Reserve Bank of Australia Cuts Cash Rate to 3.60% as Inflation Eases

The Reserve Bank of Australia (RBA) has lowered the official cash rate by 25 basis points to 3.60%, marking its third cut of the year and taking the total reduction to 75 basis points. The decision was unanimous and came amid continued moderation in inflation, with both core and headline measures now sitting within the RBA’s 2–3% target band.

RBA Governor Michele Bullock signalled confidence that inflation will remain contained and unemployment stable, telling reporters, “That’s our best guess, and we’re looking to see that we continue on that path and, as we do, we can continue to lower interest rates.” (The Guardian)

The move is expected to deliver further mortgage relief, with all four major banks confirming they will pass on the cut in full by the end of August.

However, the RBA’s updated forecasts also pointed to a more subdued economic outlook, with “persistently” weaker productivity growth and slightly downgraded GDP projections over the next two years.

Key Takeaways from RBA’s Statement:

- Cash Rate Cut to 3.60%: The Board delivered its third reduction of 2025, citing continued disinflation and easing labour market conditions.

- More Cuts on the Horizon: The RBA flagged the potential for two to three further reductions, with some forecasts suggesting a terminal rate near 2.9% by late 2026.

- Inflation Easing as Expected: Trimmed mean inflation fell to 2.7% in the June quarter, while headline inflation slowed to 2.1%, aided by temporary cost-of-living measures.

- Productivity Growth Concerns: Long-term productivity growth forecasts have been revised down from 1% to 0.7%, which is expected to slow real income growth over the coming years.

- Domestic Demand Improving: Rising real household incomes and eased financial conditions are supporting gradual recovery, though consumption remains uneven across sectors.

- Labour Market Easing, but Still Tight: Unemployment rose slightly to 4.3% in June, but underutilisation rates remain low and skilled labour shortages persist in some industries.

- Global Uncertainty Still a Risk: Ongoing US trade policy tensions and potential delays in corporate and household spending decisions continue to cloud the global growth outlook.

The next RBA meeting in September will be closely watched for signs of further monetary easing.

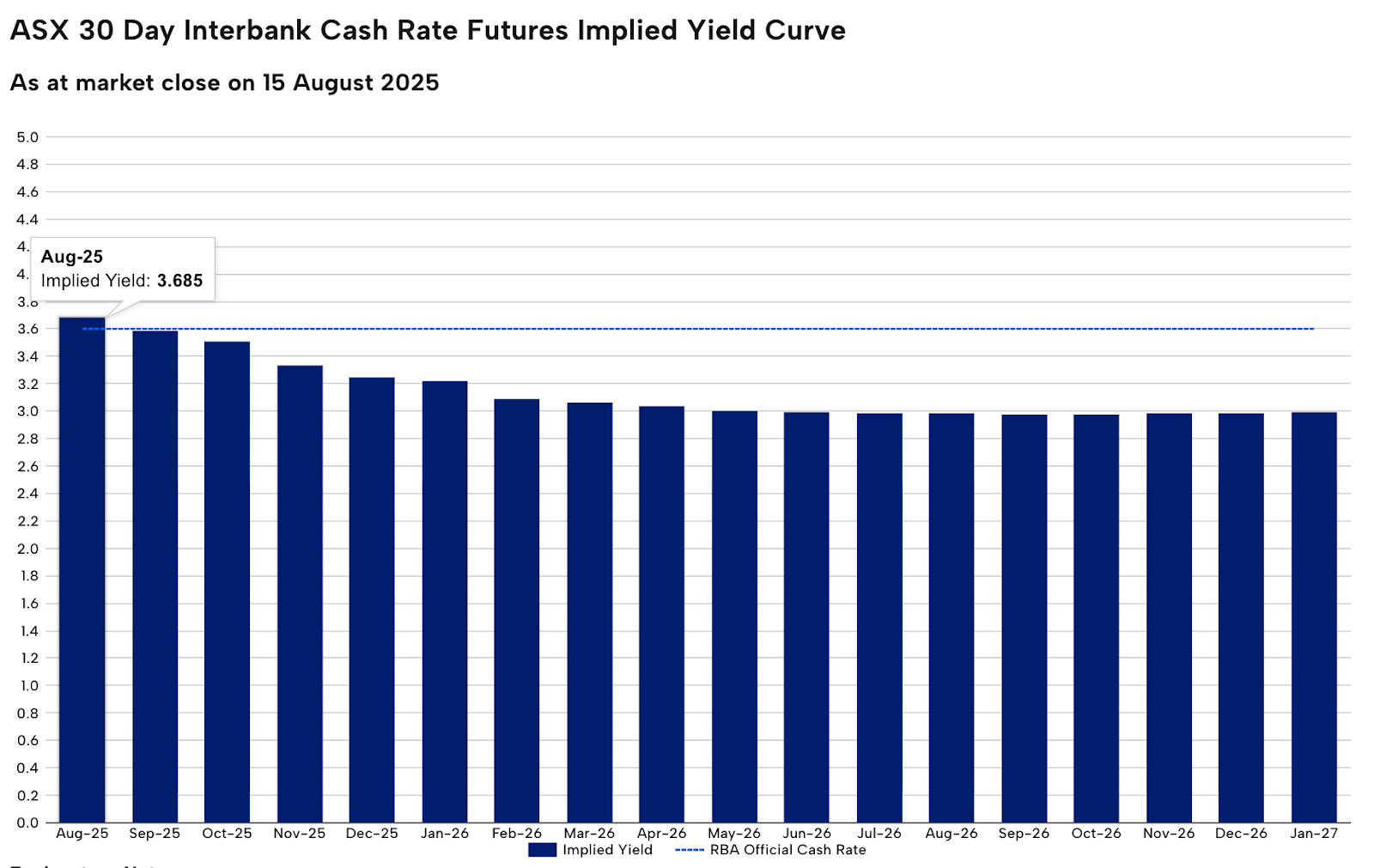

Rate Expectations

(Source: ASX RBA Rate Tracker)

On the 12th of August, the RBA reduced the official cash rate by 0.25%. The current official cash rate as determined by the Reserve Bank of Australia (RBA) is 3.60%.

As at the 15th of August, the ASX 30 Day Interbank Cash Rate Futures October 2025 contract was pricing in a 32% probability of a further decrease to 3.35% at the next RBA Board meeting on 30 September 2025.

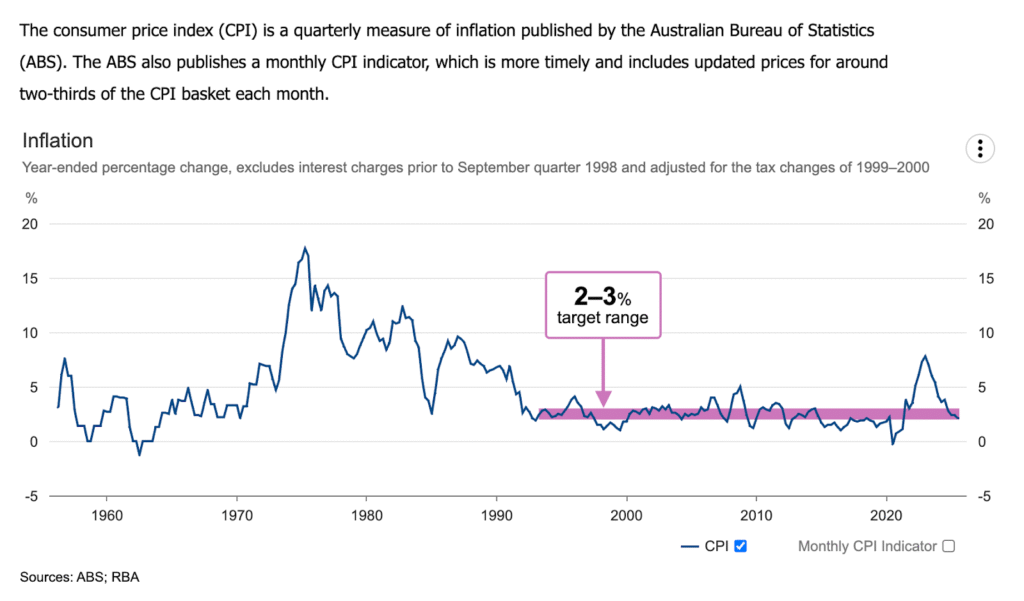

Inflation

- Underlying Inflation: Annual trimmed mean inflation eased to 2.7% in the June quarter, down from 2.9% in March. This is the lowest reading since December 2021 and keeps core inflation firmly within the RBA’s 2–3% target band, signalling further moderation in underlying price pressures.

- Headline Inflation: Headline CPI slowed to 2.1% year-on-year in June, down from 2.4% in March. The ABS confirmed that Australia will shift from a quarterly CPI measure to a Monthly CPI measure from November 2025, offering more frequent tracking of price movements.

- Household Inflation (CPI): Housing costs rose 2.0% over the year to June 2025, with rents up 4.5% (down from 5.5% in March) and new dwelling prices rising just 0.7%. Food and non-alcoholic beverages increased 3.0%, led by fruit and vegetables (+4.6%). Electricity prices climbed 8.1% for the quarter but remain 6.2% lower annually due to ongoing Energy Bill Relief Fund and state-based subsidies.

- RBA Stance & Outlook: The August rate cut reflects the RBA’s confidence in a “soft landing” scenario – containing inflation while keeping unemployment stable. However, the Board remains cautious amid global trade uncertainty, weaker productivity growth, and patchy domestic consumption trends, leaving scope for further policy easing in 2025 if conditions warrant.

(Source: RBA)

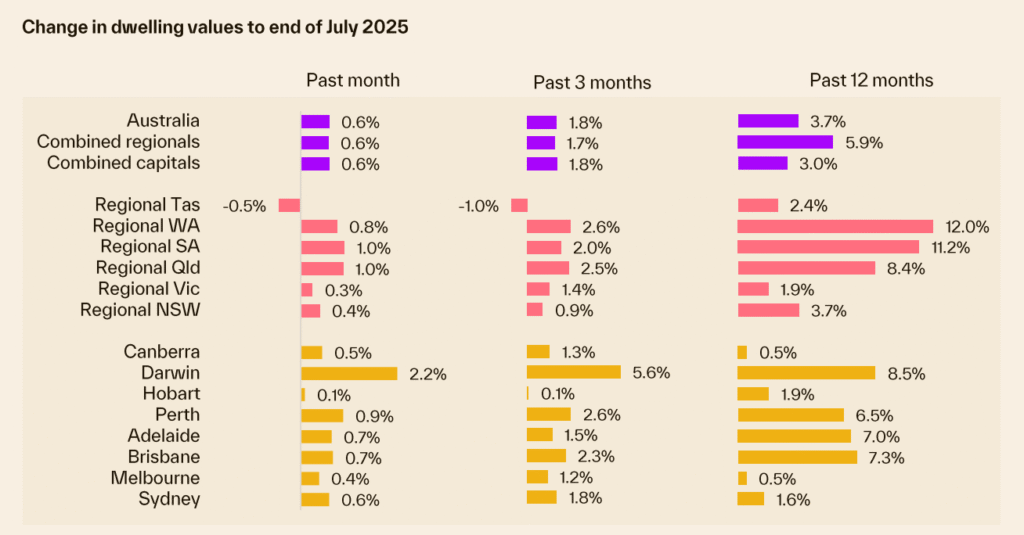

Property Market Update

- Sixth Consecutive Month of Growth: National dwelling values rose 0.6% in July, maintaining the same monthly pace seen in recent months and marking the sixth straight month of gains since the first rate cut in February. Growth remains steady, with strong buyer confidence balancing affordability constraints and ongoing geopolitical uncertainty.

- Capital Cities Outpace Regionals (Quarterly): Over the three months to July, combined capital city values rose 1.8%, edging out combined regional markets (1.7%). Among the capitals, Darwin (+5.6%) recorded the strongest quarterly growth, followed by Perth (+2.6%), Brisbane (+2.3%), and Sydney (+1.8%). Melbourne (+1.2%), Adelaide (+1.5%), and Hobart (+0.1%) posted more modest gains. In the combined regional markets, Regional WA (+2.6%), Regional QLD (+2.5%), and Regional SA (+2.0%) led the quarterly increases, each outperforming their corresponding capital city markets.

- Outlook Remains Positive but Balanced: Persistently low listing volumes (around 19% below the five-year average) and recent interest rate cuts are expected to support further price growth through the second half of 2025. However, affordability pressures, limited new housing supply, and the widening gap between national median house and unit values (now a record 32.3%, or roughly $223,000) may temper the pace of gains.

(Source: Cotality August HVI)

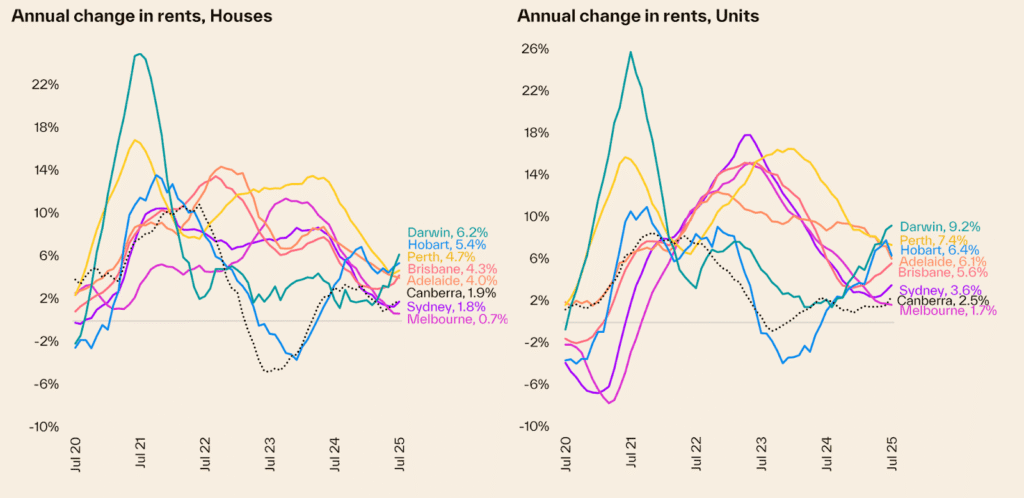

Rental Market Update

- National Rent Growth Accelerates: National rents rose 1.1% over the three months to July (quarterly), up from a recent low of 0.5% in late 2024. This marks a clear turnaround in rental momentum, driven by persistently low vacancy rates and limited new housing supply.

- House vs Unit Trends: Unit rents led the gains, rising 1.3% over the quarter compared to 1.1% growth in house rents. The strongest capital city rent increases came from Darwin units (+2.9%), Darwin houses (+2.2%), and Hobart houses (+2.0%).

- Vacancy Rates Remain Near Record Lows: National rental vacancy rates held at 1.7% in July, sustaining intense competition for available properties. While the annual change in rents has lifted slightly to 3.7%, it remains well below last year’s 7.2% pace. Gross rental yields eased to 3.68% nationally, with Darwin continuing to post the highest yields at 6.4%, supported by relatively low purchase prices compared to rental income.

(Source: Cotality August HVI)

📞 Considering buying, investing, or refinancing?

With rates trending lower, tight property supply, and rental markets heating up again, now is the time to review your strategy. Speak with Azura Financial’s award-winning brokers for tailored advice and competitive lending solutions.