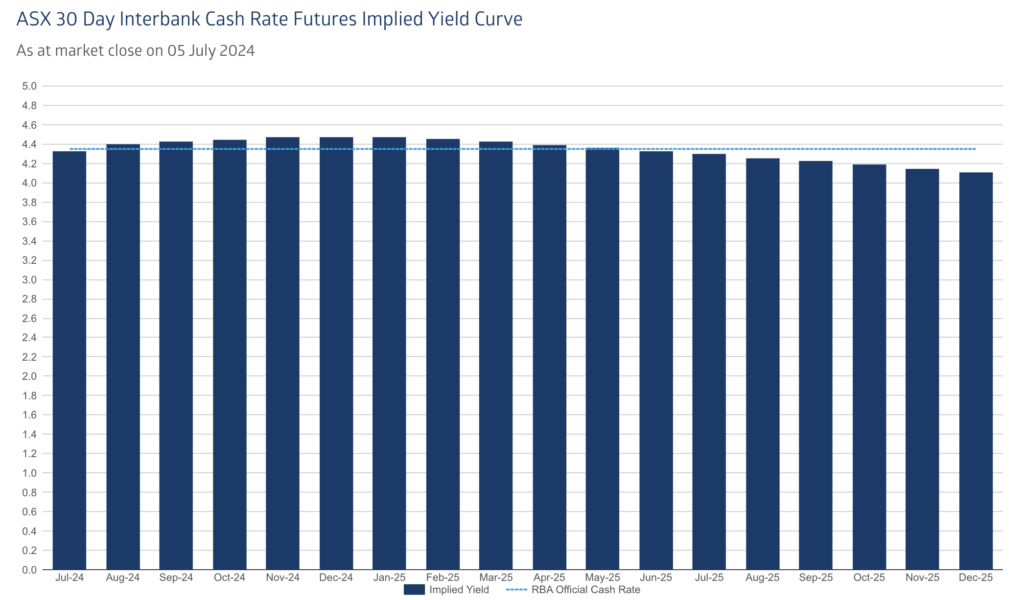

Cash rate expectations

- ANZ: First cut in Feb 2025

- CBA: First cut in November 2024

- NAB: First cut in May 2025

- Westpac: First cut in November 2024

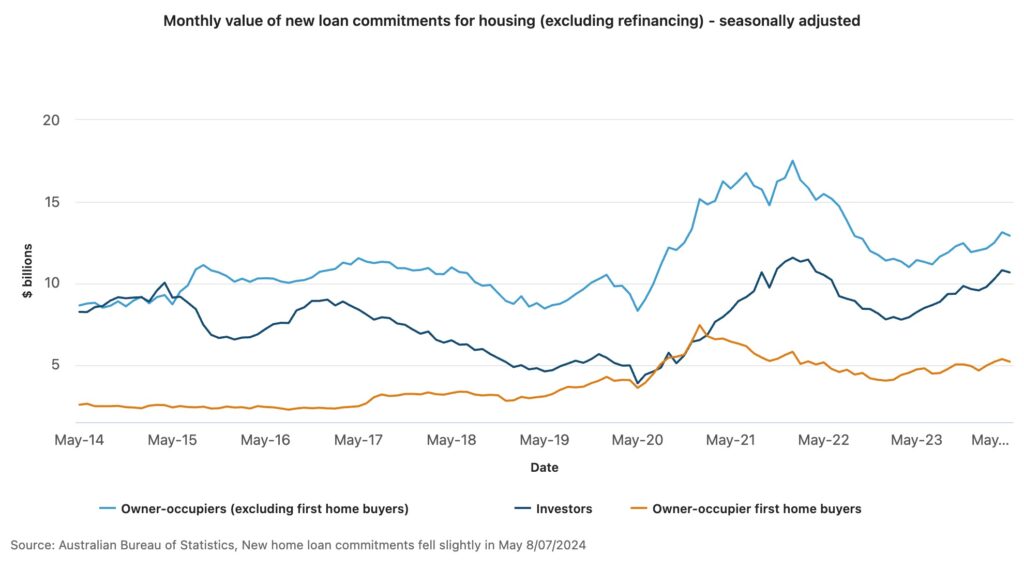

Lending data

- The ABS recorded a 1.7% month-on-month fall in new housing loans to $28.8 billion in May.

- First home buyer loans fell the most, dropping 2.9%.

- However, since May 2023, the total value of new loan commitments has risen 18.0%.

- Loans to investors have grown 29.5% year-on-year, compared to a 12.2% increase for owner-occupiers.

- Western Australia had the largest increase in investor loans, up 73.9%, while NSW saw a 24.8% rise.

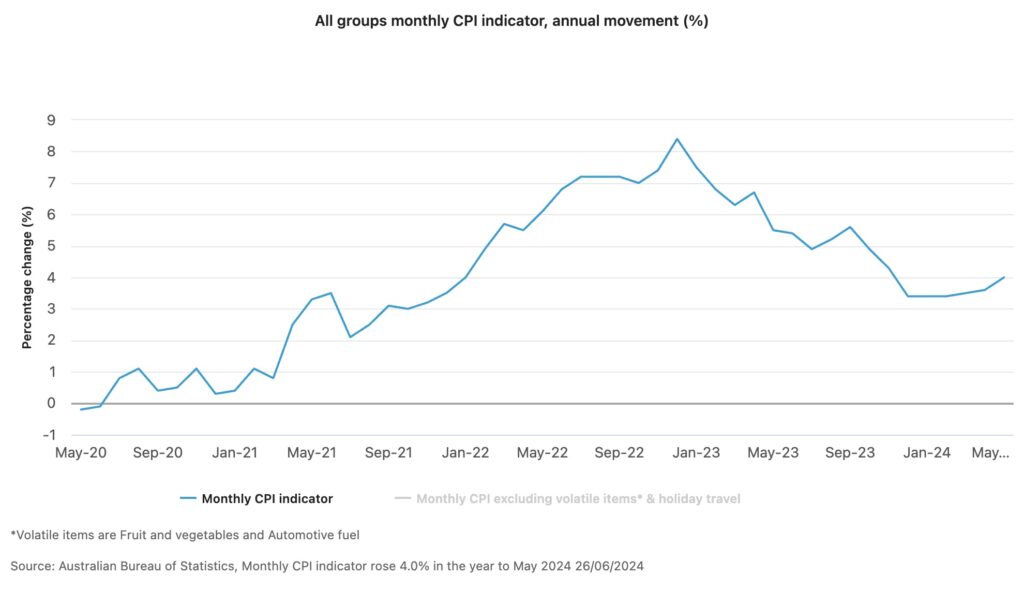

Inflation

- The Australian Bureau of Statistics reported a 4.0% annual inflation rate in May, up from 3.6% in April.

- This increase raises concerns that the RBA might need to raise the cash rate again.

- However, monthly inflation figures are less complete than the quarterly ones (which will be released on 31 July).

- Significant contributors to May’s inflation include housing costs, which grew 5.2% from May 2023.

- Electricity prices rose by 6.5% from a year ago, accelerating from April’s 4.2% increase.

- Without federal and state rebates, electricity prices would have been 14.5% higher.

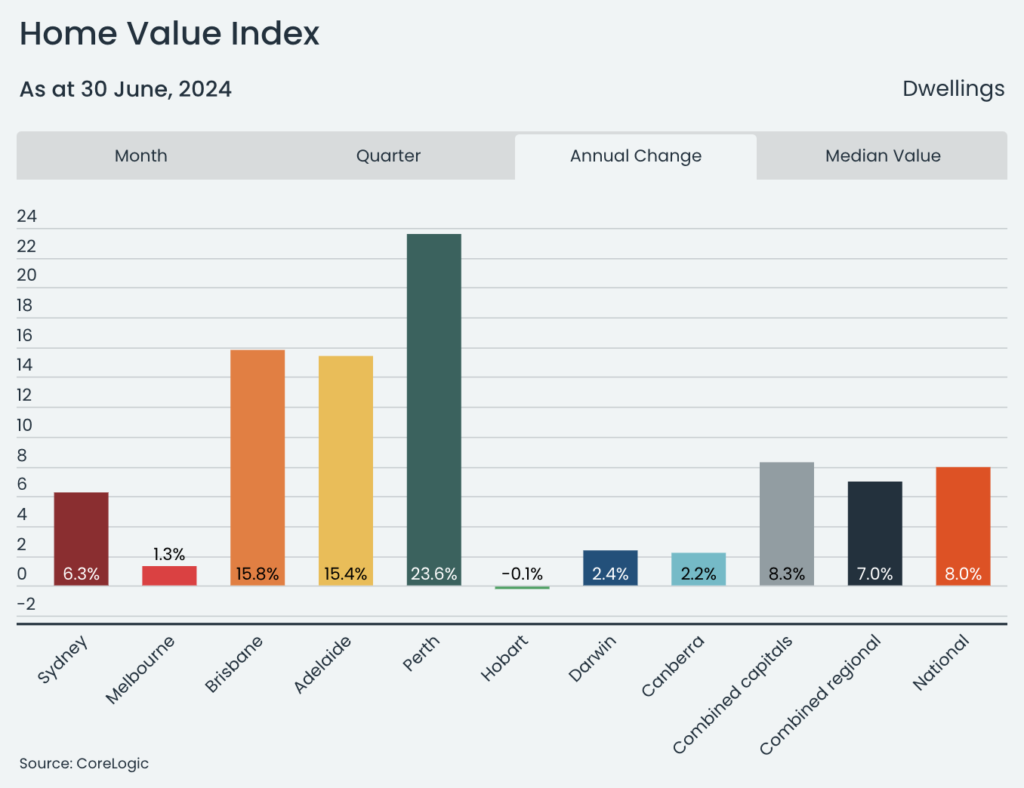

Property market update

- Australia’s median dwelling price reached a new all-time high of $794,000 in June after increasing 0.7% since May to be up 8.0% on the year.

- Prices have consistently grown between 0.5% and 0.8% each month since February as tight supply continues to put upward pressure on prices.

- Perth was the strongest market, with values surging 2.0% in June to be 23.6% higher over the year.

Rental market update

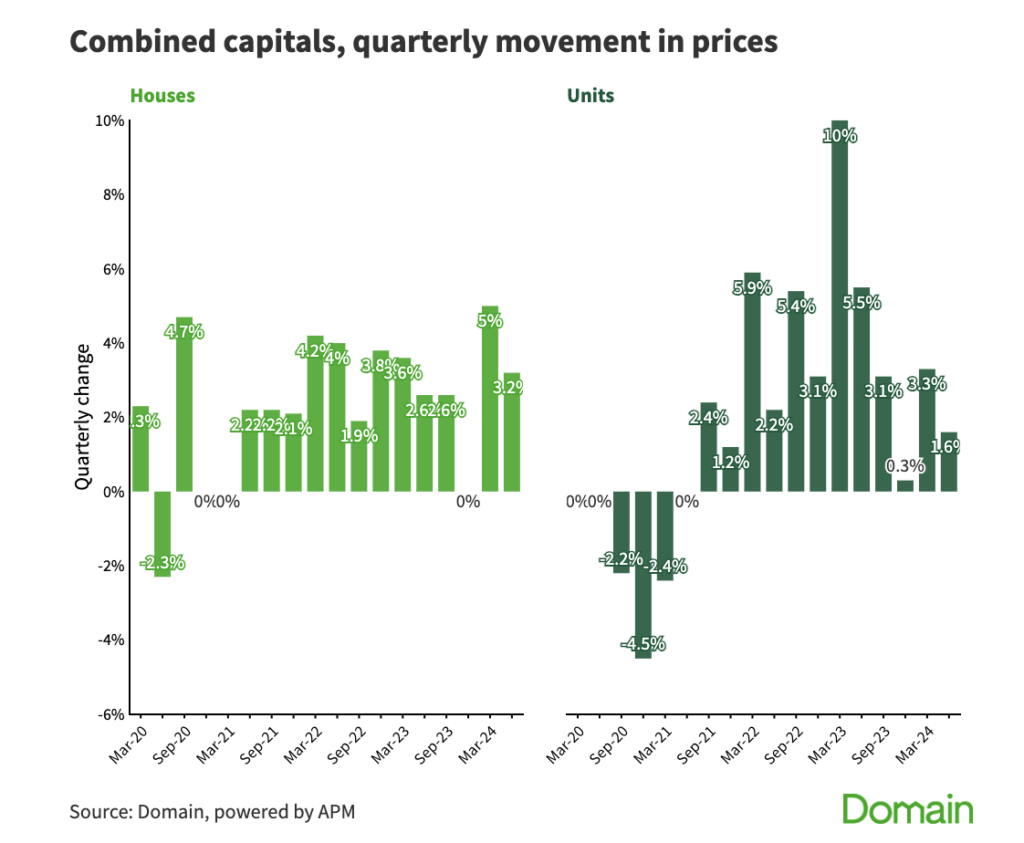

- Domain’s June 2024 Rent Report shows record-high rental prices in the combined capitals, but growth is slowing due to easing vacancy rates

- Nationally, house rents have increased by 11.1% over the year, while unit rents have grown by 8.6%.

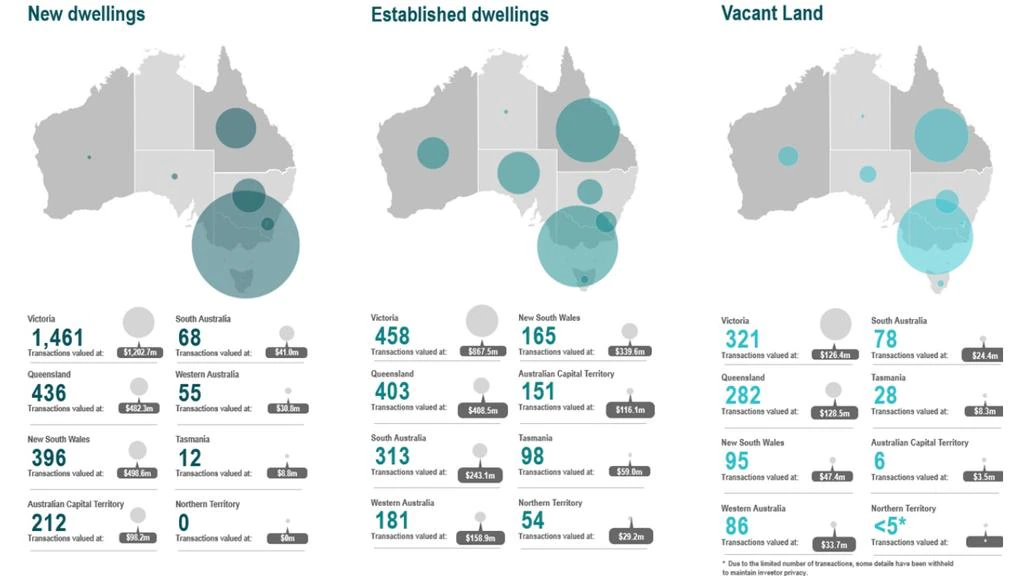

Overseas investors

- In the 2022-23 financial year, overseas buyers purchased 5,360 homes worth $4.9 billion, up from 4,228 homes worth $3.9 billion in 2021-22, according to the latest data from the Australian Taxation Office.

- Victoria was the top state for foreign property purchases with 2,240 transactions, up from 1,703 the previous year.

- Queensland saw 1,212 foreign purchase transactions in 2022-23, up from 956, while NSW had 656, slightly down from 664 the previous year.