Despite fears that the shift from ultra-low fixed rates secured during the pandemic to higher variable rates would force many Australian homeowners to sell, mortgage holders have shown resilience.

The data supports this, with the number of residential properties sold under distressed conditions remaining very low at 5,071 in August, marking a 0.8% decrease from the previous month, according to SQM Research.

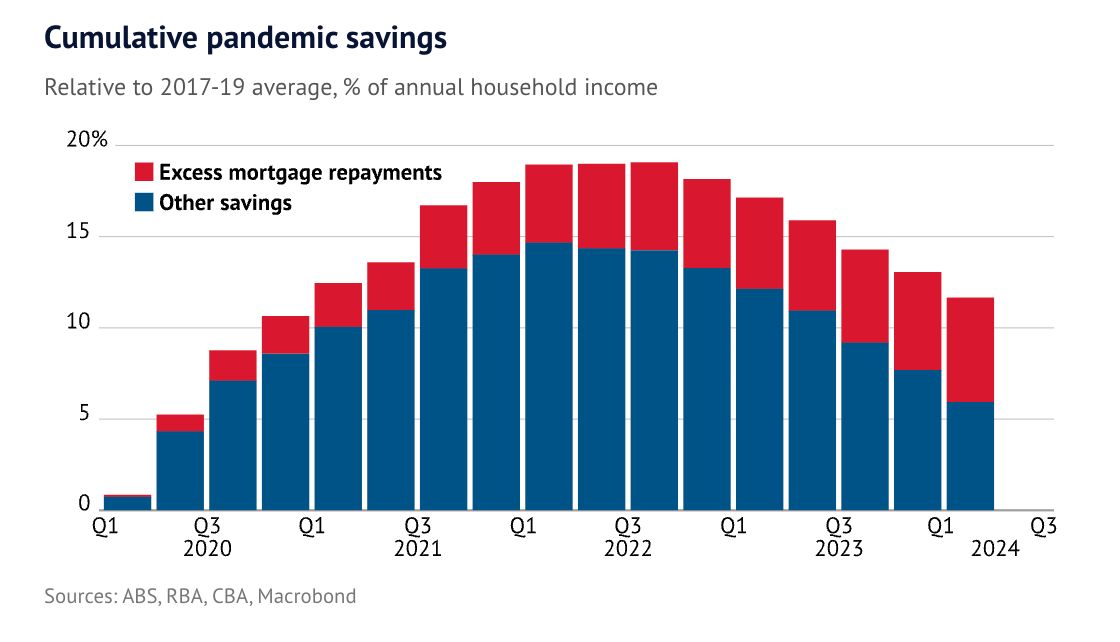

New CBA research indicates that homeowners have effectively navigated the so-called mortgage cliff by prioritising savings in offset and redraw accounts. CBA’s data reveals that while overall savings decreased from $220 billion in late 2022 to around $80 billion by March, the amounts specifically in offset and redraw accounts have increased (see image).

As reported by Domain, CBA’s Gareth Aird said this was a sign that homeowners are prioritising their mortgage commitments.

“It’s a good thing for financial stability. It means many households have money sitting against their loan which they can use if they get into financial difficulty,” he said.