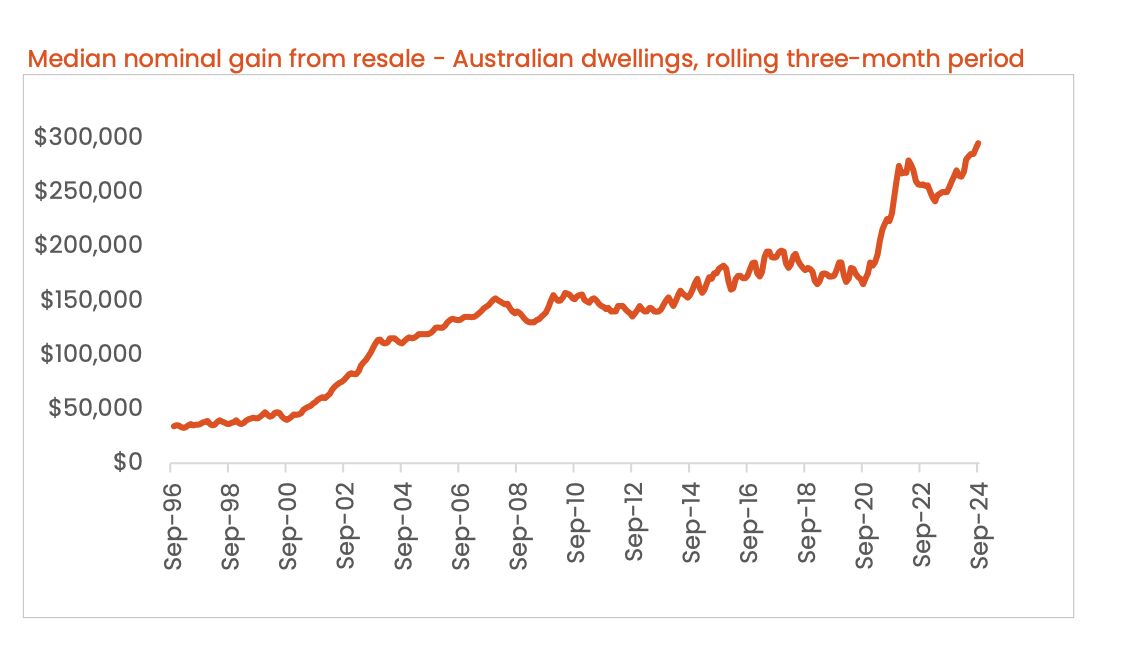

The latest CoreLogic Pain & Gain Report for Q3 2024 reveals record-breaking profitability for Australian property resales, with 95% of sales nationally delivering a profit. The median resale gain reached a remarkable $295,000 – the highest since the series began in the mid-1990s – while the total resale profit stood at nearly $34 billion for the quarter.

Key findings include:

- Brisbane emerged as the most profitable capital city, with 99.4% of sales yielding a nominal gain.

- Houses outperformed units, with just 2.9% of houses resold at a loss compared to 9.4% in units.

- The median hold period across all resales increased to 9 years, reflecting long-term capital growth trends.

CoreLogic’s Head of Research, Eliza Owen, noted the importance of stable lending practices and strong demand conditions in driving profitability. However, challenges persist, particularly for properties held for short durations or purchased during low-rate periods. Ms. Owen added, “A decline in home values is only a problem for sellers if they have issues servicing home loan repayments, or are in some other circumstance where they need to sell.”

While these results highlight resilience in the Australian property market, the report also underscores regional disparities and ongoing risks for some property types, particularly units and short-term holds.

To stay updated on key property market trends and insights, subscribe to our newsletter today.