The Australian Bureau of Statistics’ monthly CPI indicator showed annual inflation rising to 4.0% in the year to May, up from 3.6% in April.

With inflation climbing again, there are now concerns that this might lead to another cash rate hike.

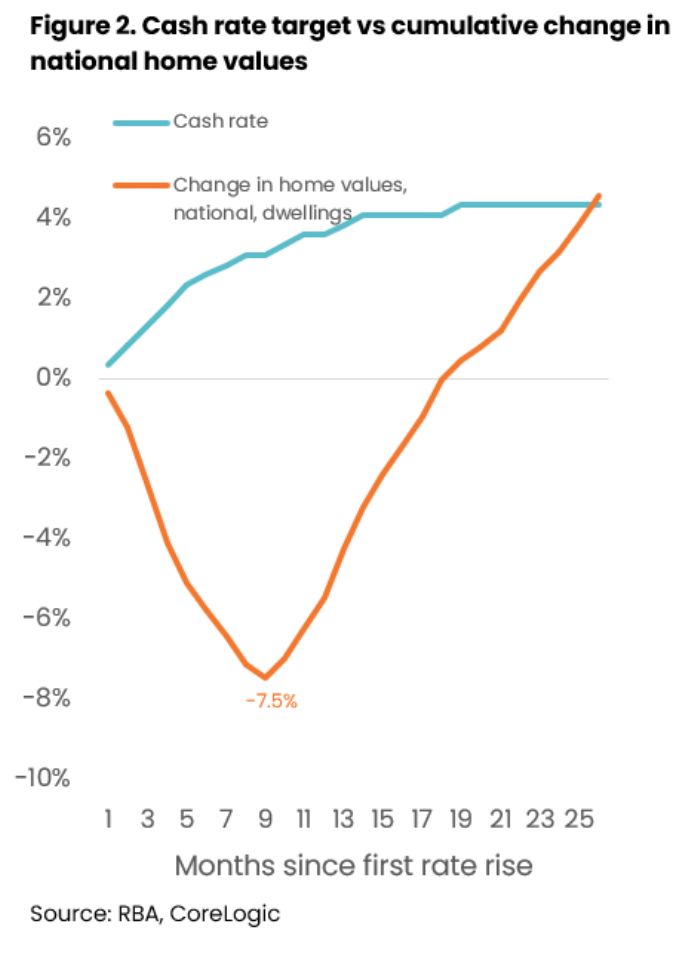

CoreLogic’s head of research Eliza Owen has examined the potential impact of this on the Australian property market, which has shown resilience to higher interest rates so far (see graph).

Ms Owen partly attributes this resilience to low supply relative to demand, noting that as long as more people want to buy homes than sell, prices should theoretically keep rising.

Buyers may also be factoring in a future reduction in the cash rate, expecting they are purchasing near the peak of the rate cycle and that mortgage rates will decrease over time.

“From this perspective, a further rate increase could certainly slow demand and signal to the market that interest rates are not yet at peak or at the very least, are likely to take longer to reduce,” she said.