RBA Wraps Up 2025 with Cash Rate Held at 3.60%

At its final meeting for 2025, the RBA again held the cash rate at 3.60%, closing out a year that shifted from early easing to a prolonged pause as inflation proved more stubborn than expected.

In the post-meeting press conference, Governor Michele Bullock said “additional cuts are not needed” and pointed to the hand-over in growth drivers, noting that “the private economy is recovering”. (ABC)

She reinforced that the near-term risk profile has changed, adding she doesn’t see rate cuts “on the horizon for the foreseeable future,” framing the next phase as either an extended hold or a potential move higher if inflation persistence demands it.

With demand strengthening, housing activity lifting, and the labour market still a little tight, the RBA is wrapping up the year in a cautious, data-dependent stance focused on ensuring inflation returns sustainably to target.

Key Takeaways from RBA’s Statement:

-

- Cash rate: The RBA held the cash rate at 3.60%, extending its pause while it gauges how the economy and prices evolve.

- Inflation: Inflation has picked up more recently. Some drivers look temporary, but the Bank sees signs of broader, potentially persistent pressure and is watching closely.

- Labour market: Conditions remain a little tight despite gradual easing. Unemployment has risen and jobs growth slowed, yet underutilisation is low and firms still report hiring difficulty.

- Policy stance: The Board judges policy is still somewhat restrictive. With inflation risks tilting upward, it wants more evidence before considering further cuts.

- Outlook: The RBA is firmly data-dependent, updating its view as new inflation and activity readings come in. Risks to inflation are presently skewed to the upside.

(Source: RBA)

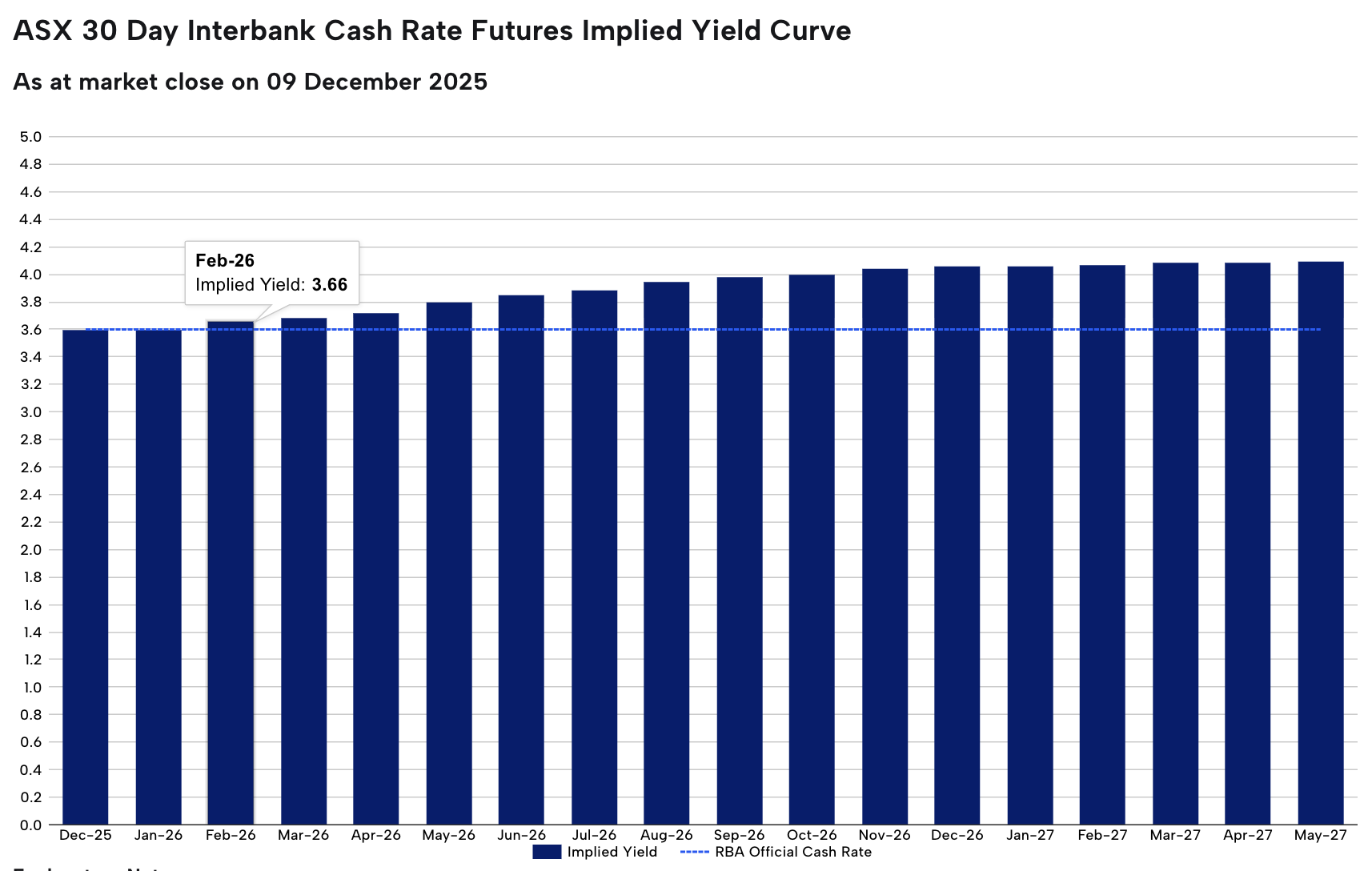

Rate Expectations

(Source: ASX RBA Rate Tracker)

On the 9th of December the RBA left the official cash rate unchanged. The current official cash rate as determined by the Reserve Bank of Australia (RBA) is 3.60%.

The next RBA Board meeting and Official Cash Rate announcement will be on the 3rd February 2026.

As at the 9th of December, the ASX 30 Day Interbank Cash Rate Futures February 2026 contract was trading at 96.34, indicating a 27% expectation of an interest rate increase to 3.85% at the next RBA Board meeting.

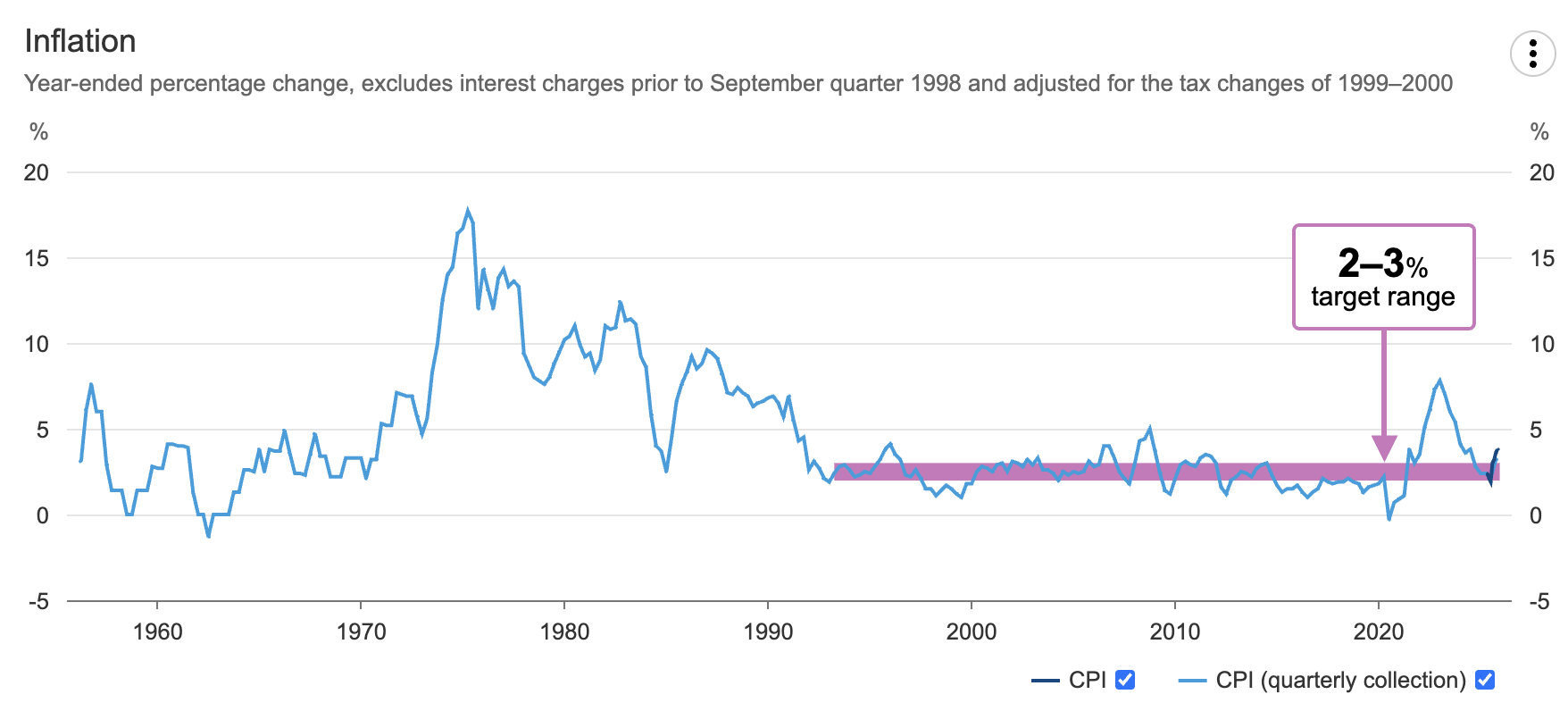

Inflation

(Source: RBA)

- Underlying Inflation: Trimmed mean inflation rose to 3.0% annually in the September quarter, up from 2.7% in June, the first increase since December 2022. The uptick reflects renewed underlying inflation pressures, particularly from housing, utilities, and service-related costs.

- Headline Inflation: Australia’s quarterly CPI rose 1.3%, bringing annual inflation to 3.2%, up from 2.1% in the June quarter — the highest annual rate since mid-2024. Electricity prices were the key driver, surging 9.0% in the quarter, alongside higher travel and transport costs.

- Household Inflation (CPI): Housing inflation increased 2.5% for the quarter, led by a 23.6% annual rise in electricity costs as state-based rebates expired in QLD, WA and TAS. Food and non-alcoholic beverages rose 3.1% annually, while rising rents (+3.8%) and medical costs (+5.1%) added further pressure to household budgets.

- RBA Stance & Outlook: The RBA kept the cash rate on hold at 3.60%, citing persistent inflation pressures despite earlier progress. While the Bank views some recent price rises as temporary, it expects inflation to stay above 3% in the near term before easing toward 2.6% by 2027. Governor Michele Bullock reaffirmed a cautious, data-dependent approach, stating that “anything is possible” when it comes to future rate moves.

From November 2025, the ABS will replace the quarterly CPI with a complete Monthly CPI as Australia’s main inflation measure. The October release marked the final publication of the monthly CPI indicator, and the last time the quarterly CPI served as the primary measure of headline inflation which is a significant shift in how Australia tracks price movements. (ABS)

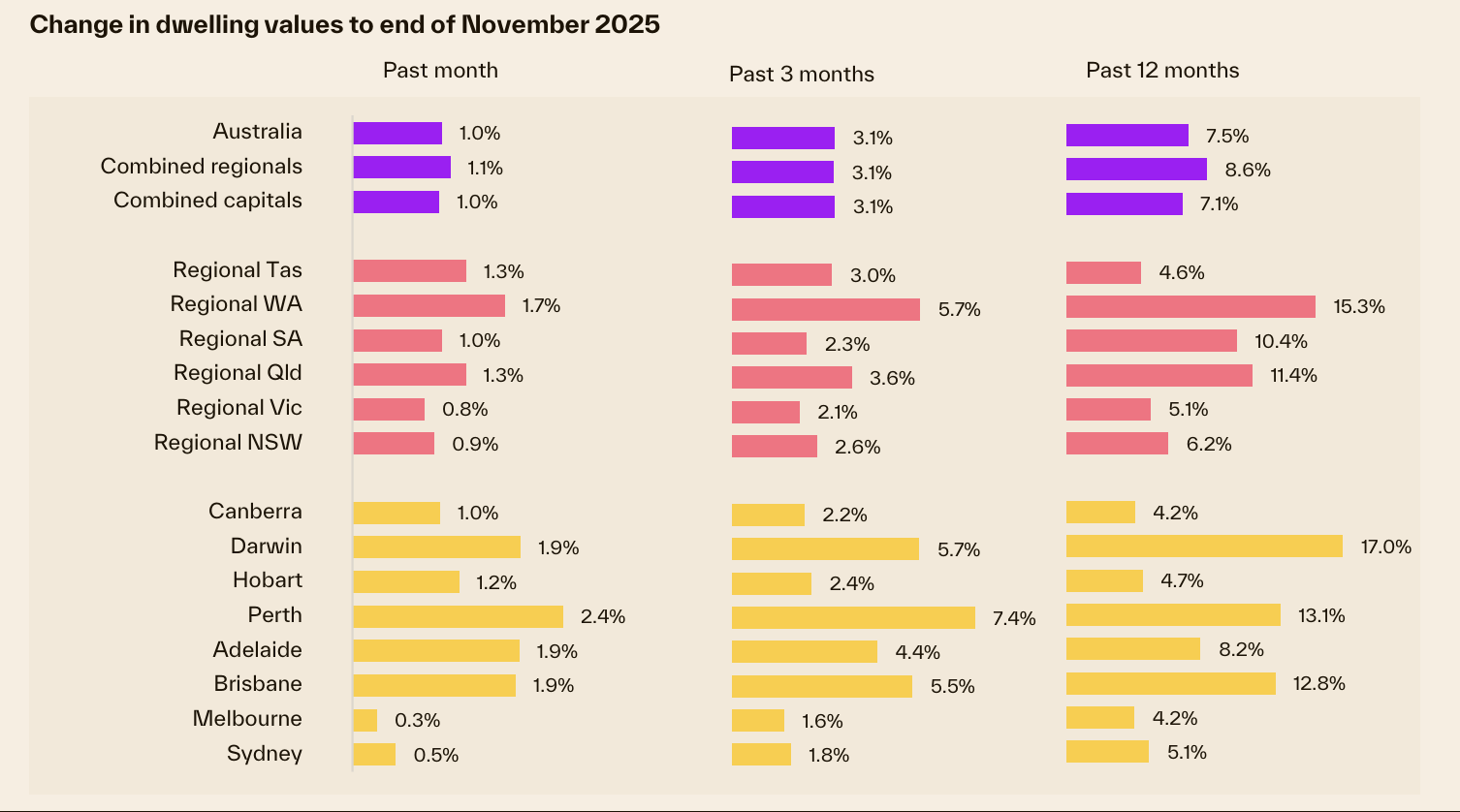

Property Market Update

(Source: Cotality December HVI)

- Growth stays strong but is starting to cool. National dwelling values rose 1.0% in November, marking a third straight month of 1%+ gains, but easing slightly from October’s 1.1%. Annual growth is holding at 7.5%, showing the upswing remains intact even as momentum moderates.

- Mid-sized capitals are doing the heavy lifting. Sydney (+0.5%) and Melbourne (+0.3%) lagged and dragged on the headline result, while every other capital city rose at least 1%. Perth led with a 2.4% jump, followed by strong rises in Brisbane and Adelaide (both +1.9%) and Darwin (+1.9%), reinforcing the divergence between smaller and larger markets.

- Supply shortages and policy support are outweighing affordability headwinds—for now. Listings remain deeply constrained (especially in Perth, where stock is 40%+ below average), keeping buyer competition elevated. However, affordability is now a clear ceiling: national values sit at a record 8.2x household income and mortgage servicing requires about 45% of income, with softer clearance rates in Sydney/Melbourne hinting that stretched budgets and an “rates-on-hold” outlook may slow growth into 2026.

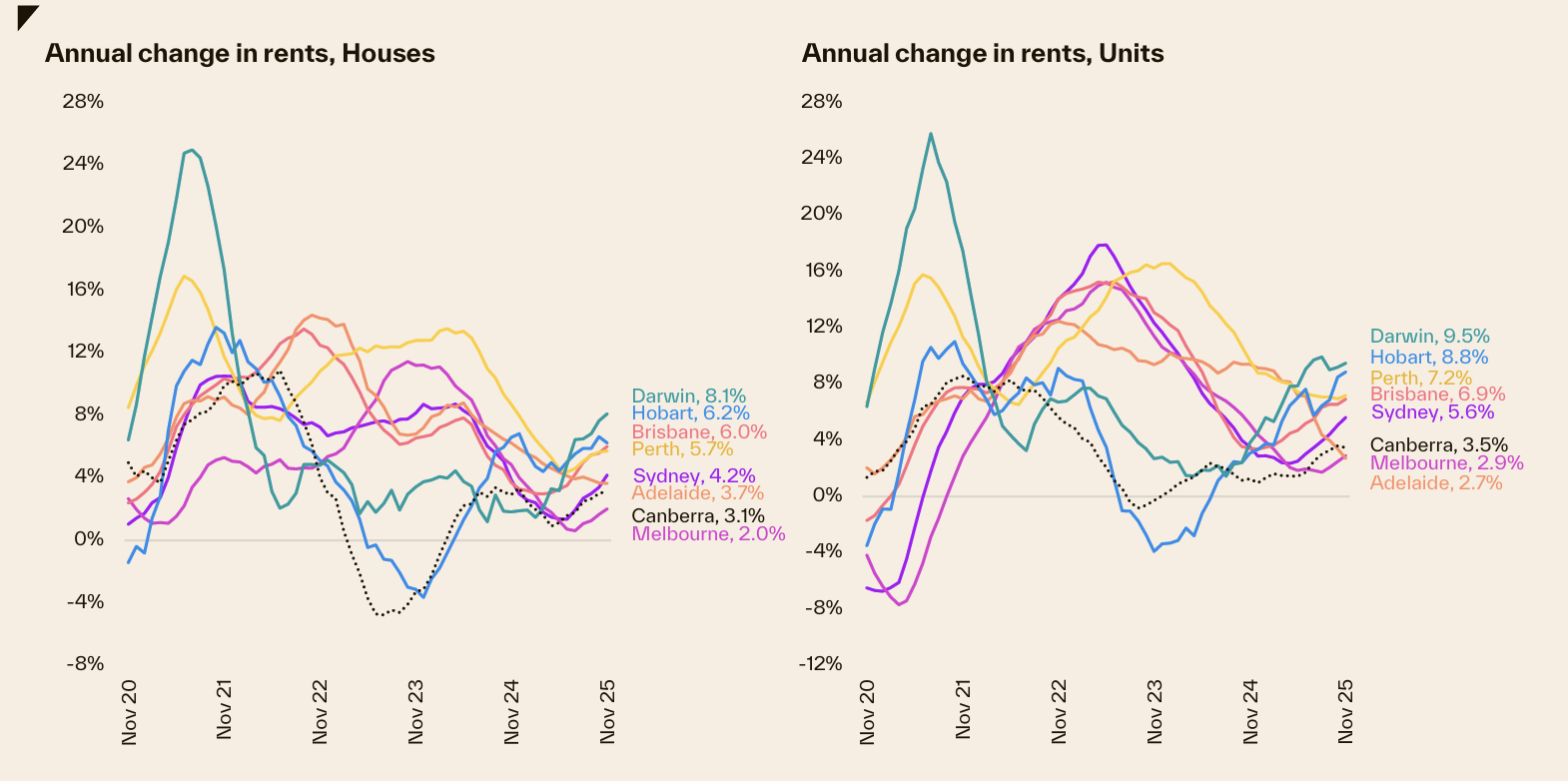

Rental Market Update

(Source: Cotality December HVI)

- National rents push higher again. The national rental index rose 0.5% in November, lifting annual rental growth to 5.0% — the strongest year-ended pace since this time last year, signalling rental momentum is re-accelerating.

- Vacancy rates stay near record lows. Rental conditions remain extremely tight, with vacancy rates holding around 1.5% nationally for four straight months, down from 1.9% a year ago, keeping consistent upward pressure on rents.

- Smaller capitals lead gains, with units outperforming. Rents are rising across every capital city, led by Darwin (+9.5% y/y) and Hobart (+8.8%), while growth is increasingly skewed to the apartment market, where unit rents are rising faster than houses in most cities.

The new year is often our favourite time to reset on financial goals.

It’s no surprise that January is historically Azura’s busiest month for new loan applications and strategy reviews.

If you also want to hit the ground running in the new year and get ahead for 2026 we’ve made it easier than ever to get ahead by joining our New Year list.

When you join the list you’ll receive a complimentary strategy review at a time that suits you in the new year.

Click below to let us know if you’re interested and a member of our team will reach out to organise a time.