RBA Holds Cash Rate at 3.60% Amid Renewed Inflation Pressures

At its meeting on 4 November 2025, the Reserve Bank of Australia (RBA) decided to leave the cash rate unchanged at 3.60%. This decision comes as the Board navigates a delicate balance between keeping inflation in check and supporting a steady economic recovery.

Inflation has picked up in recent months, with underlying (trimmed mean) inflation rising to 3.0% over the year to September, up from 2.7% in June. Headline inflation also rose sharply to 3.2%, partly due to the end of electricity rebates across several states. Despite this uptick, the RBA believes some of the recent inflation increase is temporary, expecting inflation to ease back toward the mid-point of its 2–3% target range by 2027.

Domestic conditions are showing mixed signals: private demand continues to recover, and the housing market is strengthening as rate reductions flow through. However, the labour market has eased slightly, with the unemployment rate nudging up to 4.5%, and productivity growth remains weak. Given this backdrop, the RBA has opted for a cautious approach, keeping rates steady while monitoring inflation and economic momentum closely.

In a press conference following the decision, RBA Governor Michele Bullock reaffirmed the Board’s cautious stance, saying:

“It’s possible that there’s no more rate cuts. It’s possible there’s some more. All I would say is that I think we’re at the right spot we need to be at the moment, and we can respond where the risks arise.”

Bullock confirmed the Board did not consider a rate cut at this meeting and remains committed to bringing inflation back to the 2–3% target band sustainably, indicating the RBA remains highly dependent on incoming data before making any future moves.

Key Takeaways from RBA’s Statement:

- Cash rate held at 3.60%.

- Inflation uptick: Trimmed mean inflation rose to 3.0% annually, slightly higher than expected. The RBA attributes part of the inflation lift to short-term influences, including energy cost changes.

- Economic recovery ongoing: Private demand and housing activity continue to strengthen.

- Labour market easing slightly: Unemployment rose to 4.5%, though job vacancies remain high.

- Policy Stance: The RBA judges monetary policy remains “a little restrictive” and wants more data before making further moves.

- Outlook: Underlying inflation is expected to rise above 3% in the near term before easing back to around 2.6% by 2027.

(Source: RBA)

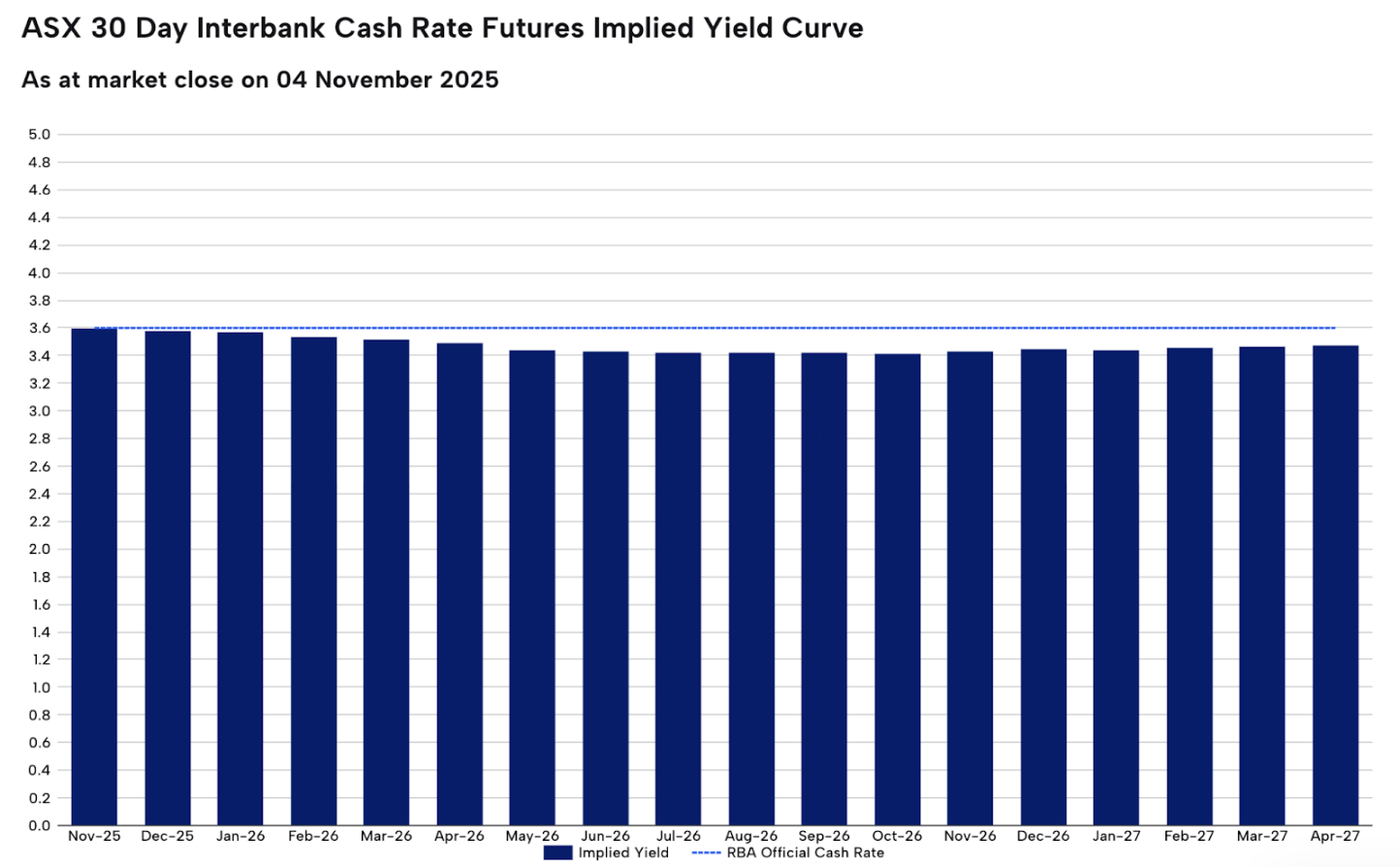

Rate Expectations

(Source: ASX RBA Rate Tracker)

On the 4th of November the RBA left the official cash rate unchanged. The current official cash rate as determined by the Reserve Bank of Australia (RBA) is 3.60%.

As at the 4th of November, the ASX 30 Day Interbank Cash Rate Futures December 2025 contract was trading at 96.42, indicating a 11% expectation of an interest rate decrease to 3.35% at the next RBA Board meeting.

The next RBA Board meeting and Official Cash Rate announcement will be on the 9th December 2025.

Inflation

(Source: RBA)

- Underlying Inflation: Trimmed mean inflation rose to 3.0% annually in the September quarter, up from 2.7% in June, the first increase since December 2022. The uptick reflects renewed underlying inflation pressures, particularly from housing, utilities, and service-related costs.

- Headline Inflation: Australia’s quarterly CPI rose 1.3%, bringing annual inflation to 3.2%, up from 2.1% in the June quarter — the highest annual rate since mid-2024. Electricity prices were the key driver, surging 9.0% in the quarter, alongside higher travel and transport costs.

- Household Inflation (CPI): Housing inflation increased 2.5% for the quarter, led by a 23.6% annual rise in electricity costs as state-based rebates expired in QLD, WA and TAS. Food and non-alcoholic beverages rose 3.1% annually, while rising rents (+3.8%) and medical costs (+5.1%) added further pressure to household budgets.

- RBA Stance & Outlook: The RBA kept the cash rate on hold at 3.60%, citing persistent inflation pressures despite earlier progress. While the Bank views some recent price rises as temporary, it expects inflation to stay above 3% in the near term before easing toward 2.6% by 2027. Governor Michele Bullock reaffirmed a cautious, data-dependent approach, stating that “anything is possible” when it comes to future rate moves.

From November 2025, the ABS will replace the quarterly CPI with a complete Monthly CPI as Australia’s main inflation measure. The October release marked the final publication of the monthly CPI indicator, and the last time the quarterly CPI served as the primary measure of headline inflation which is a significant shift in how Australia tracks price movements. (ABS)

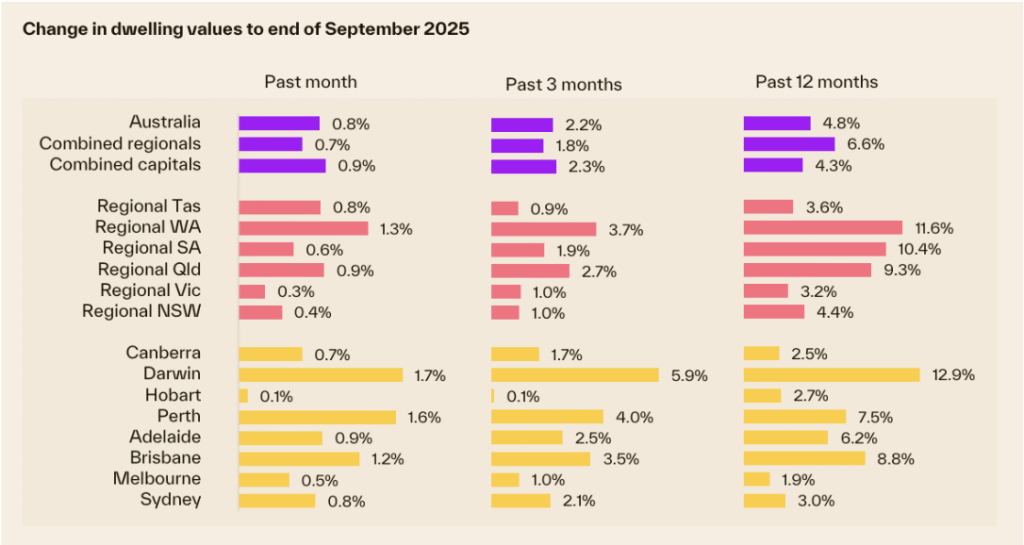

Property Market Update

(Source: Cotality November HVI)

- National values surge at fastest pace in over two years. Australian home values rose 1.1% in October, the strongest monthly growth since June 2023, taking national dwelling values up 6.1% year-on-year. The rebound follows February’s first rate cut, with every capital city and regional market recording gains led by Perth (+1.9%), Brisbane (+1.8%), and Darwin (+1.6%)

- Broad-based growth across capitals and regions. Across the combined capitals, dwelling values increased 1.1% in October and 2.9% over the quarter, while regional markets climbed 1.0%, their strongest monthly gain since early 2022. Perth (+5.4%) and Brisbane (+4.9%) led quarterly capital growth, while Regional WA (+1.8%) and Regional QLD (+1.1%) topped regional rises

- Tight supply and renewed demand continue to drive growth. Housing demand remains elevated, with home sales 3.1% above the five-year average and advertised listings 18% below normal levels. The expanded 5% Deposit Guarantee Scheme, in effect from October 1, has further boosted activity among first-home buyers and lower-priced segments.

Rental Market Update

(Source: Cotality November HVI)

- National rents lift again. Rents continued to climb through October, rising 0.5% per month over the past three months — the fastest pace since May 2024

- Vacancy rates remain at record lows. Rental markets remain extremely tight, with vacancy rates holding around 1.4%, keeping upward pressure on rents across most capital cities

- Growth led by smaller capitals. Annual rental gains were strongest in Darwin (+8.5%) and Hobart (+6.9%), while unit rents outpaced houses across the combined capitals (up 4.4% vs 3.9%)

With rates steady for now, tight property supply, and rental markets heating up again, now is the time to review your strategy. Speak with Azura Financial’s award-winning brokers for tailored advice and competitive lending solutions.