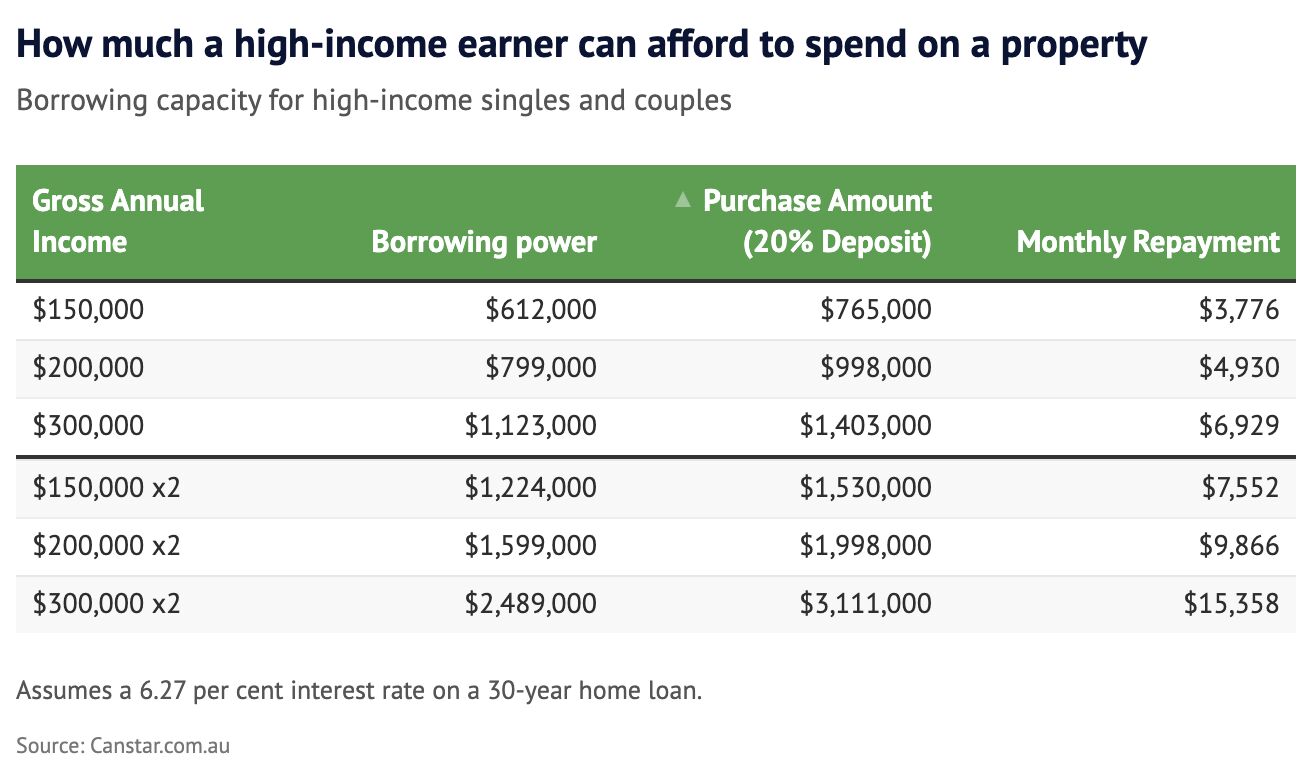

Australia’s housing market is presenting significant challenges, even for high-income earners. New research highlights that individuals earning $150,000 annually can afford to purchase a house in only a small fraction of suburbs across major cities. For singles, this translates to just 2.3% of Sydney suburbs and roughly a quarter in Melbourne. Even with dual incomes of $150,000 each, only about half of Sydney’s suburbs are within reach.

CoreLogic data reveals that “the high income of $150,000 still provides access to a surprisingly low proportion of markets.” Even couples earning $300,000 each may find themselves priced out of high-demand areas such as Sydney’s Coogee or Melbourne’s Toorak, where property prices exceed their borrowing capacity.

This dynamic, described as “an intergenerational wealth game,” underscores the importance of supplementary financial support, such as gifts or guarantees from family, in achieving homeownership in these exclusive markets.

As borrowing capacities shrink due to sustained high interest rates and climbing property prices, the path to homeownership requires careful planning. Strategic approaches, including buying smaller properties as stepping stones or exploring options further from city centres, can help buyers navigate these challenges.

The takeaway? Whether setting short-term goals for 2025 or rethinking what “affordability” means in this landscape, staying informed and adapting strategies is essential in navigating Australia’s property market.

Stay ahead of the latest trends and updates in the property market by signing up for our newsletter to receive insights delivered straight to your inbox.