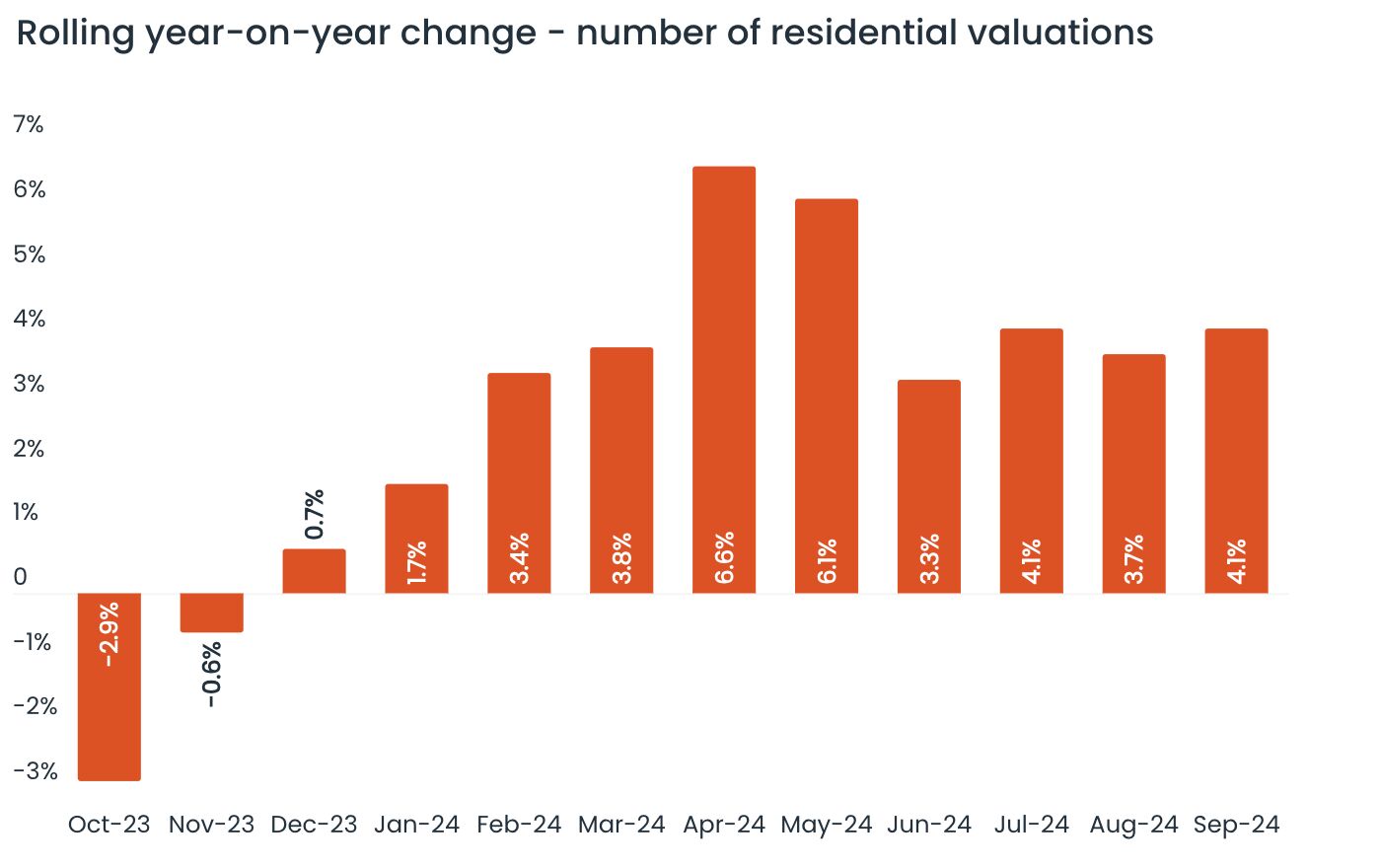

Australia’s property market in 2024 proved resilient, with valuation volumes climbing 4.1% year-on-year despite softening conditions. As we move into 2025, the market offers a mix of challenges and opportunities, influenced by interest rates, inflation, and evolving buyer behaviour.

Refinancing remains a standout driver of valuation activity, accounting for 35% of all new lending as of September 2024. CoreLogic data highlights a steadying trend after refinancing peaked at $21 billion in March 2023, levelling off to $16 billion. This trend is expected to persist into 2025, as borrowers may look to lock in current property values amid potential interest rate reductions.

In contrast, purchasing-related valuations face challenges. Higher interest rates and affordability constraints have softened buyer sentiment, leading to a 7.1% decline in national sales volumes and lower auction clearance rates in major cities like Sydney and Melbourne. Yet, there’s a silver lining—if interest rates ease, renewed demand could spark a recovery in the latter half of 2025, with high-growth markets like Perth well-positioned for increased activity.

The construction sector presents a mixed outlook. New dwelling approvals remain 13% below the decade average, but a backlog of 251,000 incomplete dwellings—well above the 20-year average—may sustain valuation activity in the short term, offering a stabilising factor in uncertain times.

For Australians navigating these conditions, 2025 is shaping up as a year of transition. Refinancing is expected to underpin the market in the first half of the year, with potential for stronger purchasing demand later as economic conditions shift.

Staying informed and prepared will be key to making the most of these dynamic market changes.

Get the latest trends and updates in the property market by signing up for our newsletter below to receive insights delivered straight to your inbox.