Australians spent $613.0 billion on residential and commercial properties in 2023, according to PEXA’s latest Mortgage Insights Report.

Of this, $300.9 billion was financed through new lending, marking a 12.7% decrease from the previous year.

The rest, $312.1 billion, was contributed with cash or other forms of financing (via deposits or outright cash purchases or loans not attached to the property being purchased).

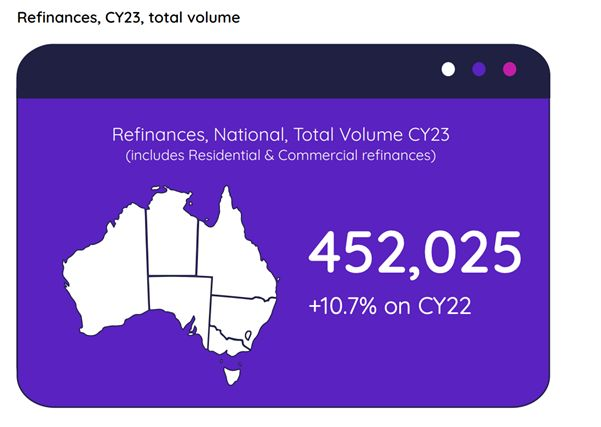

But while they borrowed less, Australians refinanced more, with volumes surging 10.7% year-on-year to over 452,000, driven by higher interest rates and cost of living pressures.

However, PEXA head of research Mike Gill said there was a notable decline in refinancing volumes in the final quarter of the year, despite November’s cash rate hike.

“Typically, rate hikes spur refinancing activity as homeowners seek better options for their home loans. However, the timing of this rate increase, so close to the end of the year, may have hindered many homeowners from taking action before the Christmas break,” he said.

Have you got a fixed rate ending on your existing loan? Feel free to get in contact and review your best options at [email protected] or 0438 693 821.