Cash Rate

The Reserve Bank of Australia (RBA) has maintained the nation’s cash rate target at 4.35% for the seventh consecutive meeting, despite rising pressure both domestically and internationally to lower borrowing costs. After concluding their two-day meeting, the RBA board chose to keep interest rates unchanged, a level they have held since November 2023.

Key takeaways from their statement below:

- Cash rate unchanged at 4.35%

- Consumer Price Index (CPI) inflation rate is down to 3.8% for the year

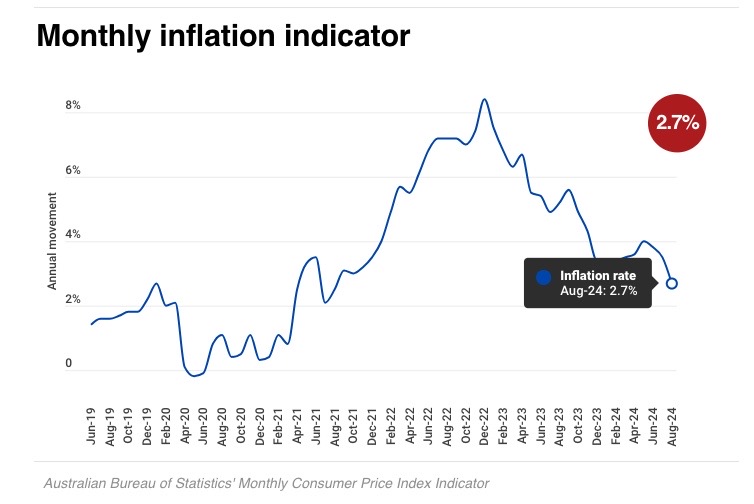

- Monthly inflation rate is down to 2.7%, a 3-year low and within target range

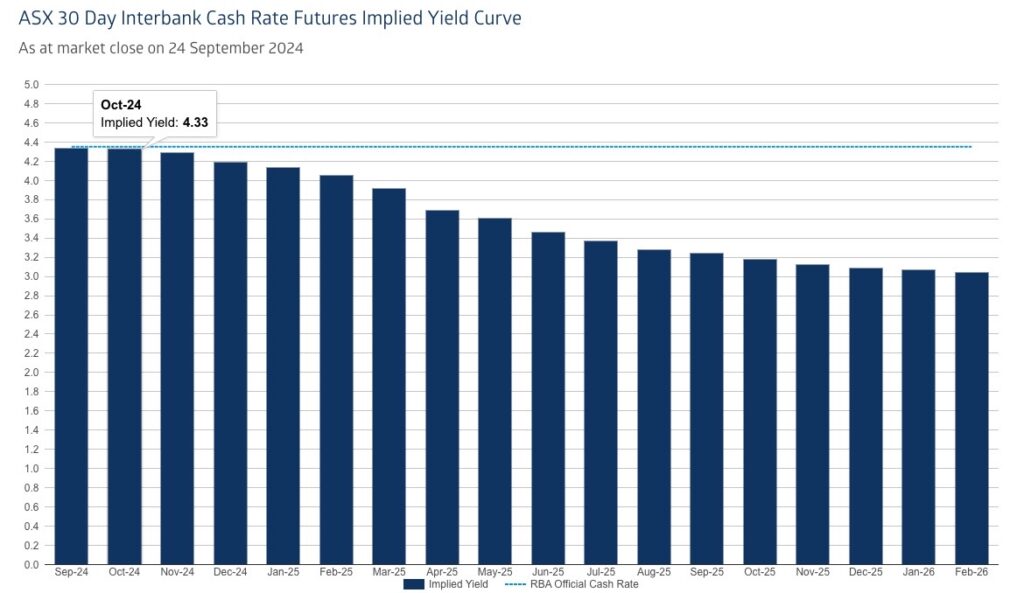

- As of the 24th of September, the ASX 30-Day Interbank Cash Rate Futures November 2024 contract was trading at 95.71, indicating a 24% expectation of an interest rate decrease to 4.10% at the next RBA Board meeting.

Rate Expectations

Source: ASX RBA Rate Tracker

Inflation

- Inflation falls into target range: Australia’s inflation dropped to 2.7% in August, marking the first time it has fallen within the Reserve Bank of Australia’s 2-3% target range since August 2021. However, the RBA remains cautious about whether inflation is sustainably under control.

- Government relief driving short-term reduction: Temporary government subsidies, such as cost-of-living relief, played a significant role in lowering headline inflation. Economists warn that once these measures expire, inflation could rise again.

- RBA maintains cautious approach to rate cuts: Despite inflation falling, the RBA is holding interest rates steady at 4.35% and does not foresee rate cuts in the near future. The bank is focused on long-term inflation control and is waiting for more consistent inflation data before considering easing rates, likely not until 2025.

- While the headline inflation figure may look promising, RBA Governor Michele Bullock is more focused on the underlying inflation rate, which stands at 3.4%. She cautioned that “inflation is not sustainably back within the band” and is expected to rise when the subsidies expire.

Property Market Update

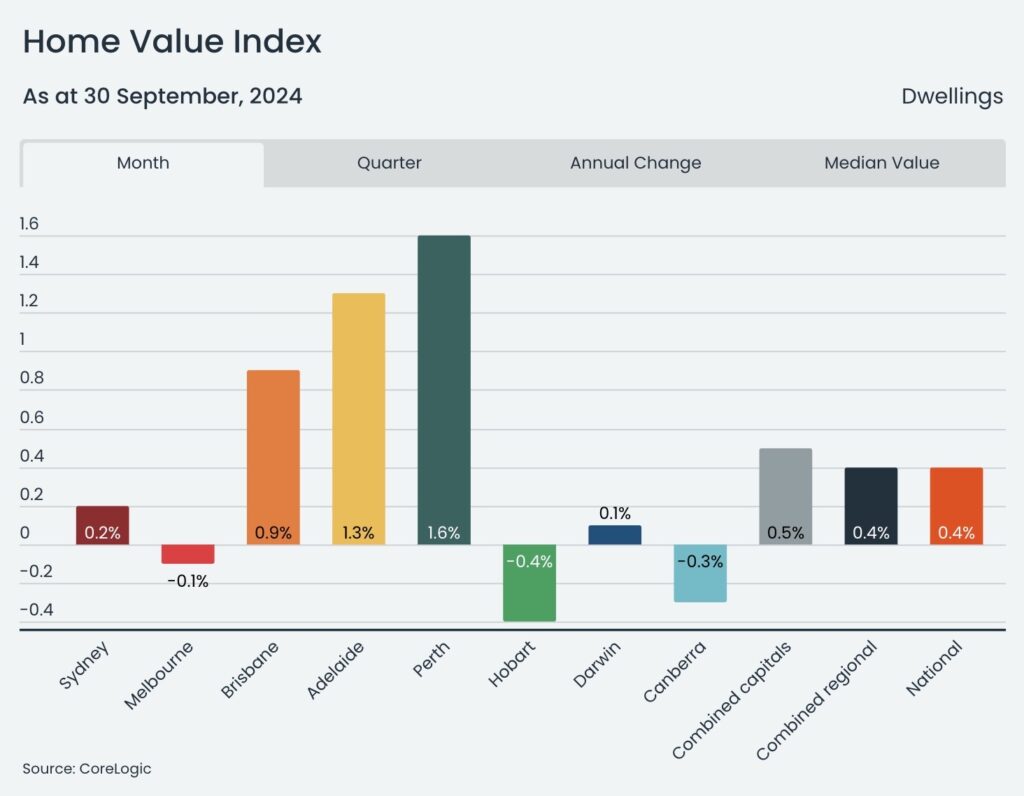

- In September, dwelling values rose a modest 0.4%, marking the third consecutive month of slow growth as market momentum continues to wane. Nationally, values increased by 1.0% in the September quarter, the lowest quarterly rise since March 2023.

- Housing conditions are increasingly diverse, with four capital cities, including Melbourne, recording declines. Meanwhile, spring listings are 3.2% higher than last year, resulting in tougher selling conditions and longer selling times.

- Affordable housing segments are performing better than higher-priced markets, with lower-quartile dwelling values significantly outpacing the upper quartile.

Major insights:

- National Property Growth Slowing: The modest national dwelling value increase in September and over the quarter reflects a broader trend of slowing property market momentum. While growth continues, it is the slowest since March 2023, indicating a potential market plateau. The steady rise in home values, especially in cities like Sydney (+0.5%) and Adelaide (+4.0%), contrasts with declines in cities such as Melbourne (-1.1%) and Canberra (-0.9%).

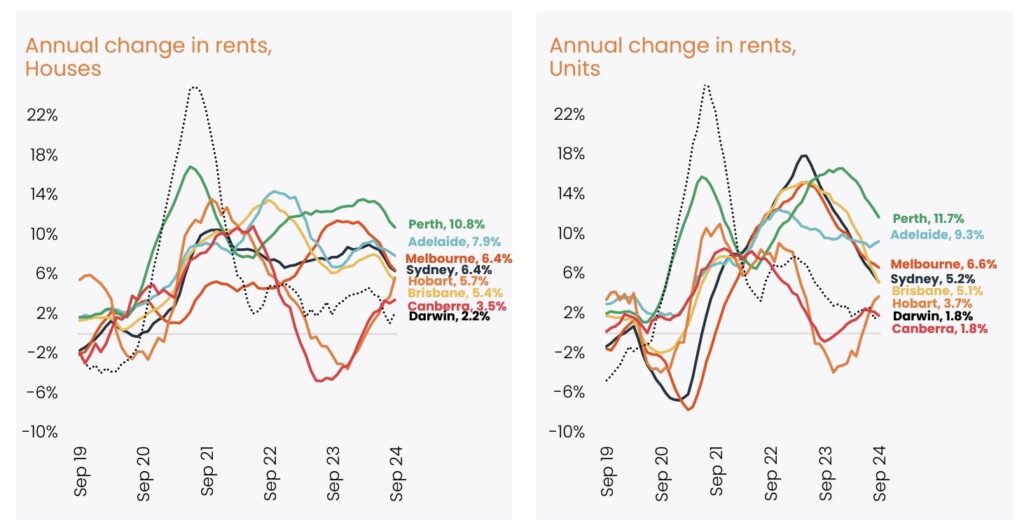

- Rental Yields Pressured by Lower Growth: Rental markets have lost momentum, as seen with minimal increases or declines in rents across key cities. This softening rental growth is impacting national gross rental yields, which have dropped to 3.68%, the lowest since December 2023. This downward pressure is notable in a high mortgage rate environment, where new investors face lower returns and possible cash flow losses.

- Affordability and Supply Constraints: The rental market has been shaped by both affordability constraints and reduced supply. Easing net overseas migration, down 19% from 2023, has reduced rental demand, but high rents are also pushing more households to adopt group or multigenerational living arrangements. The tight labor market and squeezed profit margins for builders have constrained new housing supply, maintaining upward pressure on both home prices and rents.

- City-Level Variations in Yields: While cities like Perth (4.2%) and Darwin (6.8%) offer relatively higher rental yields, other capital cities, such as Sydney (3.0%) and Melbourne (3.7%), continue to see lower returns for investors. Perth and Adelaide (+4.0%) also lead in property price gains, reinforcing them as favorable markets for property investors. However, with mortgage rates for investors sitting at around 6.6%, investors are likely facing tighter margins across the board.

- Regional Markets and Divergence: Regional markets like Western Australia (+3.6%) and South Australia (+2.3%) continue to exhibit stronger property price growth than many capital cities. As growth in combined regional areas outpaces that of combined capitals, opportunities for higher rental yields exist outside of major cities. This trend suggests that regions could become more attractive to investors seeking better returns, especially given the comparatively lower property prices.

- Interest Rate Outlook and Market Sentiment: A potential cut in interest rates, likely by early next year, could reinvigorate housing demand and support investor sentiment. However, ongoing supply challenges will likely keep prices elevated, ensuring that rental demand remains strong even amid softer growth.

In summary, while property prices continue to rise, albeit at a slower pace, rental yields are under pressure, particularly in high-priced markets like Sydney and Melbourne. Investors in regions with higher yields, such as Perth and Adelaide, may find better opportunities, but cash flow challenges are likely until broader market conditions improve. A potential interest rate cut could provide relief, but supply constraints are expected to keep the rental market tight.