The value of Australia’s housing market has reached a new high, totalling $11 trillion as of September, reflecting a combination of new builds and rising property prices. In the past 12 months alone, home values increased by 6.7%, delivering an additional $900 billion in wealth to homeowners.

Kaytlin Ezzy, CoreLogic economist, notes, “We’re expecting prices to rise over the near to medium term, although the pace of growth will likely ease as more supply comes online this spring.” Recent data from the Australian Bureau of Statistics also shows 176,000 new homes were completed by June, with the government aiming to add 1.2 million homes over the next five years.

Despite softer quarterly growth of just 1% in September, new listings rose by 2.1%, marking the strongest start to the spring selling season since 2021. “The increase in stock is providing more opportunities for both buyers and investors, easing some of the competitive pressure,” Ezzy explains.

Investors are re-entering the market, with new investor loans reaching 38.6% of all lending in August—the highest share since 2017. Tight rental conditions and potential long-term capital gains are attracting investors, who are seeing favourable opportunities.

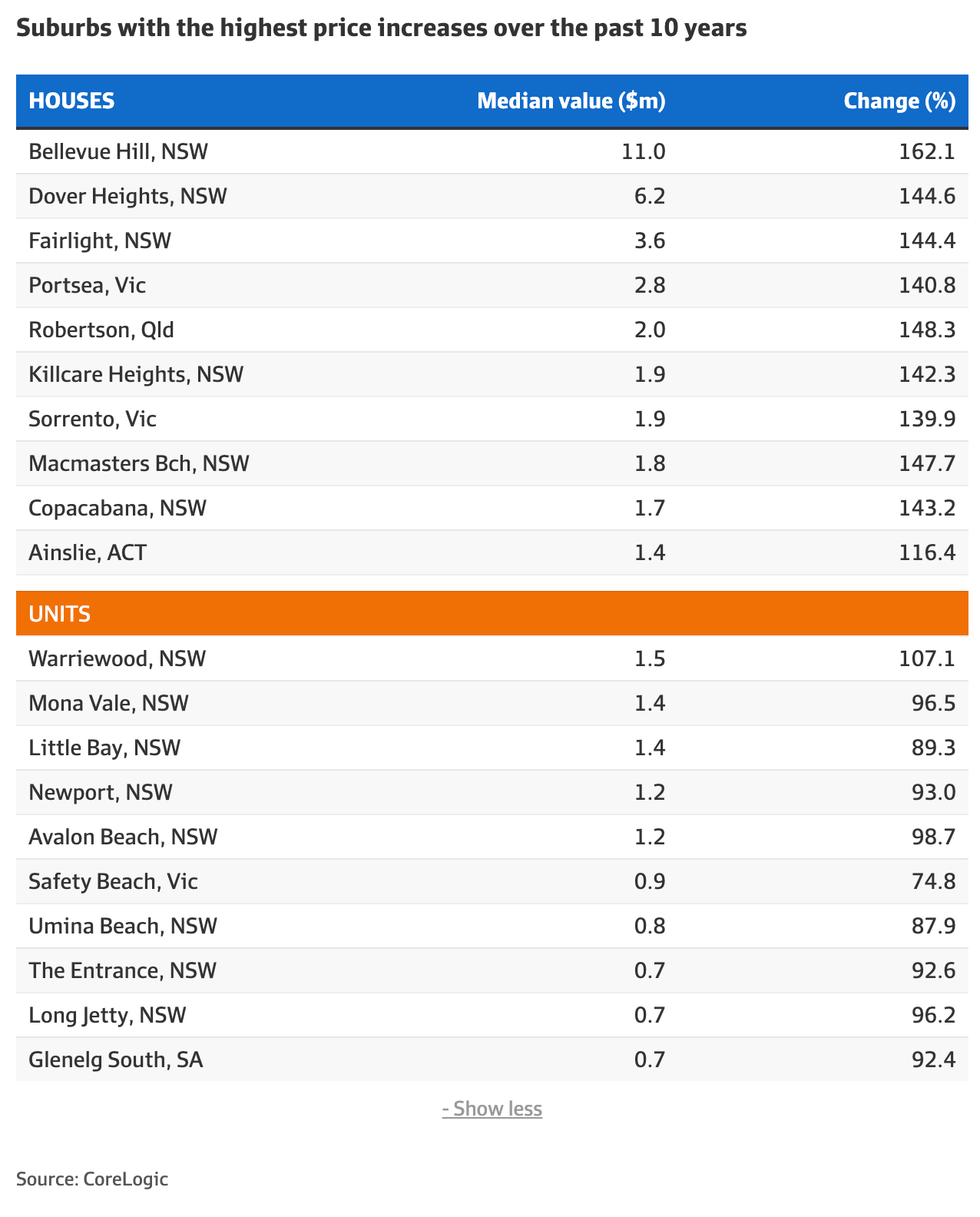

Over the last decade, house values have risen by 85.9% nationwide. Sydney recorded the largest increase among capital cities, with house prices climbing 95.2% to an average of $1.47 million. Brisbane, Adelaide, and Melbourne followed with significant gains, underscoring the resilience of property markets across Australia.

While property continues to be a key driver of household wealth, AMP’s chief economist Shane Oliver notes that rising property values are also contributing to intergenerational wealth disparities. “Property remains a reliable way to build wealth, but with prices outpacing income growth, it’s becoming harder for many people to enter the market,” Oliver says.