Reserve Bank of Australia Leaves Cash Rate on Hold at 3.60%

At its September meeting, the RBA Board opted to keep the cash rate unchanged at 3.60%.

The unanimous decision reflects a balance between encouraging economic recovery and addressing ongoing inflationary pressures. While inflation has eased significantly from its 2022 peak, the pace of decline has slowed, and there are signs it could remain persistent in some areas. At the same time, domestic activity is showing signs of recovery, supported by rising household incomes, stronger private consumption, and a strengthening housing market.

The RBA highlighted that labour market conditions remain steady, with unemployment holding at 4.2%. However, productivity growth continues to lag, and unit labour costs remain high.

The Board also noted that while financial conditions have eased since the start of the year, it will take time for the full effects of earlier rate cuts to flow through the economy.

In a press conference following the decision, Governor Michele Bullock said: “We’ll make that decision in November about whether it’s down again or maybe on hold again, and if the economy is continuing to recover, that’s really good news. I’m not going to predict what the interest rate is going to be in the next three to six months. What I’m saying is that we have got a situation now which is actually quite a positive situation.” (AFR)

With increasing uncertainty in both domestic spending behaviour and global risks, the RBA judged it prudent to keep policy steady for now, while remaining cautious and signalling readiness to act if conditions shift materially.

Key Takeaways from RBA’s Statement:

- Cash rate remains unchanged at 3.60%.

- Inflation update: Inflation has eased notably from its 2022 peak, with higher interest rates bringing demand and supply closer to balance. Both headline and trimmed mean inflation sat within the 2–3% target range in the June quarter. However, the decline in underlying inflation has slowed, and recent (partial and volatile) data suggest September quarter inflation may be higher than expected at the time of the August Statement on Monetary Policy.

- Private demand strengthening, led by rising household incomes, stronger consumption, and housing market recovery.

- Labour market broadly steady: Growth in employment has slowed by slightly more than expected, but the unemployment rate was unchanged at 4.2% in August. Wage growth has eased from its peak, while productivity stays weak and unit labour costs high.

- Global uncertainties persist, including trade tensions and geopolitical risks.

- RBA cautious but flexible, prepared to adjust policy if inflation or global developments demand it.

(Source: RBA)

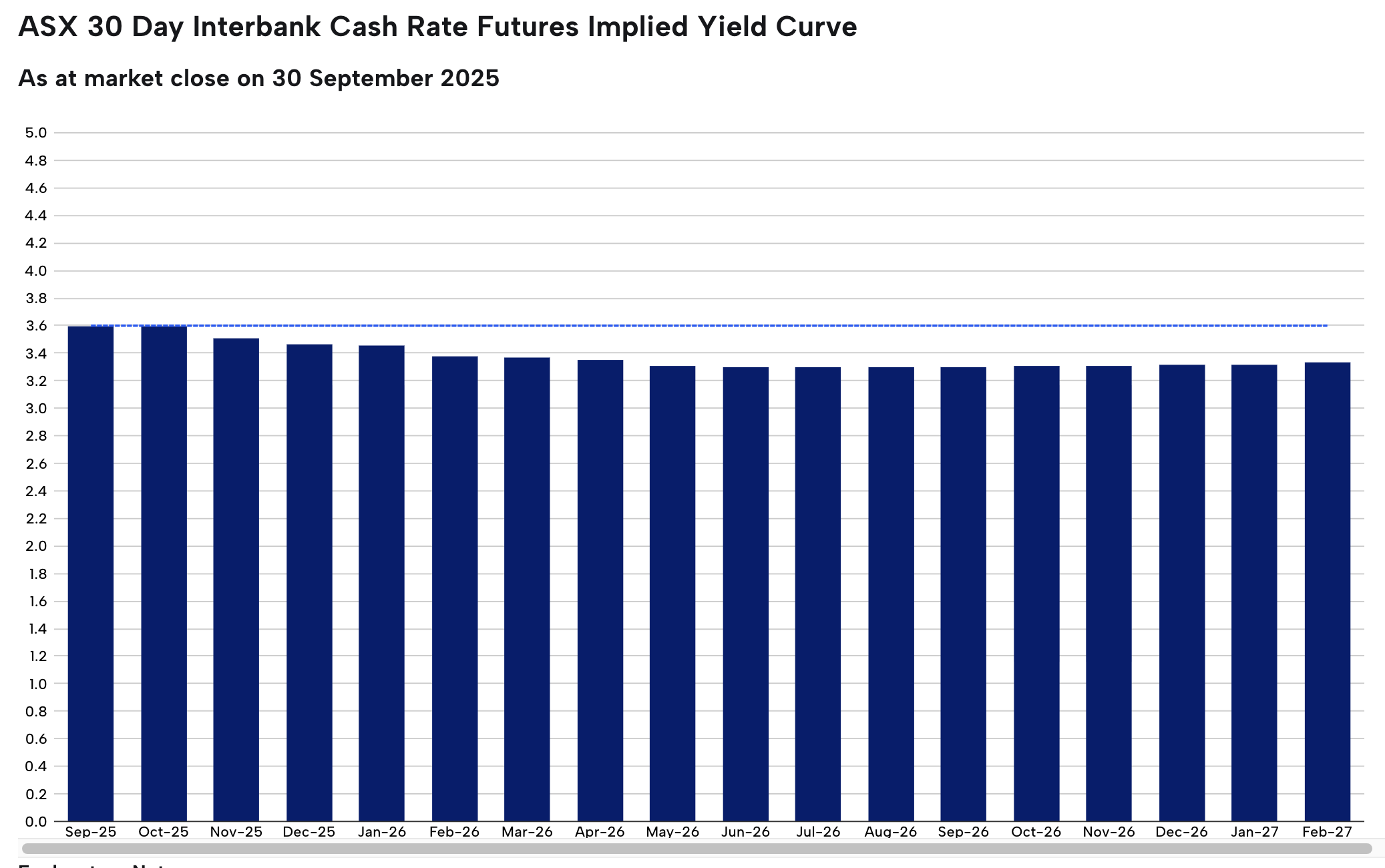

Rate Expectations

(Source: ASX RBA Rate Tracker)

On the 30th of September the RBA left the official cash rate unchanged. The current official cash rate as determined by the Reserve Bank of Australia (RBA) is 3.60%.

As at the 30th of September, the ASX 30 Day Interbank Cash Rate Futures November 2025 contract was trading at 96.49, indicating a 42% expectation of an interest rate decrease to 3.35% at the next RBA Board meeting on the 4th November 2025.

Inflation

- Underlying Inflation: Annual trimmed mean inflation eased to 2.6% in August, down from 2.7% in July, keeping it within the RBA’s 2–3% target band. However, a broader measure excluding volatile items and holiday travel rose to 3.4%, suggesting underlying pressures remain elevated.

- Headline Inflation: Australia’s monthly CPI indicator rose 3.0% over the year to August, up from 2.8% in July — the highest annual rate since July 2024.

- Household Inflation (CPI): Housing inflation rose 4.5%, driven by a 24.6% spike in electricity costs — largely due to the end of state-based rebates in QLD, WA and TAS. Food and non-alcoholic beverages remained steady at 3.0%, with mixed movement in fresh produce and a monthly fall in vegetable prices (-4.6%) easing some pressure on household budgets.

- RBA Stance & Outlook: The central bank is holding the interest rate steady at 3.60% because, while inflation has fallen into their 2%–3% target range, domestic spending is recovering and recent data suggests inflation might be getting stuck (or even ticking up), making them cautious about lowering rates too soon.

From November 2025, the ABS will replace the quarterly CPI with a complete Monthly CPI as Australia’s main inflation measure. The final release of the current monthly CPI indicator will be for September 2025, due 29 October. (ABS)

(Source: RBA)

Property Market Update

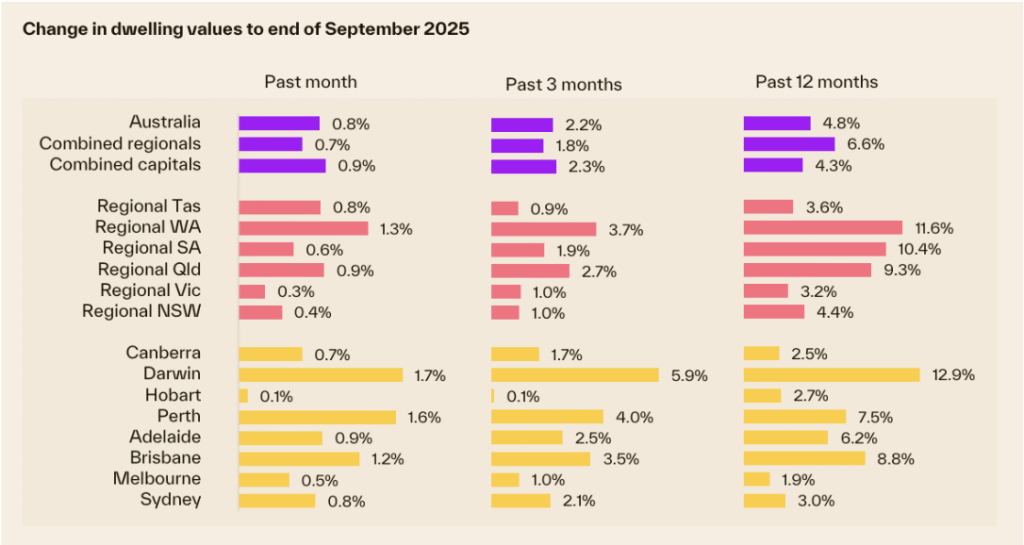

- National values continue to climb: Housing values rose another 0.8% in September, taking national growth to 4.8% year-on-year. Growth momentum remains broad-based across capital cities and regions, with gains supported by rising household incomes, strong consumption, and tight advertised stock levels.

- Widespread gains across cities: Darwin (+1.7%), Perth (+1.6%), and Brisbane (+1.2%) led the monthly increases, while Sydney (+0.8%), Adelaide (+0.9%), and Canberra (+0.7%) also recorded solid growth. Melbourne (+0.5%) saw modest gains, and Hobart (+0.1%) remained flat.

- Spring momentum building: With advertised stock tracking about 18% below the five-year average and auction clearance rates holding around 70% since mid-August, demand remains strong heading into spring. Buyer competition continues to push values higher, particularly across the middle of the market.

(Source: Cotality October HVI)

Rental Market Update

- Vacancy Rates Hit Record Low: The national vacancy rate fell to a new low of 1.4% in September (1.1% for units, 1.7% for houses), underscoring severe rental shortages. Listings are tracking 25% below the five-year average.

- National Rent Growth Rebounds: National rents rose 0.5% in September (seasonally adjusted, monthly), taking quarterly growth to 1.4%, the highest pace since last year. Momentum is picking up again despite affordability challenges.

- Darwin & Hobart Lead Gains: Darwin recorded the strongest quarterly growth (+2.9%), followed by Hobart (+1.9%) and Perth (+1.7%). At the other end, Adelaide (+0.4%) and Melbourne (+0.8%) saw the weakest increases.

(Source: Cotality October HVI)

With rates steady for now, tight property supply, and rental markets heating up again, now is the time to review your strategy. Speak with Azura Financial’s award-winning brokers for tailored advice and competitive lending solutions.