RBA Lifts Cash Rate to 3.85% as Inflation Risks Resurface

The Reserve Bank of Australia lifted the cash rate by 25 basis points to 3.85% at its February meeting, responding to a renewed lift in inflation through the second half of 2025. While inflation is well below its 2022 peak, the RBA noted that price pressures have re-accelerated and are likely to remain above target for some time.

The Board pointed to stronger-than-expected private demand, supported by household spending, business investment and continued momentum in the housing market. With financial conditions having eased over 2025, the RBA questioned whether monetary policy remains sufficiently restrictive.

Labour market conditions also remain tight, with unemployment lower than expected and unit labour costs still elevated. The decision was unanimous, and the RBA reaffirmed a data-dependent approach, signalling it will act further if inflation pressures do not ease as expected.

Key Takeaways:

-

- Cash rate: The RBA lifted the cash rate target by 25 basis points to 3.85%, citing a material pick-up in inflation in the second half of 2025.

- Inflation: While well below its 2022 peak, inflation has re-accelerated, with stronger private demand and capacity pressures expected to keep it above target for some time.

- Labour market: Conditions remain a little tight, with unemployment a little lower than expected, low underutilisation, and growth in unit labour costs still high despite some easing in headline wage measures.

- Policy stance: The Board is concerned that financial conditions may no longer be sufficiently restrictive after easing through 2025 and stands ready to do what it considers necessary to contain inflation.

- Outlook: Future decisions will remain firmly data‑driven, with the RBA watching global conditions, domestic demand, inflation and labour market trends closely as upside risks from persistent capacity pressures remain in focus.

(Source: RBA)

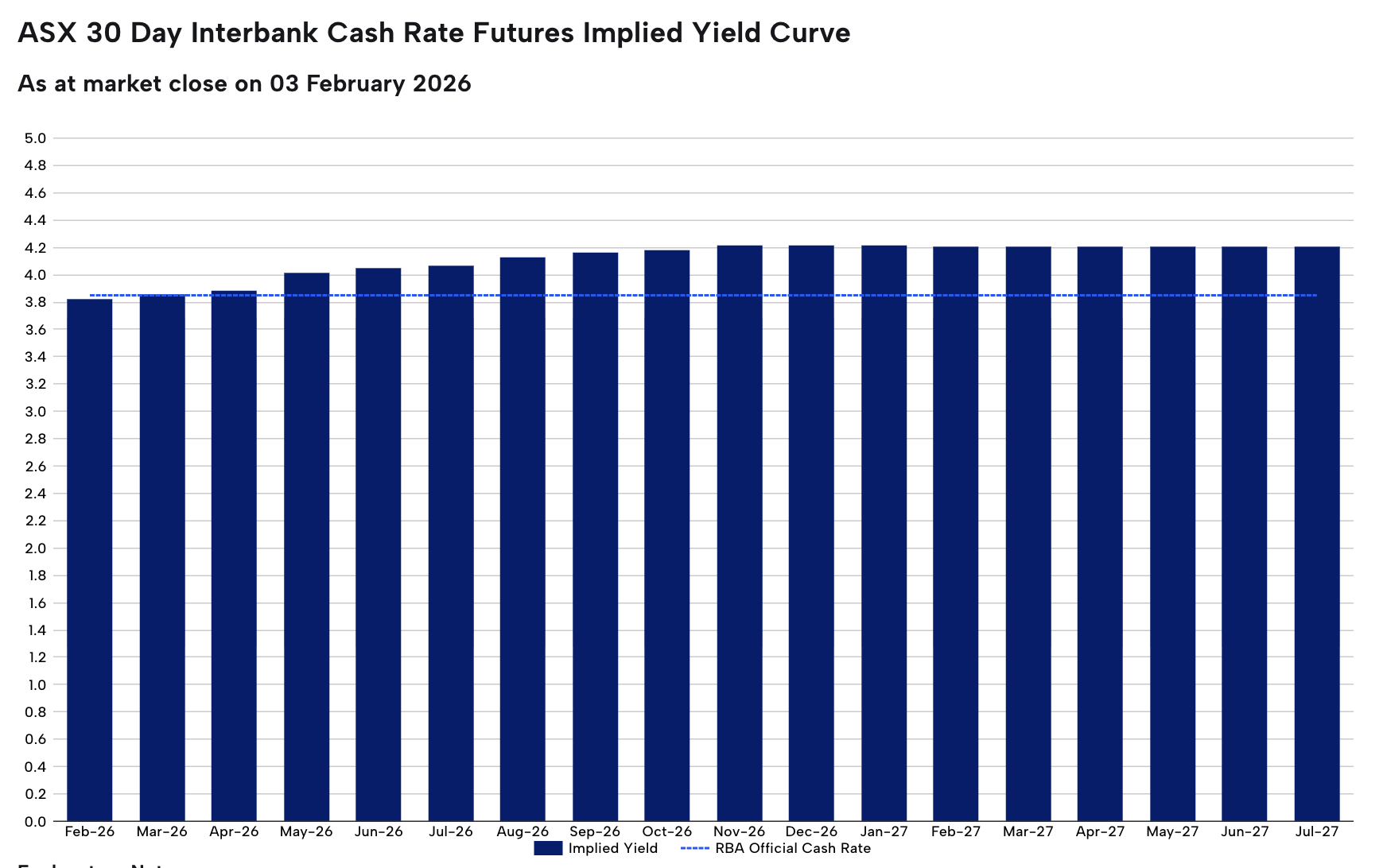

Rate Expectations

(Source: ASX RBA Rate Tracker)

On the 3rd of February the RBA increased the official cash rate by 0.25%. The current official cash rate as determined by the Reserve Bank of Australia (RBA) is 3.85%.

The next RBA Board meeting and Official Cash Rate announcement will be on the 17th March 2026.

As at the 3rd of February, the ASX 30 Day Interbank Cash Rate Futures March 2026 contract was trading at 96.14, indicating a 9% expectation of an interest rate increase to 4.10% at the next RBA Board meeting.

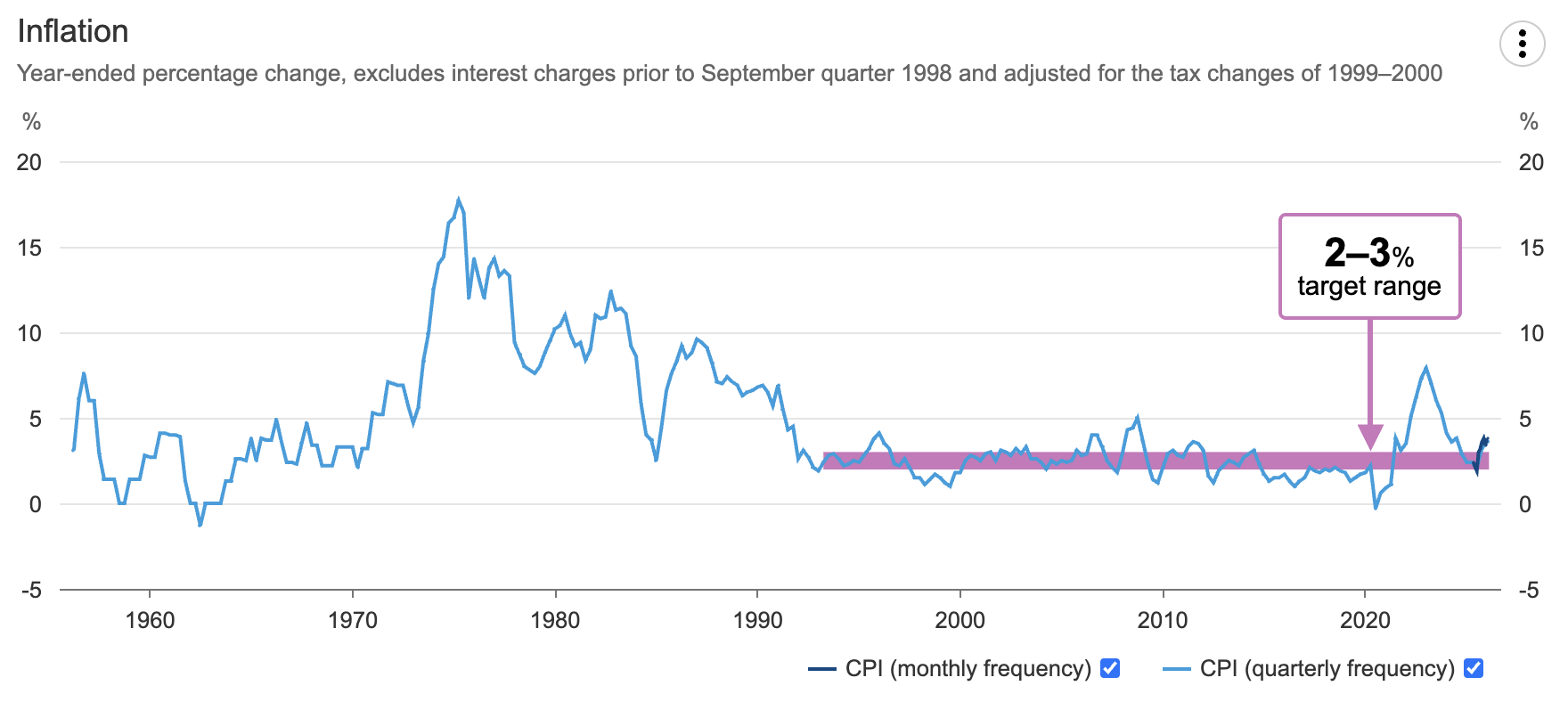

Inflation

(Source: RBA, ABS)

- Headline Inflation:

Inflation jumped to 3.8% in the 12 months to December 2025, a significant leap from the 3.4% recorded just one month prior, driven primarily by resilient housing costs, higher food prices, and strong seasonal increases in recreation and travel. - Underlying Inflation:

Underlying inflation (trimmed mean) edged higher to 3.3% year-on-year in December, up from 3.2% in November, signalling that underlying price pressures remain sticky and persist above the RBA’s 2–3% target band. - Household Inflation (CPI):

Household inflation continues to be led by the Housing group (+5.5%). Notably, electricity prices surged as government rebates rolled off, removing earlier subsidies and keeping cost-of-living pressures elevated for households. - RBA Stance & Outlook: The RBA assesses that inflation pressures have picked up materially and are likely to remain above target for some time, with stronger private demand and capacity constraints raising the risk of more persistent inflation, potentially requiring a tighter policy stance.

From November 2025, the ABS will replace the quarterly CPI with a complete Monthly CPI as Australia’s main inflation measure. The October release marked the final publication of the monthly CPI indicator, and the last time the quarterly CPI served as the primary measure of headline inflation which is a significant shift in how Australia tracks price movements. (ABS)

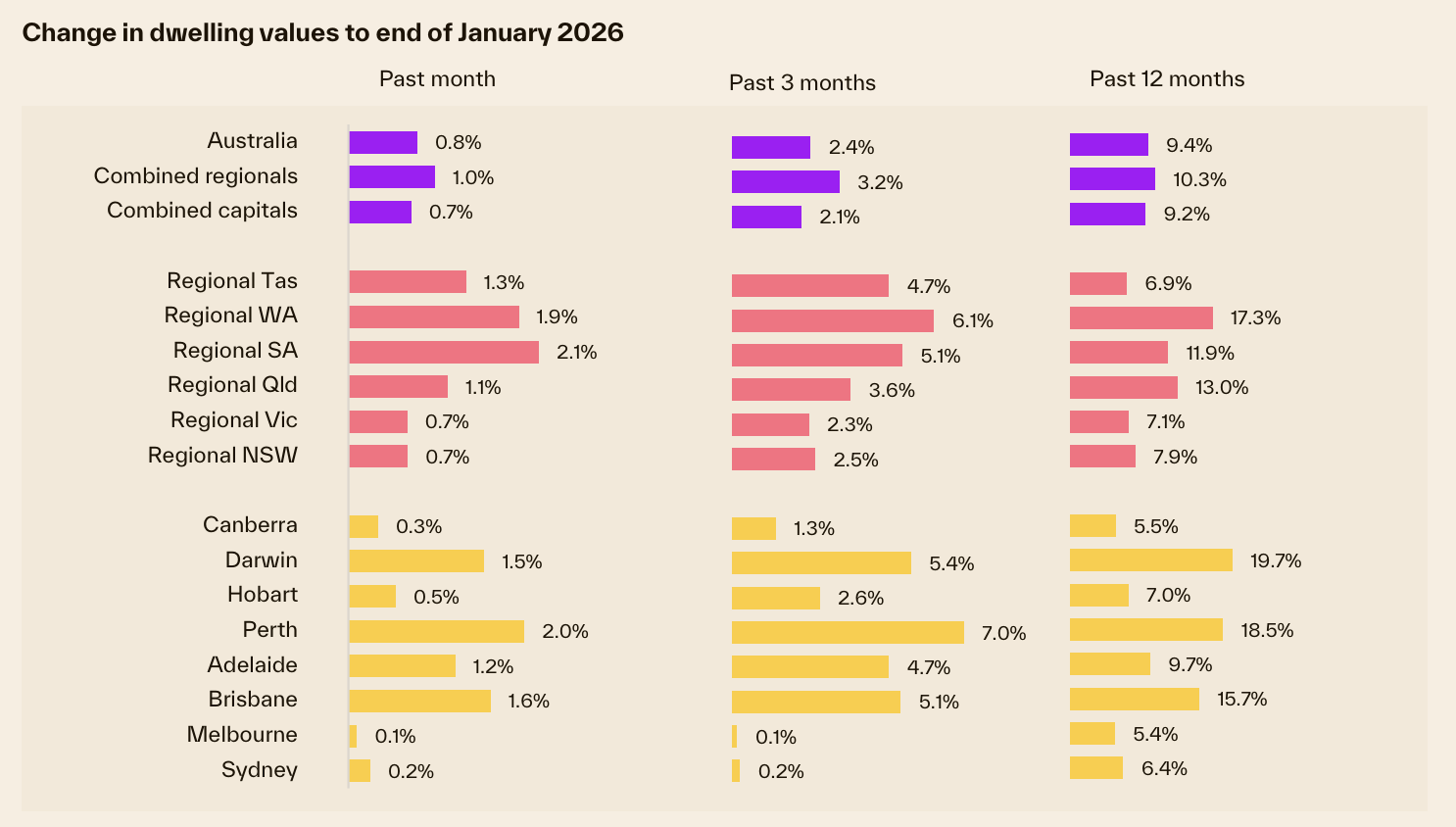

Property Market Update

(Source: Cotality December HVI)

- Home values rise nationally as momentum eases in some major cities.

Australian home values rose 0.8% in January, taking annual growth to 9.4%. While national growth picked up slightly from December, momentum has eased in some major cities as affordability pressures and higher living costs continue to weigh on buyers. - Perth, Brisbane and Adelaide remain the standout performers.

Mid-sized capitals continue to lead the market, with Perth (+2.0%), Brisbane (+1.6%) and Adelaide (+1.2%) recording the strongest monthly gains. Regional markets also outperformed, rising 1.0% over the month compared with 0.7% across the combined capitals. - Low housing supply is keeping prices supported.

Despite affordability challenges, housing supply remains tight, with listings around 25% below average. This shortage is helping to underpin prices and limiting the risk of a sharp downturn, even as demand is expected to soften through 2026.

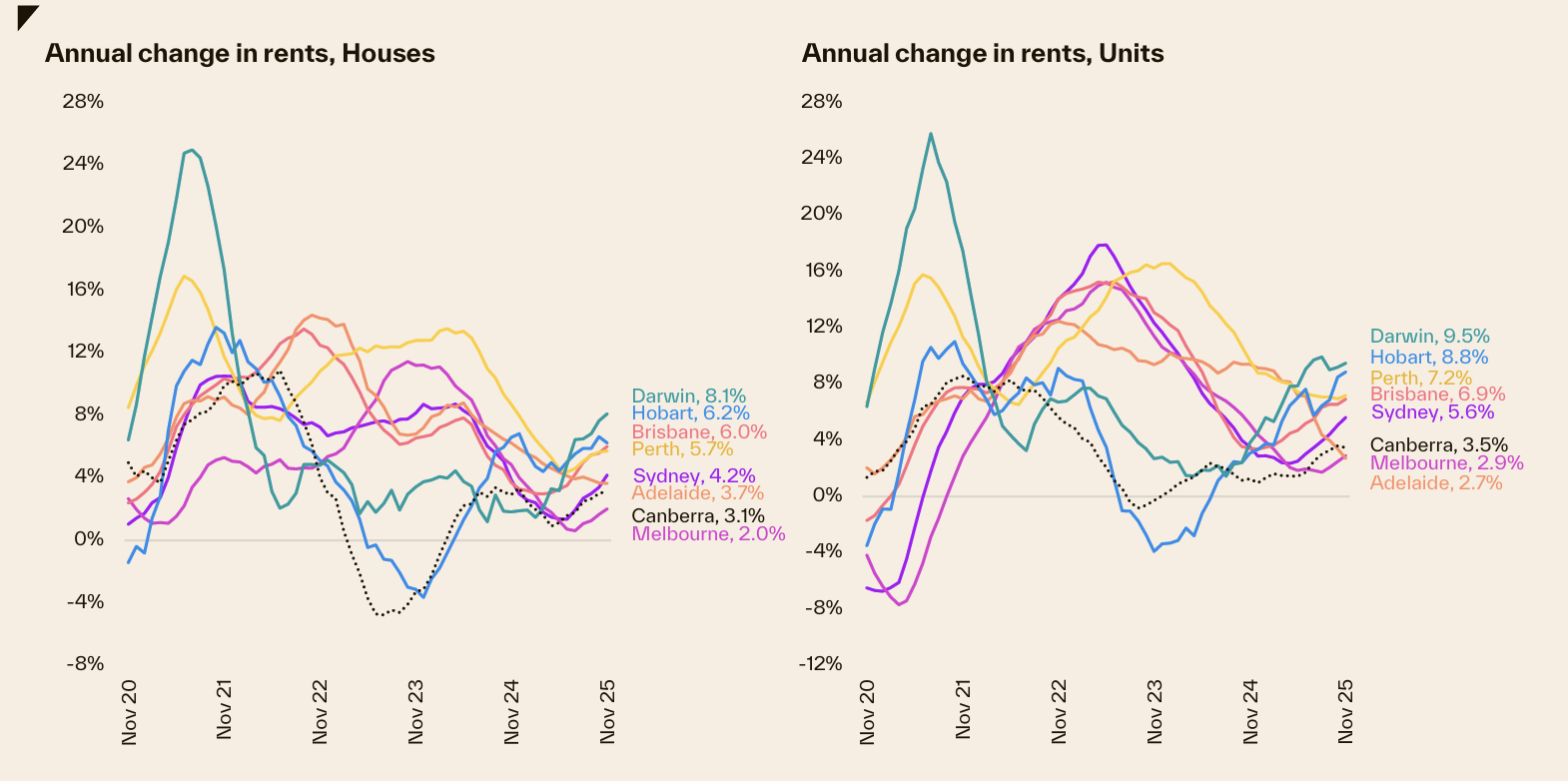

Rental Market Update

(Source: Cotality December HVI)

- Rents pick up pace nationally.

National rents rose 0.6% in January, the strongest monthly increase since April last year, lifting annual rental growth to 5.4%. This added about $35.20 per week to the median rent, extending cost-of-living pressures for renters. - Vacancy rates remain very tight.

Rental conditions continue to favour landlords, with the national vacancy rate at 1.7%, still well below the long-run average of 2.5%. Most capital cities remain below their 10-year average vacancy levels, with Adelaide the tightest at just 1.0%. - Smaller capitals lead rental growth.

Annual rental increases were strongest in Darwin and Hobart, with Darwin rents up 7.1% for houses and 8.2% for units, while Hobart recorded gains of 6.8% for houses and 7.6% for units over the year. - Yields continue to ease as values rise faster.

Despite stronger rental growth, housing values have risen more quickly, pushing the national gross rental yield to around 3.56%, the lowest level since September 2022. Yields remain higher across regional markets at 4.2%, with Regional NT (8.1%) and Darwin among the strongest nationally.

With the RBA lifting the cash rate to 3.85% and national property values hitting record highs despite a 25% supply shortage, the market has shifted. Whether you are managing higher mortgage costs or looking to buy while supply is tight, expert advice is now more critical than ever.