Cash Rate

The Reserve Bank of Australia (RBA) left its cash rate unchanged at 4.35% for the sixth meeting in a row on Tuesday, 6th August 2024. The next RBA meeting and Official Cash Rate announcement is scheduled for 24th September 2024.

Key takeaways from their statement below:

- Cash rate unchanged at 4.35%

- The current underlying Consumer Price Index (CPI) inflation rate is 3.9% for the year leading up to the June quarter

- Although inflation has decreased since its peak in 2022, it is still above the target range of 2-3%

- Revisions in consumption, high unit labour costs, and sustained inflation in the services sector all pose upside risks to inflation

- Wage growth seems to have peaked, but is still higher than what trend productivity growth will allow for

- Economic activity momentum is weak, as seen by slow Gross Domestic Product (GDP) growth, rising unemployment rates, and pressure on businesses

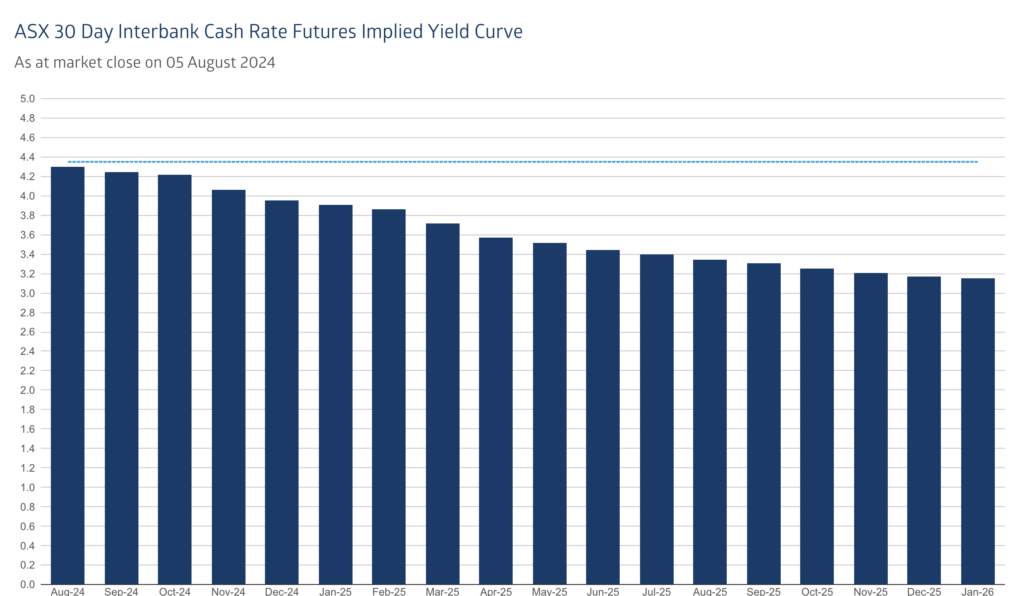

Rate Expectations

Source: ASX RBA Rate Tracker

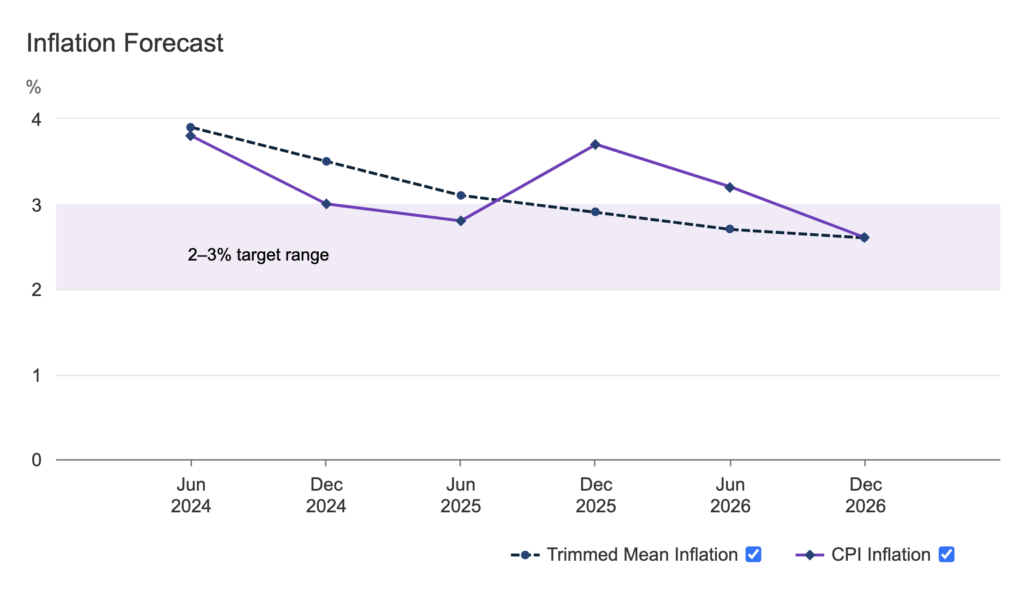

Inflation

- Current Underlying CPI Inflation is 3.9% over the year to the June quarter and has been above the midpoint target for 11 consecutive quarters.

- The current inflation rate indicates the economy may not be able to meet domestic demand as well as previously believed.

- Inflation is expected to return to the target range of 2-3% late in 2025 and approach the midpoint in 2026.

- The Board’s top priority is restoring inflation to target within a reasonable timeframe, which is consistent with the RBA’s goal of ensuring price stability and full employment.

Source: RBA

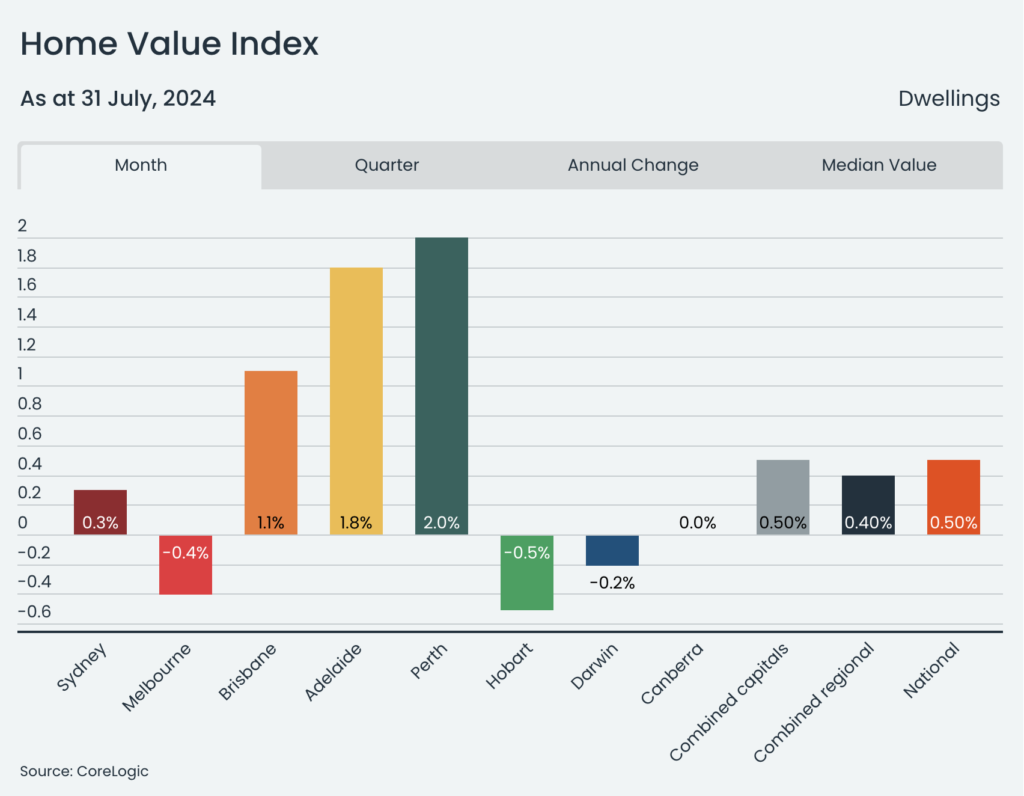

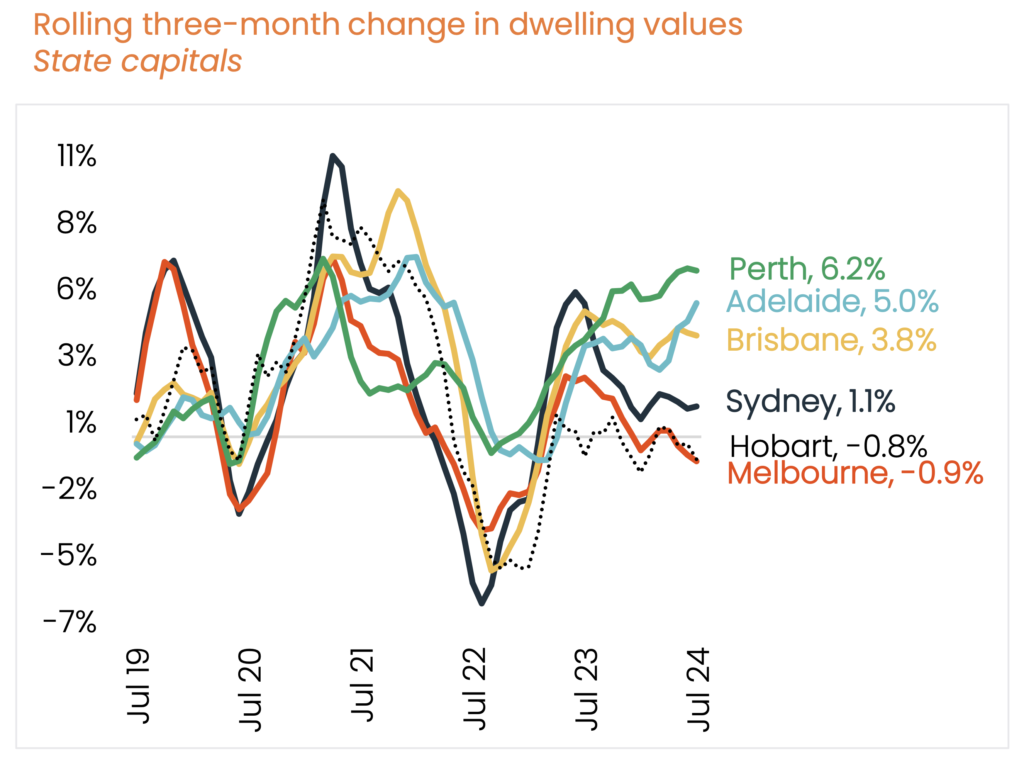

Property Market Update

- Home values went up by 0.5% in July, indicating 18 months of growth. (CoreLogic)

- Perth saw a year-on-year growth of 22.77%, while Adelaide and Brisbane grew by 14.81% and 13.93% respectively. (Broker News)

- A second property boom in Perth is anticipated once interest rates decrease in 2025. (Domain)

Rental Market Update

- Declines were observed in rental prices in Brisbane, Hobart, and Sydney

- CoreLogic’s rental index rose only 0.1% in July, the smallest monthly increase since August 2020

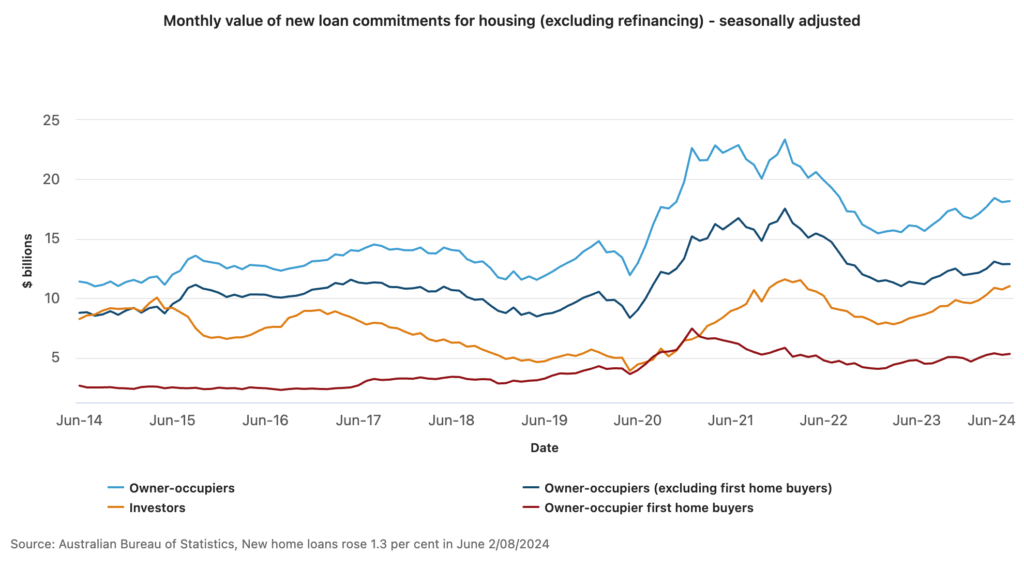

Lending Data

- Australian Bureau of Statistics (ABS) lending data shows the total value of new housing loans rose 1.3% in June to $29.2 billion.

- ABS head of finance statistics, Mish Tan, noted investor lending growth outpaced owner-occupier growth in June.

- Investor loans climbed 2.7% to $11 billion, a 30.2% increase compared to last year.

- New owner-occupier loans increased by 0.5% to $18.2 billion, reflecting an annual gain of 13.2%.

- First home buyer loans rose 0.7% in June and increased by 3.4% compared to last year, driven by a 6.5% growth in Victoria.

- New investor loan growth was observed across all states, led by New South Wales (up 27.3%), Queensland (up 34.5%) and Western Australia (up 56.7%).

- Personal fixed term loans rose 1.1% to $2.6 billion, an 11.7% increase from last year.

Economic Outlook

- Meeting the target inflation rate may take longer if the labour market remains tight or GDP growth is stronger than expected.

- Stronger-than-expected public demand and an increase in household expenditure as real incomes rise have improved the GDP picture.

- It is anticipated that faster growth in imports and slower growth in home development will partially counteract these concerns.

- Slow recovery has been observed in advanced economies, but Australian economic growth is expected to improve next year.