Cash Rate

The Reserve Bank of Australia (RBA) has decided to keep the cash rate unchanged at 4.35% for its ninth consecutive meeting on 10 December 2024, with the next rate decision scheduled for 18 February 2025.

The central bank highlighted key economic factors in its December 2024 statement, including weak economic growth and persistent inflation pressures.

Governor Michele Bullock acknowledged that progress has been made in managing inflation but highlighted that reducing inflation further remains challenging, emphasising the need for ongoing monitoring of economic data to inform future rate decisions.

Economists and major banks are predicting rate cuts could begin as early as February 2025, with some analysts suggesting gradual reductions in the first half of the year. However, there’s consensus that cuts will be cautious and data-driven, with most expecting modest adjustments rather than sharp reductions.

Key takeaways from the RBA’s statement:

- Cash Rate Held at 4.35%: No change to the cash rate as the RBA balances inflation concerns with weaker economic activity.

- Inflation: While underlying inflation has eased significantly from its 2022 peak, it remains at 3.5%, above the RBA’s target range (2.5%), especially driven by services and high unit labour costs.

- Wage Growth: Wage growth has eased more than expected, with the Wage Price Index showing a 3.5% increase for the year to the September quarter.

- Although wage pressures have reduced, labour productivity growth remains weak, continuing to affect inflation dynamics.

- Economic Weakness: Economic activity is weak, with GDP growth at 0.8% over the past year, the slowest since the early 1990s outside of the pandemic. The unemployment rate rose to 4.1%, up from 3.5% in late 2022, while wage growth slowed to 3.5%, reflecting weak productivity.

- Future Rate Cuts: The market anticipates potential rate cuts by the RBA in early 2025, although the central bank’s caution reflects its ongoing concerns over inflation.

Rate Expectations

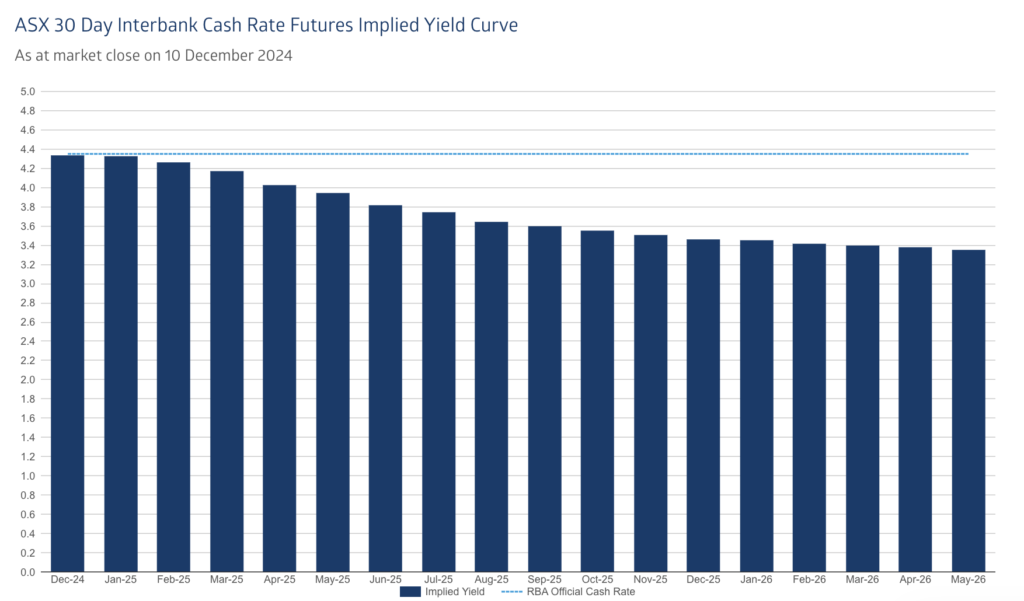

(Source: ASX RBA Rate Tracker)

Based on the recent ASX 30-Day Interbank Cash Rate Futures data, here is a summary of market expectations for RBA rate changes in the coming months:

- February 2025: An 84% probability of a 25-basis-point decrease to 4.10% at the next RBA meeting.

- Throughout 2025: Markets signal further rate reductions, with probabilities rising as the year progresses, suggesting modest expectations for monetary easing.

The sentiment highlights a market cautiously leaning towards rate cuts starting in early 2025 as economic conditions evolve.

Inflation

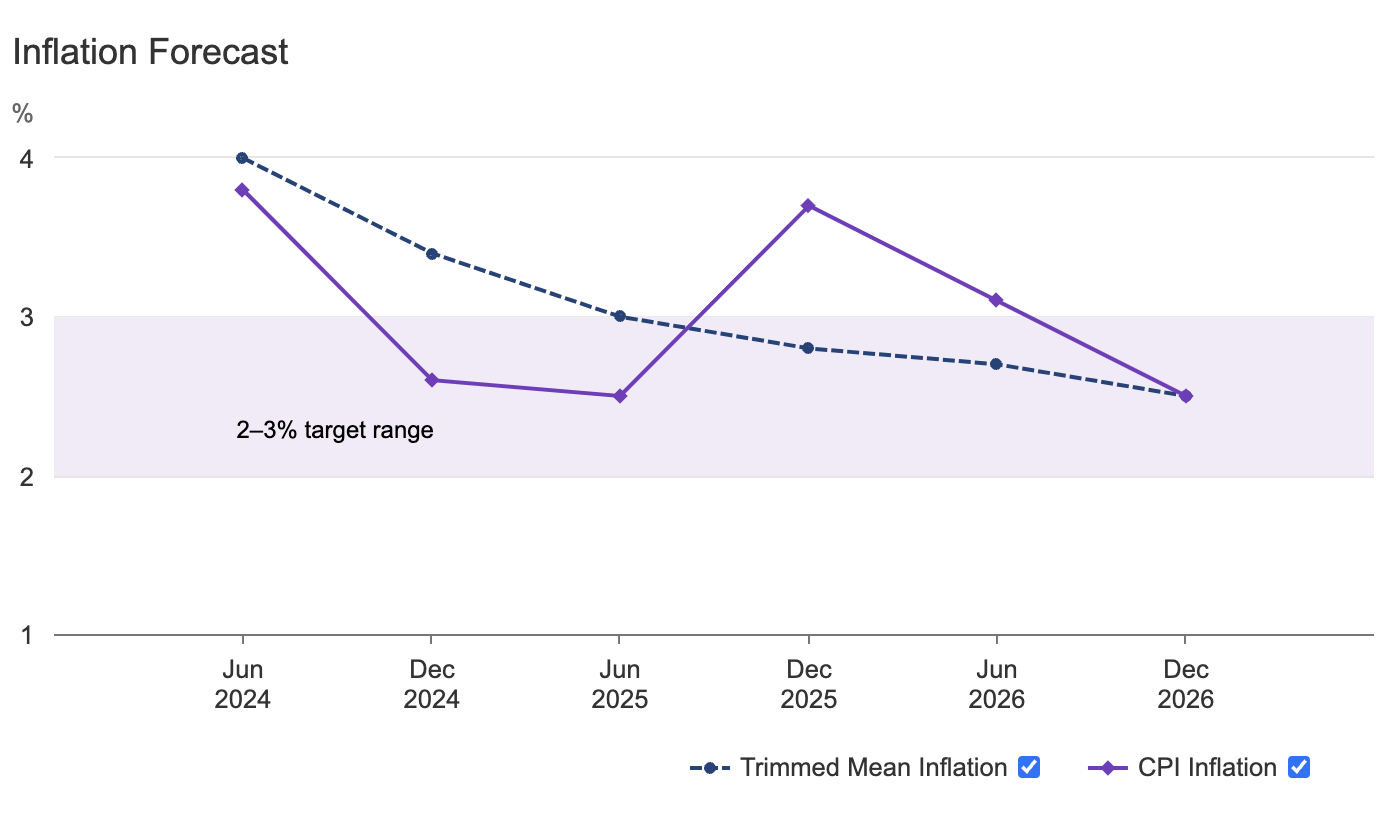

- Headline Inflation: Temporary cost-of-living relief measures have contributed to a drop in headline inflation but are expected to reverse as these measures end. Headline inflation is anticipated to briefly reach the target range in early 2025.

- Underlying Inflation: While underlying inflation is easing, it remains too high. This slower decline reflects persistent demand exceeding supply despite gradual normalisation.

- Annual CPI growth: +2.1% (unchanged from September).

- Cost of Living: Prices are 16% higher than three years ago, continuing to strain household budgets, especially for vulnerable Australians.

- RBA Stance: Tight monetary policy remains in place until inflation consistently progresses toward the 2–3% target range midpoint.

- Forecast: Inflation is expected to reach 2.5% by late 2026. Headline inflation may enter the target range briefly in early 2025, influenced by temporary factors.

(Source: RBA)

Property Market Update

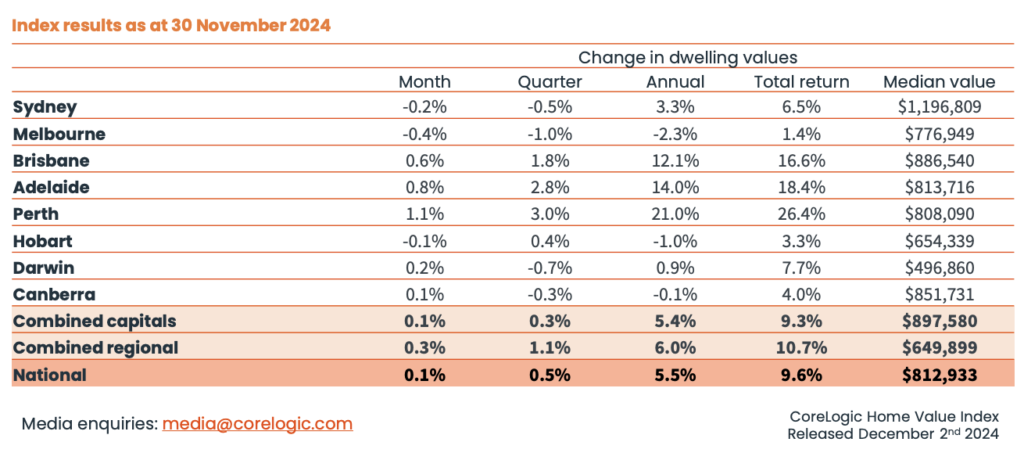

- November Home Values: National Home Value Index (HVI) rose by only 0.1%, the weakest growth since January 2023, signalling a near end to the upswing.

- Capital Cities: Melbourne and Sydney are leading the downturn with respective monthly falls of -0.4% and -0.2%. Quarterly declines are now evident in four capitals: Melbourne (-1.0%), Darwin (-0.7%), Sydney (-0.5%), and Canberra (-0.3%).

- Strong Performers: Perth remains a leader with a 1.1% rise in November, though growth is slowing. Regional markets outperformed capitals, with a 1.1% rise in the combined regional index.

(Source: Property Update and CoreLogic)

Rental Market Update

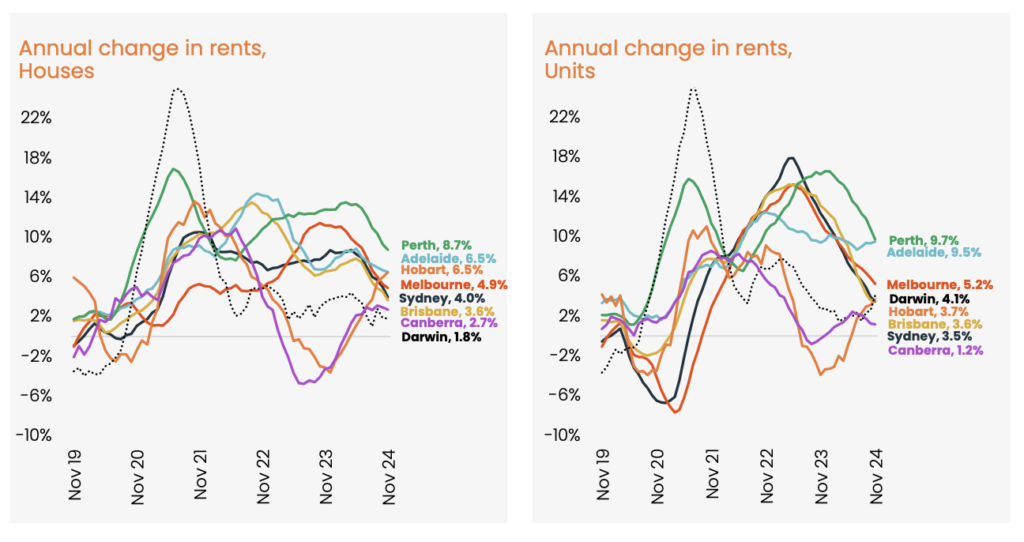

- Slowdown in Rent Growth: National rents increased by 0.2% in November, marking the smallest annual rise (5.3%) since April 2021.

- Regional Variations: Perth leads rental growth for units (9.7%) and houses (8.7%). However, rental demand is easing due to reduced population growth and rising household sizes.

- Gross Rental Yields: Yields have stabilised at 3.6%, with Sydney recording the lowest (3.0%) and Darwin offering the highest near-investor mortgage rates (~6.6%).

- Shift in Household Preferences: Record low affordability is forcing renters to restructure households, reducing demand for individual rental properties.

(Source: Property Update and CoreLogic)

Lending Data

- Loan Statistics: The average new home loan for owner-occupiers is $642,121, with average monthly repayments of $3,962. Interest rates are at 6.27%, and 98% of new loans are variable. 21% of new loans are interest-only, while 79% are principal and interest.

- Market Trends: Home values rose by 5.5% over the past year, driven by factors such as population growth, low supply, and strong demand. However, high interest rates and affordability constraints are slowing market growth.

- Refinancing & Borrowers: Nearly 29,000 homeowners switched lenders in September 2024. Refinancers tend to request larger loans, and more than 70% of loans are arranged via brokers.

- Deposits & Affordability: First home buyers now face a $159,000 deposit, a 50% increase since 2020. Loan affordability is under pressure due to high interest rates and reduced savings.