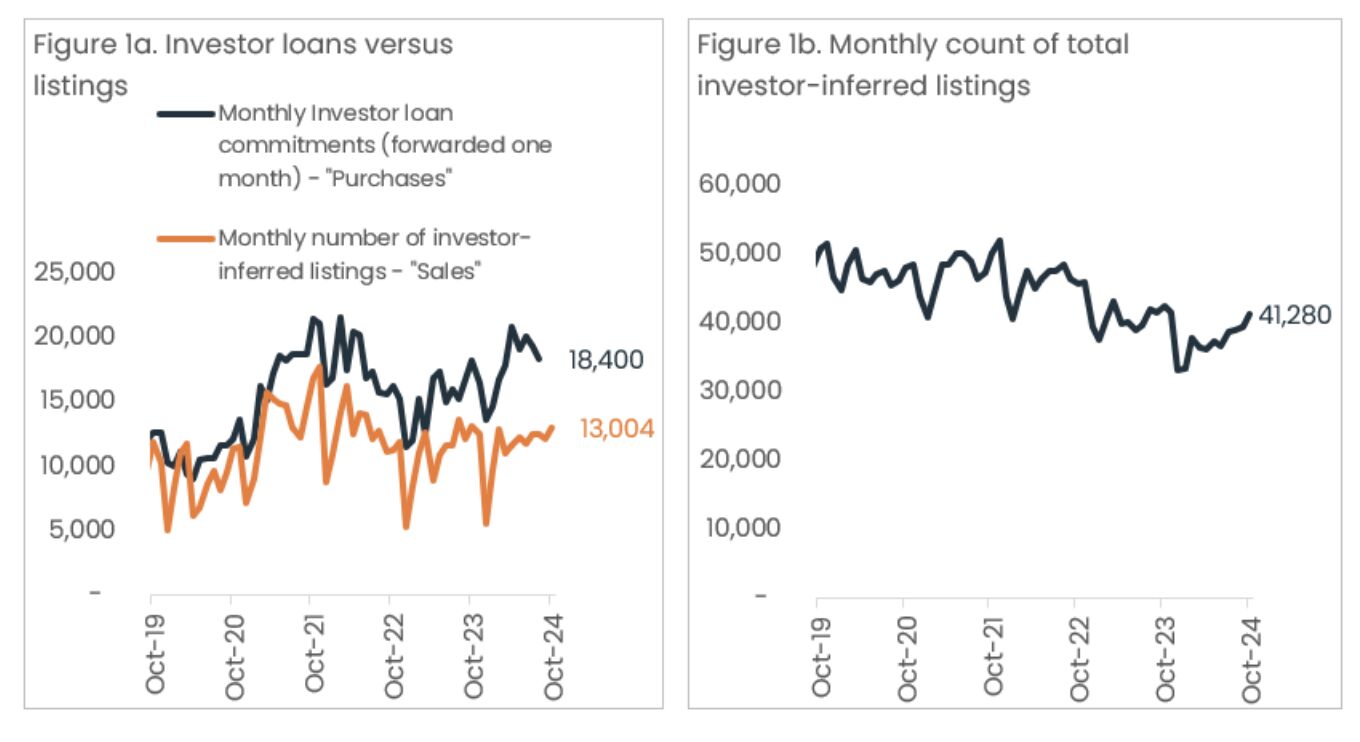

The Australian property market is witnessing contrasting trends in investor activity this year. While some existing investors are discouraged by high interest rates, tenancy reforms, and increased taxes, new investment purchases continue to grow. According to Australian Bureau of Statistics (ABS) data, investor loan commitments rose 18.8% in the year to September 2024.

Regional variations highlight differing dynamics. High-growth markets like Queensland, Western Australia, and South Australia are experiencing elevated new investor loan activity. Victoria and Tasmania are seeing more investor listings come to market, influenced by factors like softer capital growth and higher holding costs.

The profile of investors is also evolving. The landscape is adapting to changing economic conditions with less leveraged investors entering the market and a modest rise in first-home buyers purchasing investment properties. Though investor activity has softened slightly since April, a stable cash rate may temper new purchases without driving significant increases in investor sales.

These trends underline the complex nature of Australia’s property investment market in 2024.