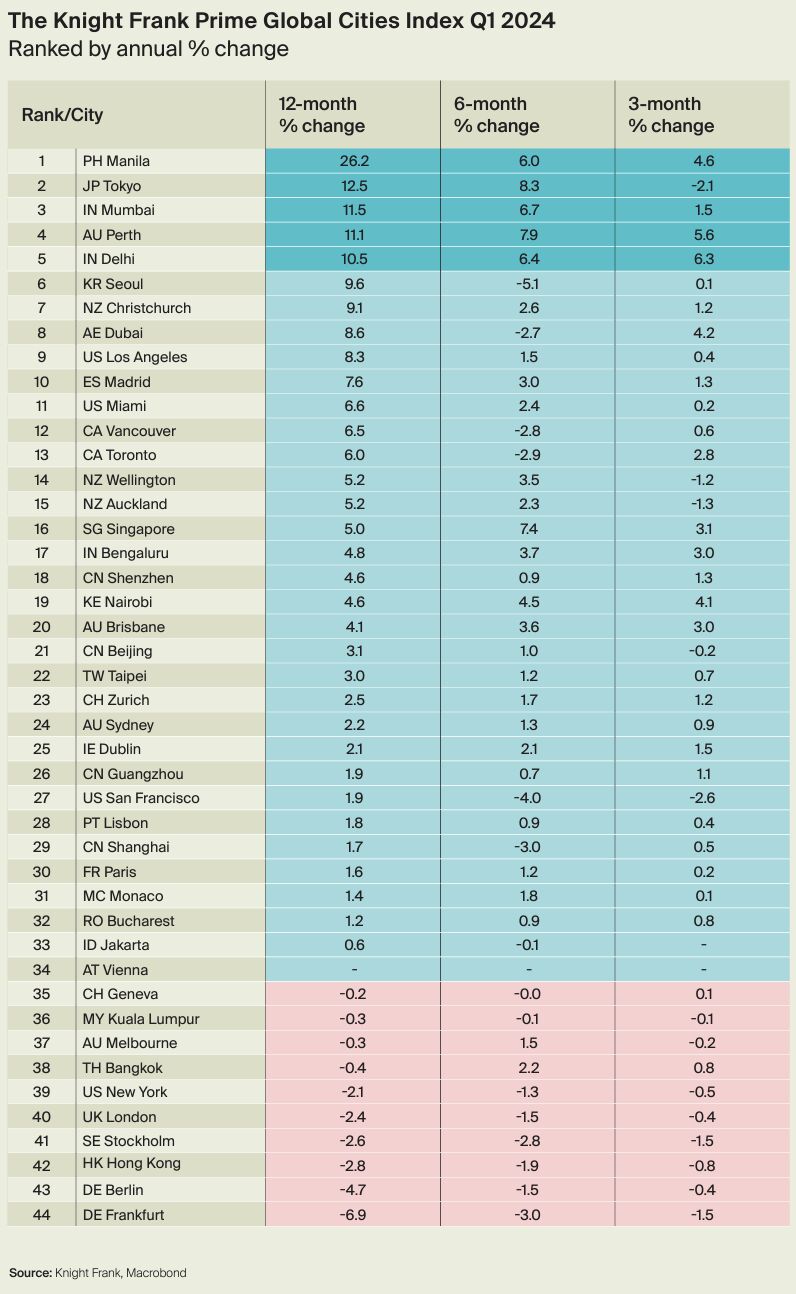

Australia’s luxury property market has demonstrated resilience, outperforming many of its international counterparts despite global economic challenges. Recent data from Frank Knight’s Prime Global Cities Index highlights that Perth, Sydney, Brisbane, and Melbourne have all seen positive growth in luxury residential property prices, with Perth leading at 3.7% annual growth.

This upward trend is supported by Australia’s strong population growth, particularly post-COVID, which has helped sustain demand. However, “we expect Australia will also see a slowdown in price growth in the luxury market over the next year or so like the rest of the world,” according to Knight Frank’s global head of research, Liam Bailey.

Notably, Sydney’s luxury market remains robust, with significant interest from international buyers. “Internationally, we’re seeing a strong interest in Sydney prestige property from Europe, Asia, and also the expat community coming back,” said Ray White Double Bay principal Elliott Placks.

Moving forward, the luxury market’s trajectory will hinge on key factors such as interest rates, population dynamics, and broader economic conditions.