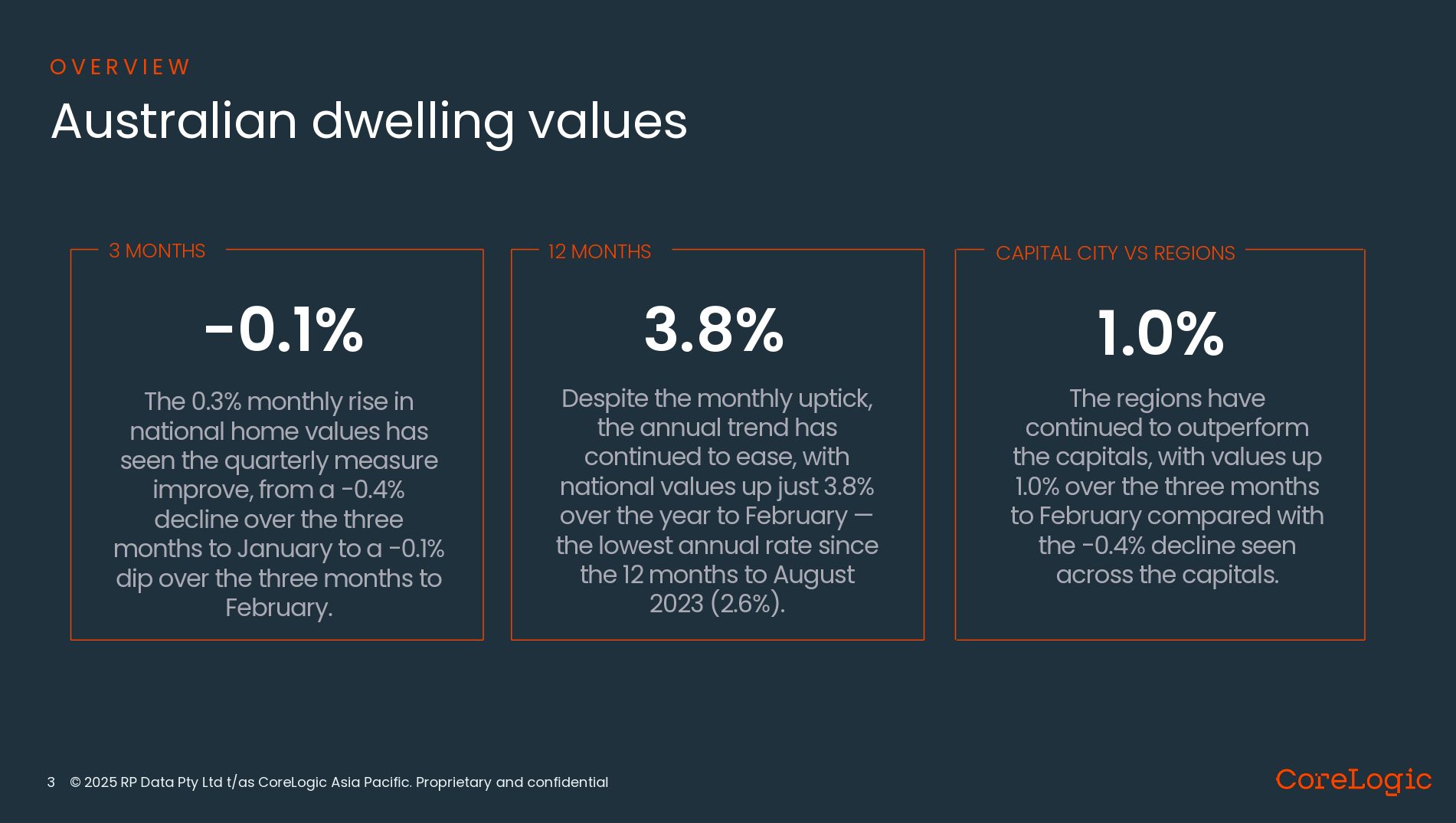

Australia’s high-end housing market bounced back in February, with the upper quartile of home values in capital cities rising 0.2% in March, reversing a previous decline.

Historically, top-tier markets have been early indicators of broader trends, and CoreLogic data suggests this rebound could signal the start of a wider recovery.

Sydney, Melbourne, and Hobart led the turnaround, with Greater Sydney’s prestige markets seeing a 2% increase in February and Melbourne’s Stonnington East recording a 0.8% gain after a sharp decline in January.

“The top quartile is the one to watch as they tend to be a bellwether for broader market recoveries,” says CoreLogic economist Kaytlin Ezzy.

If momentum continues, high-end properties could soon outperform the rest of the market for the first time since August 2023.

With interest rate shifts playing a key role, buyer sentiment and expectations around credit access are already influencing demand.

Whether this trend holds will depend on economic conditions, but early signs suggest a renewed strength in the premium market.

Get the latest property insights delivered to your inbox—subscribe to our newsletter today.