Cash Rate

The RBA has left the cash rate on hold at a 12-year high of 4.35% at its June 18 meeting. The next cash rate announcement is scheduled for the 6th of August.

A summary of their statement is as follows:

- Inflation has fallen substantially since its peak in 2022, but the pace of decline has slowed, with inflation still above the 2-3% target range

- Over the year to April, inflation rose by 3.6% in headline terms, which was similar to December 2023

- Broader data indicate continuing excess demand in the economy, coupled with elevated domestic cost pressures, for both labour and non-labour inputs

- Wages growth appears to have peaked but is still above the level that can be sustained given the trend of productivity growth

- The economic outlook remains uncertain and recent data have demonstrated that the process of returning inflation to target is unlikely to be smooth

- The central forecasts published in May were for inflation to return to the target range of 2–3 per cent in the second half of 2025 and to the midpoint in 2026

- Since then, momentum in economic activity has been weak, including slow growth in GDP, a rise in the unemployment rate and slower-than-expected wage growth

- Revisions to consumption and the saving rate and the persistence of inflation suggest that risks to the upside remain

- Returning inflation to target within a reasonable timeframe remains the Board’s highest priority

- Inflation is easing but has been doing so more slowly than previously expected, and it remains high

- The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome

In summary, inflation is easing but not as rapidly as the RBA wants. Current uncertainties make the environment hard to navigate. However, the RBA remains committed to achieving its inflation target and will assess the situation closely and do what is necessary to achieve its goal, i.e. if inflation does not continue to decline, a hike may be possible.

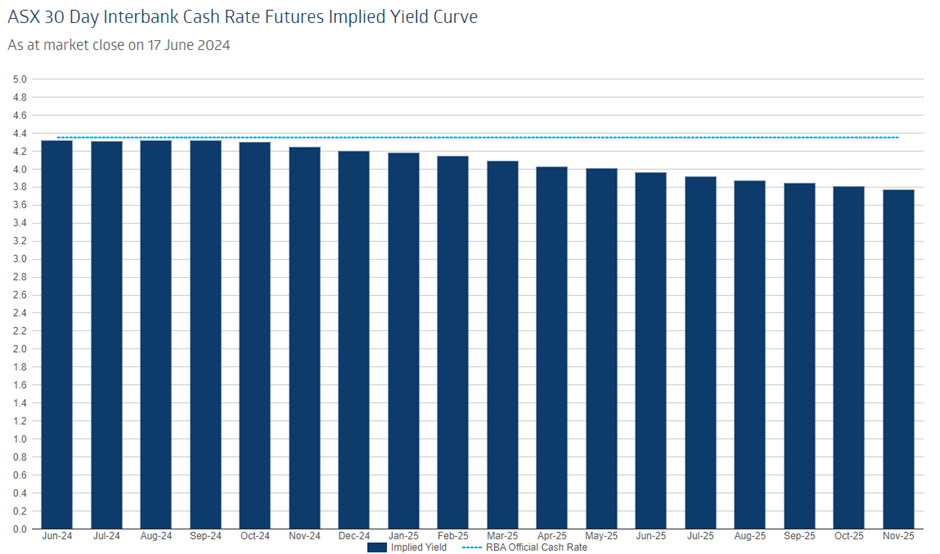

Rate Expectations

A rate cut is not currently expected until the second quarter of 2025.

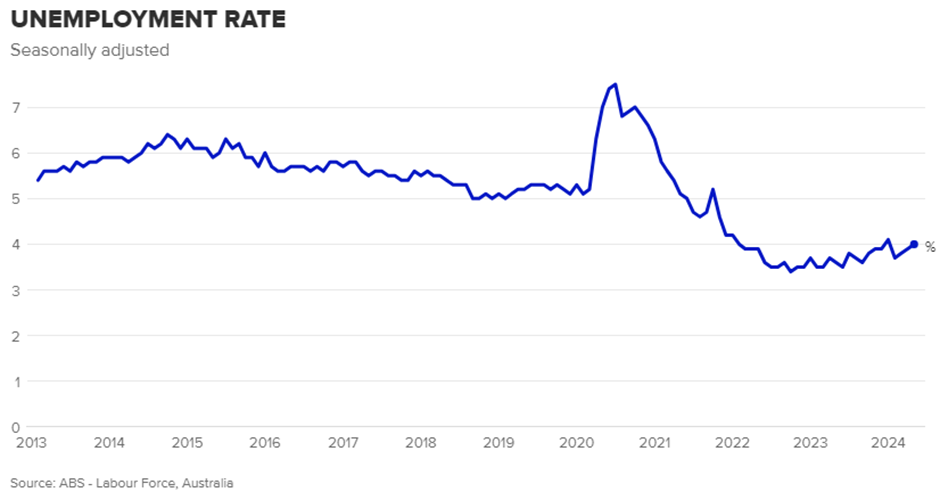

Unemployment

- Australia’s unemployment rate eased to 4.0% in May, down from 4.1% in April

- The economy added 39,700 jobs last month

- Despite the current economic headwinds, the labour market remains strong

Some great commentary from Tim Lawless – worth a read!

“Although the cash rate has risen by 425 basis points, variable mortgage rates haven’t seen quite the same lift. The average variable mortgage rate for a new owner occupier loan has risen to an estimated 6.27% in June, a rise of 386 basis points since April. Similarly, the average variable mortgage rate on a new investor loan has risen by 382 basis points to an estimated 6.53%. The smaller rise in variable mortgage rates relative to the cash rate reflects a heightened level of competition among lenders; no doubt borrowers are shopping around for the best rates.

Housing markets seem to be somewhat insulated from higher interest rates, with CoreLogic’s Home Value Index continuing to rise through June, and the combined capitals daily index already 0.4% higher over the first 18 days of the month. The RBA made a point of calling out an increase in household wealth via higher housing prices which, together with a rise in disposable incomes, could support household spending.

Similarly, the volume of home sales is tracking higher than a year ago and above the five-year average, demonstrating consistently strong demand from purchasers despite an array of headwinds including high interest rates, cost of living pressures, low sentiment and stretched affordability.

Most borrowers are keeping their mortgage repayments on track, but the latest data from APRA for the March quarter shows mortgage arrears are trending higher, albeit from a low base and remaining lower than pre-COVID levels. Mortgage arrears, including non-performing loans and borrowers that are 30-89 days overdue in their repayments, comprise 1.6% of home loans for all ADI’s. This is up from a recent low of just 1.0% in the September quarter of 2022, but below the 1.8% level recorded at the onset of COVID in March 2020.”

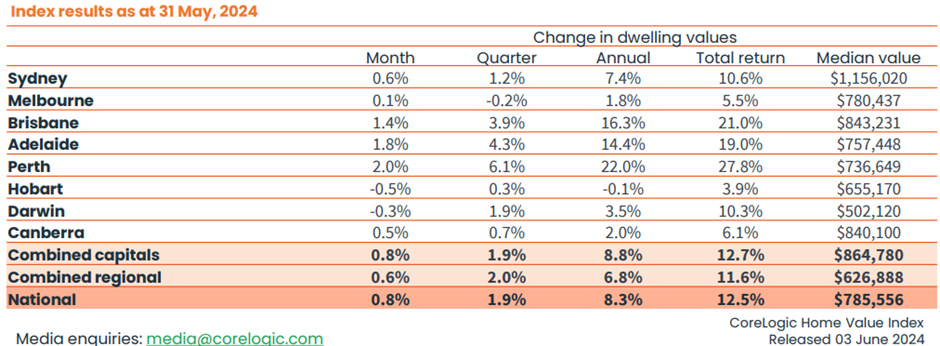

Property Market – from CoreLogic

Corelogic’s Home Value index rose 0.8% in May, marking the 16th consecutive month of growth and the largest monthly gain since October last year.

Perth, Adelaide, and Brisbane led the month, mainly supported by a severe supply shortage, with 30-40% fewer listings than the 5-year average.

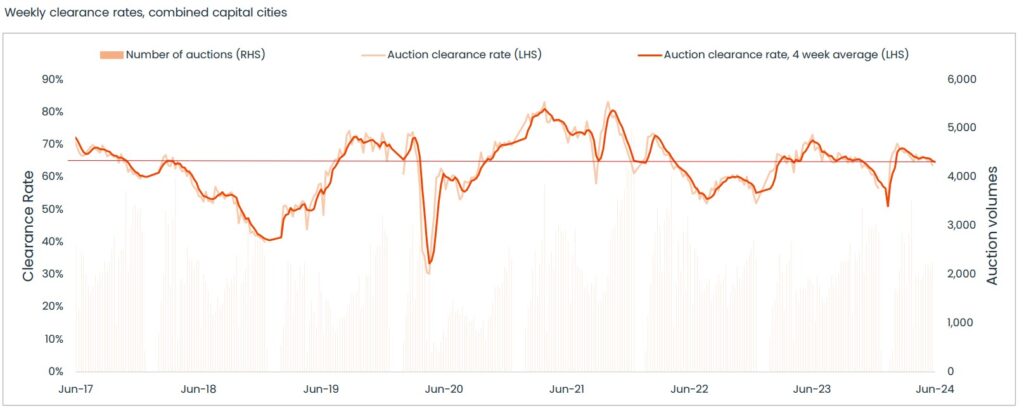

Clearance Rates

Combined capital clearance rates have trended lower since early February, suggesting slightly weaker selling conditions. The combined capital cities clearance rate averaged 65.1%Clearance rates between 60 and 70% indicate a balanced market.

Clearance rates between 60 and 70% indicate a balanced market.