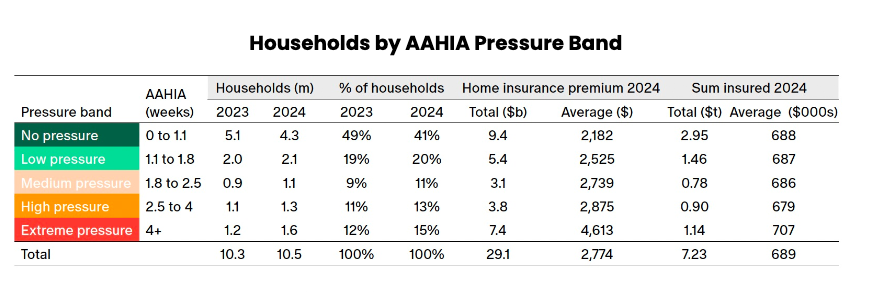

The challenge of home insurance affordability in Australia is intensifying, with 1.6 million households now struggling to meet rising premiums—a 30% increase in just one year. According to the Actuaries Institute, these households are spending about 9.6 weeks of their annual income on insurance, pushing the “affordability stressed” category from 12% to 15%.

This issue is particularly critical in high-risk regions, where premiums have surged by over 30%. The impact on Australia’s home loan market is significant, with 5% of mortgage-holding households under similar stress, representing $57 billion in home loans.

Sharanjit Paddam, lead author of the report, warns of the broader financial risks, especially if a natural disaster strikes uninsured or underinsured households. Elayne Grace, CEO of the Actuaries Institute, calls for a collaborative approach, emphasising the importance of resilience in finance to support vulnerable households.

As this situation evolves, governments, insurers, lenders, and investors need to work together to develop sustainable solutions to alleviate the growing financial pressure on Australian households.