BREAKING NEWS: GLOBAL TRADE WAR CHANGES RATE EXPECTATIONS DRAMATICALLY

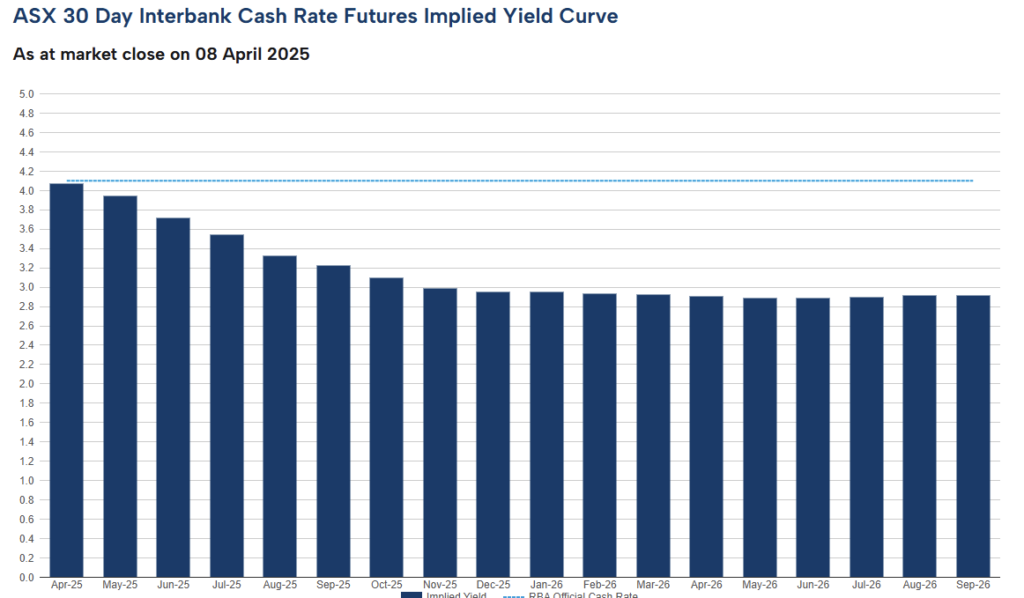

Due to expectations of subdued economic growth on the back of recent global trade policy changes, cash rate expectations have changed dramatically.

As of 8th April, there is an 80% chance of a rate cut at the next meeting May 21. Additionally, financial markets are currently pricing up to 5 cuts over the next 12 months.

The Reserve Bank of Australia (RBA) left the cash rate unchanged at 4.10% on 1 April 2025. The Board’s decision reflects a cautious stance amid moderating underlying inflation and ongoing domestic and global uncertainties.

While rates remain at 4.10%, Governor Michele Bullock reassured that the RBA can cut rates if a global trade war significantly impacts Australia’s economy. She noted that Australia is in a “reasonable position” with inflation coming down and unemployment still relatively low.

Bullock also highlighted that rising trade protectionism, particularly potential US tariffs, presents uncertainty for the Australian economy. She warned that these trends are not temporary and could have lasting impacts on global trade and inflation.

Still, the governor on Tuesday reassured Australians that the country was “well placed” to weather any future storm should tit-for-tat tariffs degenerate into a global trade war.

“The economy is in a reasonable position. Inflation is coming down. Unemployment is still relatively low,” she said. (The Guardian)

The next RBA Board meeting and Official Cash Rate announcement will be on 20 May 2025.

Key takeaways from the RBA’s statement:

- Cash Rate Held at 4.10%: The rate remains unchanged as the RBA continues to assess the evolving economic environment.

- Underlying Inflation Moderating: Recent data indicate that underlying inflation is easing in line with forecasts, although the Board remains cautious until inflation can sustainably return to target.

- Economic Outlook: Private domestic demand is slowly recovering and real household incomes have picked up, yet weak demand in certain sectors and tight labour market conditions persist.

- Global Uncertainties: Ongoing trade policy shifts and geopolitical tensions continue to weigh on global confidence, adding uncertainty to the outlook.

- RBA Priority: The Board remains resolute in its determination to sustainably return inflation to target, maintaining a restrictive monetary policy until there is clear, sustained progress.

Source: (ABC)

Rate Expectations

(Source: ASX RBA Rate Tracker)

On April 1st, the RBA held the official cash rate at 4.10%, and the next cash rate decision will be announced following the RBA Board meeting on May 20, 2025.

As of April 2nd, market pricing on the ASX 30-Day Interbank Cash Rate Futures for May 2025 reflected a 79% chance of a rate cut to 3.85%.

Inflation

- Underlying Inflation: Trimmed mean inflation fell from 2.8% in January to 2.7% in February—the lowest level over three years (since December 2021)—indicating a cooling of underlying price pressures.

- Headline Inflation: Headline inflation dropped to 2.4% year-on-year in February, although it is expected to rebound as temporary subsidies, like electricity bill relief, phase out.

- Housing Inflation: Rent inflation eased to 5.5% and new dwelling price inflation fell to 1.6% in February, showing signs of moderation in the housing market despite ongoing supply challenges.

- RBA Stance & Outlook: Despite these easing trends, the RBA remains cautious due to persistent labour market tightness and global uncertainties, with market expectations suggesting no further rate cuts until at least the July board meeting.

(Source: AFR)

Property Market Update

- Record Recovery: National home values reached new record highs in March, rising by 0.4%—a turnaround from a three-month decline of 0.5%.

- Capital vs. Regional Trends: In March, national home values rebounded by 0.4%, with capital cities showing modest gains while regional markets outperformed, with the combined regional index rising by 0.5% compared to 0.4% in capitals.

- Outlook: Improved sentiment from the recent rate cut has boosted borrowing capacity, but affordability constraints and gradual momentum suggest that while the recovery is promising, sustained growth may remain challenging.

(Source: CoreLogic Hedonic Home Value Index – Index Results as of 31 March 2025)

Rental Market Update

- Rental Growth Slowing but Still Elevated: Annual rental growth has eased to 3.8%—the slowest pace since March 2021—down from the 9.7% peak in 2021. However, it remains above the pre-COVID decade average of 2.0%.

- Unit Rents Outpacing House Rents: Rental growth has slowed more sharply for units than houses, but unit rents are still rising at a higher rate in most capital cities, driven by strong demand and migration trends.

- Yields Rising but Costs Remain High: Combined capital city gross rental yields have risen to their highest level since 2019 (3.53%), but high mortgage rates and increased maintenance costs continue to impact overall returns for investors.

(Source: CoreLogic Hedonic Home Value Index – Index Results as of 31 March 2025)

Lending Data

- Lending Growth Accelerates: Business and investor housing credit saw significant growth in December, with business credit reaching 8.9%—the highest since May 2023—and investor housing credit rising to 5.1%, its highest since December 2022.

- Drivers of Increased Credit Demand: A strong labour market, rising wages, and major investments in housing construction, renewable energy, and infrastructure fuel the demand for business and housing credit.

- Private Credit as an Emerging Opportunity: With traditional banks struggling to meet corporate borrowing needs, private credit is gaining traction, offering investors yields of around 10% per annum—more than double bank deposit rates. The RBA has acknowledged private credit’s attractive risk-return profile and relatively low volatility.