The current economic landscape presents significant challenges for property developers, particularly in Melbourne, where rising construction and financing costs widen the price gap between new and established apartments.

According to Shane Wilkinson, Managing Director of Pace, the price of new developments must rise by approximately 20% to remain viable. This is due to “surging costs” that push development prices far beyond what buyers are willing to pay. For example, new apartments at Pace’s Coburg development are listed at $8700–$10,000 per square metre, but future projects would require pricing of $11,000–$11,500 per square metre to justify construction.

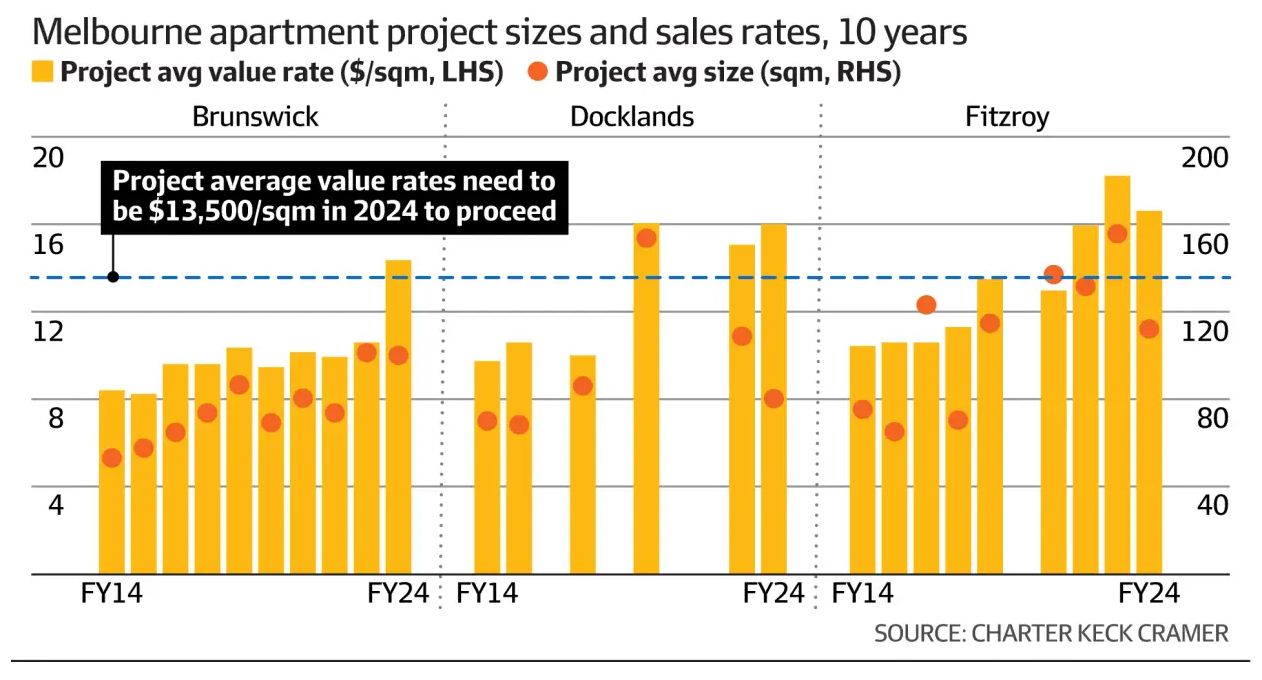

Richard Temlett of Charter Keck Cramer highlighted the broader issue, noting that “the prices of established units need to recalibrate upwards by around 15% for new stock to be accepted by the market.”

This growing imbalance is contributing to Australia’s housing shortage, as developers pause projects that are no longer financially feasible. Andrew Schwartz, Managing Director of Qualitas, notes that “development volume is significantly down.”

In Victoria, additional factors such as rising land taxes, compliance costs, and investor exit exacerbate the issue, flooding the market with existing stock and delaying new developments.

Looking ahead, the market’s recovery may depend on falling interest rates or decreases in land prices. In the meantime, developers face a tough challenge: balancing costs and demand in a housing market where affordability remains a pressing issue.