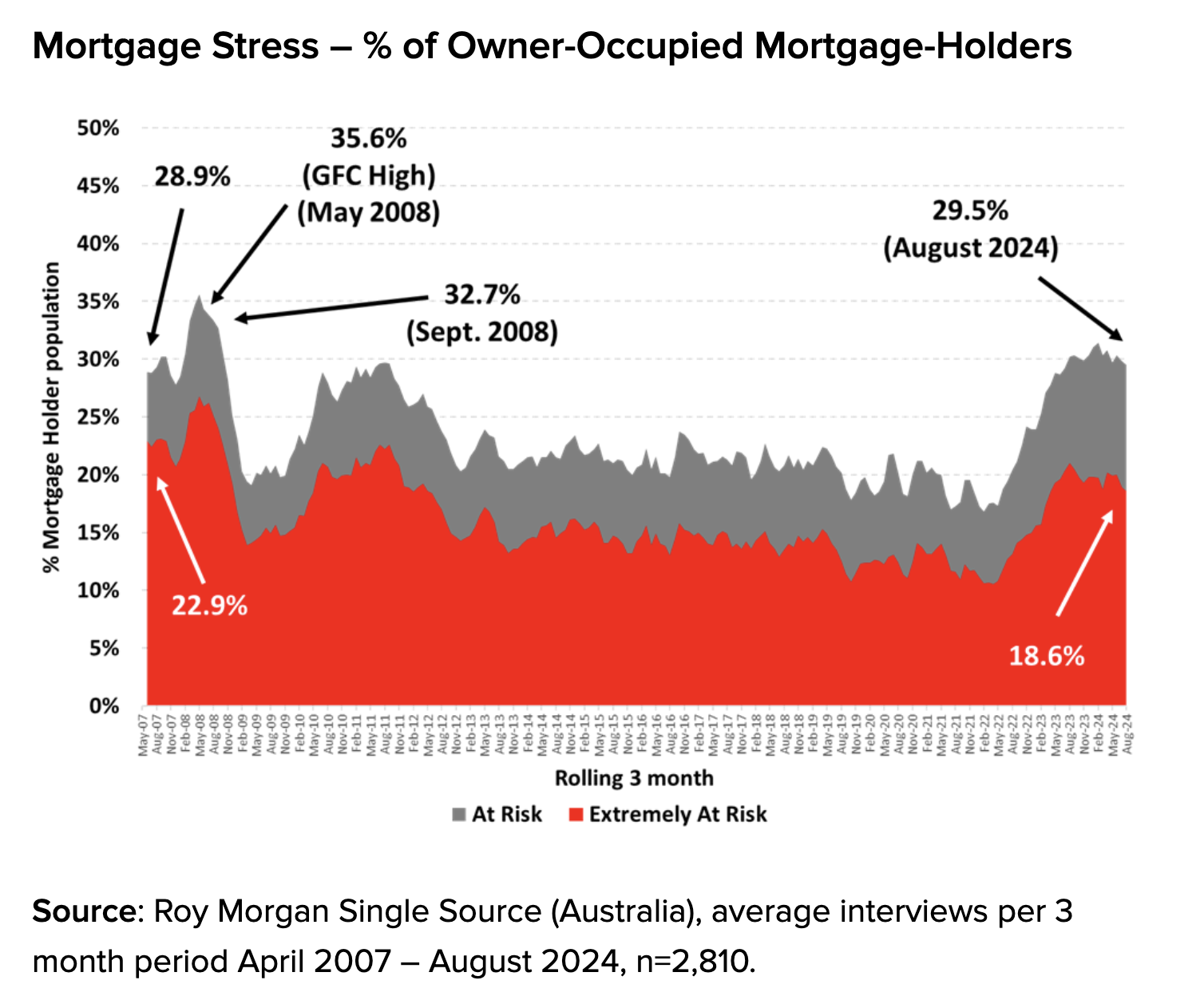

Recent data from Roy Morgan highlights that approximately 1.66 million Australian mortgage holders (29.5%) were at risk of mortgage stress in the three months to August 2024.

This figure has seen a slight decrease following the introduction of Stage 3 tax cuts, which have boosted household incomes. However, Roy Morgan cautions that this positive trend could reverse if interest rates rise.

Currently, more than one million mortgage holders (18.6%) are considered highly at risk, significantly above the 10-year average.

Michele Levine, CEO of Roy Morgan, warned that further rate increases could push over 1.7 million Australians into mortgage stress, stating, “Two additional rate increases of 0.25% would bring the total number of mortgage holders at risk to over 1.7 million.”

While tax cuts have provided temporary relief, the real concern remains the potential for further rate hikes and the ongoing challenge of underemployment, which continues to strain household incomes.