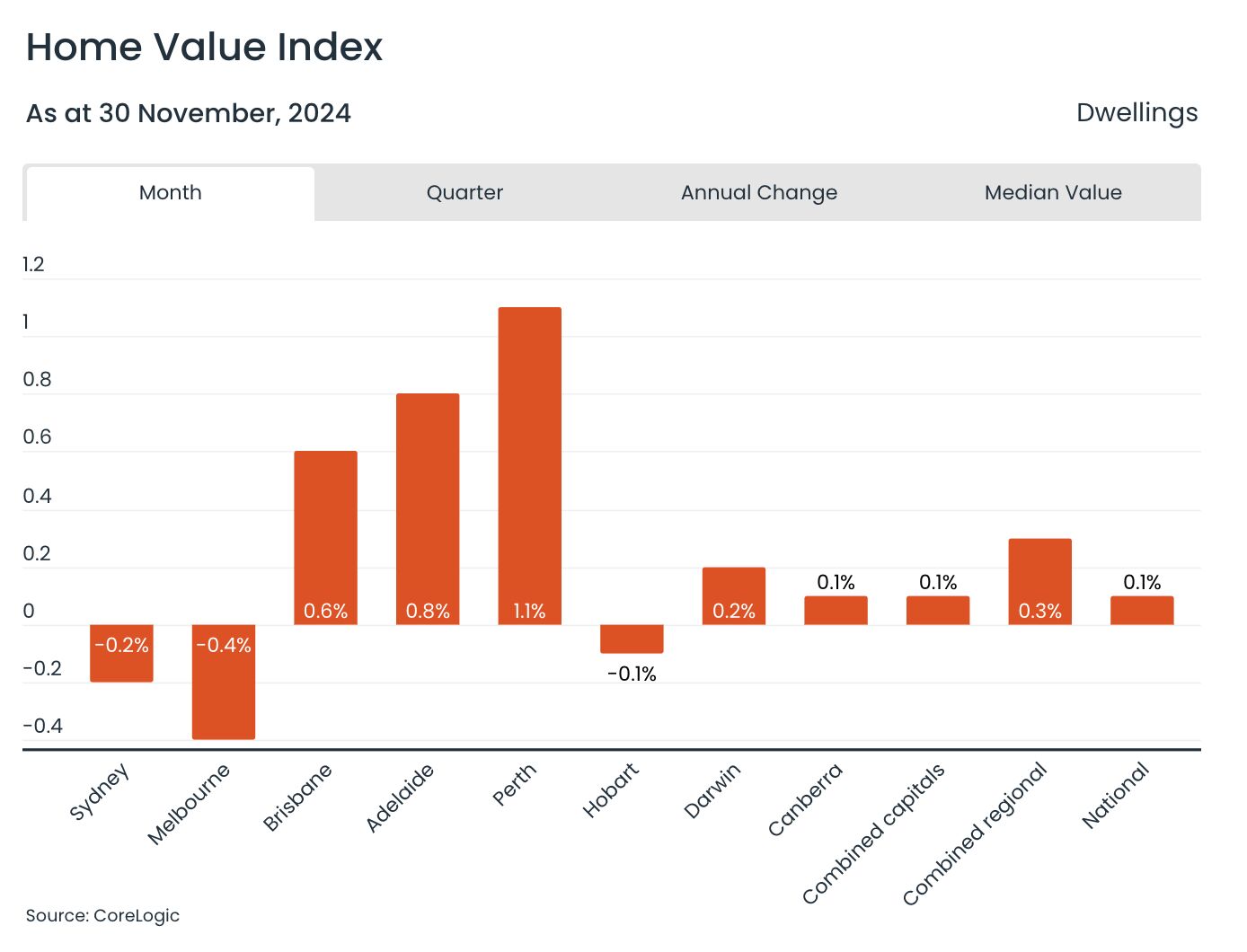

The latest CoreLogic Home Value Index shows a modest national increase of just 0.1% in November, marking the weakest result since January 2023 and signalling a potential close to the current growth cycle. This is the 22nd consecutive month of growth, but signs of a downturn are evident, particularly in major markets like Sydney and Melbourne.

Melbourne recorded a -0.4% decline in November, bringing annual values down by -2.3%. Sydney values have been flat or declining since August, with a -0.2% drop in November. Quarterly trends show similar softness, with four of eight capital cities reporting declines, led by Melbourne (-1.0%), Darwin (-0.7%), Sydney (-0.5%), and Canberra (-0.3%).

Momentum in mid-sized capitals and regional markets, which previously supported national growth, is also slowing. Perth remains the strongest performer, with a 1.1% rise in November and 3.0% growth over the quarter, though this is half the pace of gains seen in mid-2023. Brisbane and Adelaide also saw slower quarterly growth, at 1.8% and 2.8%, respectively.

Regional areas continue to show resilience, with a combined 1.1% rise over three months. However, trends vary widely—regional Victoria, for instance, declined by -0.9%, while regional WA led growth with a 3.3% increase.

Spring brought a rebalancing in supply, with capital city listings rising 16% since winter, driven by Perth (+33%) and Adelaide (+25%). Despite this, total listings remain below average in these cities. Sydney and Melbourne now report listings 10% above their five-year averages, the highest since 2018 for this time of year.

Purchasing activity has tapered off, with capital city sales down -4.6% year-on-year and -2.0% below the five-year average. Sydney experienced the steepest drop, with sales -15% lower than both last year and the historical average. This shift in supply and demand has led to tougher selling conditions, as auction clearance rates remain below 60% and median selling times increase.

The market’s current trajectory highlights the importance of staying informed as we head into 2024. Shifting conditions create opportunities and risks, emphasising the need for strategic planning in real estate decisions.

Stay ahead in the property market—sign up for our newsletter below to receive the latest insights and updates delivered straight to your inbox.