Cash Rate

The Reserve Bank of Australia (RBA) has left the cash rate unchanged at 4.35% for eight meetings in a row as of Tuesday, 5 November 2024. The next RBA meeting and Official Cash Rate announcement is set for 5th December 2024.

Governor Michele Bullock stated that while progress has been made, reducing inflation further remains challenging, and the board remains open to future adjustments based on evolving economic data.

Australia’s major banks and economists expect the RBA to begin cutting rates in early 2025, with predictions of modest reductions as soon as February. Money markets are also pricing in potential rate cuts in the first half of the year, though analysts caution against expecting significant drops.

Key takeaways from the RBA’s statement:

- Cash Rate Held at 4.35%

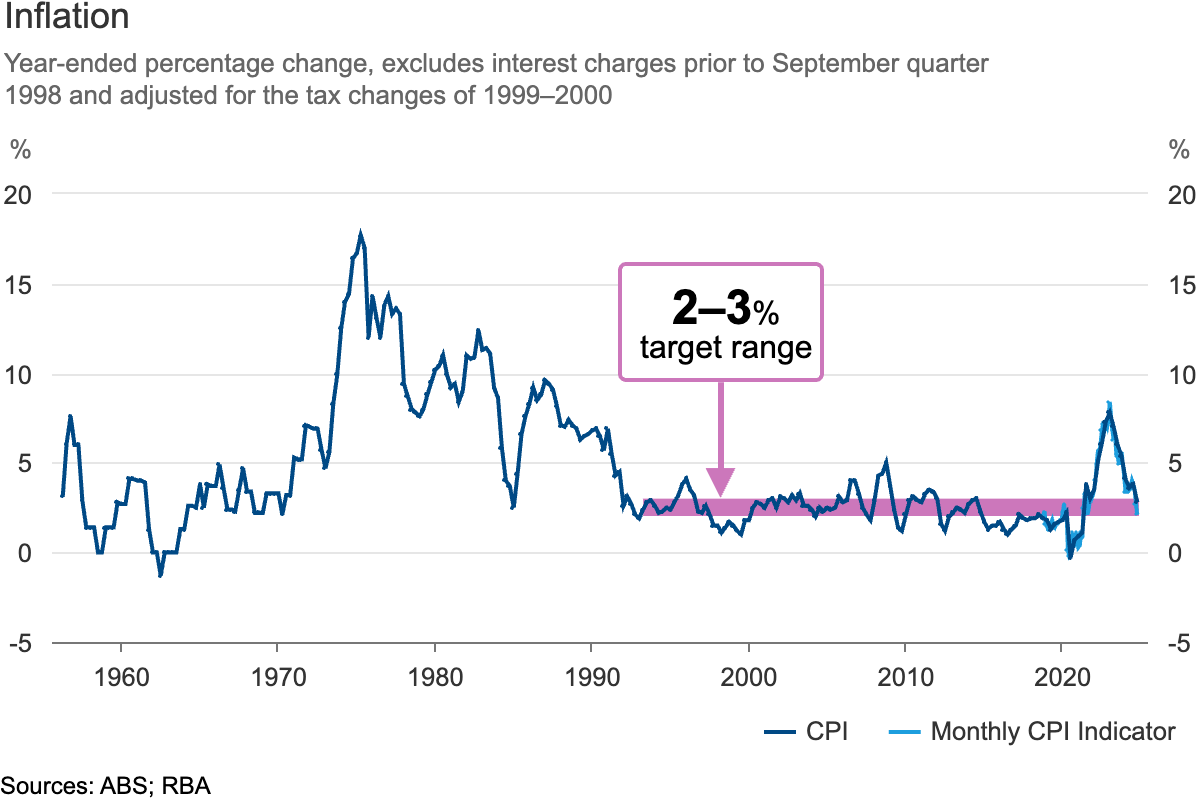

- Consumer Price Index (CPI): Australia’s headline CPI inflation fell to 2.8% for the year to September, its lowest in three years, slightly below the 2.9% forecast by economists. The trimmed mean, a key measure of underlying inflation, was 3.5%, down from 4% the previous quarter.

- Inflation Trends: Although inflation has moderated from its peak in 2022, it remains above the RBA’s target range of 2-3%.

- Upside Inflation Risks: Persistent inflation in services, along with high unit labour costs and fluctuating consumption patterns, contribute to ongoing inflationary pressure.

- Wage Growth: While wage growth has likely peaked, it still exceeds productivity growth trends, which may sustain business cost pressures.

- Economic Activity: Economic momentum remains weak, reflected in low GDP growth, a slight uptick in unemployment, and heightened challenges for many businesses across sectors.

Rate Expectations

Source: ASX RBA Rate Tracker

Based on the recent ASX 30-Day Interbank Cash Rate Futures data, here is a summary of market expectations for RBA rate changes in the coming months:

- December 2024: There is an 85% chance of no change to the cash rate and a 15% probability of a 25-basis-point decrease to 4.10%.

- First Half of 2025: Money markets indicate modest expectations for rate cuts, with probabilities increasing through the first half of the year, though not heavily priced in until mid-2025.

The market sentiment reflects a cautious approach, with a stronger lean towards stability in the immediate term but a mild expectation for rate cuts beginning in early 2025.

Inflation

- Headline Inflation: Australia’s inflation dropped to 2.8% in the September quarter, its lowest in 3.5 years. This was largely due to falling fuel prices and government energy rebates, which offset price rises in other areas.

- Underlying Inflation: The trimmed mean, which excludes volatile items, remained higher at 3.5%, still above the RBA’s target range of 2-3%. This suggests inflationary pressures persist, especially in services.

- Impact of Subsidies: Government rebates on energy bills helped reduce the CPI figure. Without these, electricity prices would have risen by 0.7% for the quarter.

- RBA’s Outlook: The RBA expects inflation to fall below 3% by 2025, but underlying inflation is expected to stay above target until at least then, due to ongoing price pressures in sectors like rent and childcare.

- Inflationary Pressures: Services inflation is still high at 4.6%, with rents and insurance costs driving much of the rise.

- Next Steps: Despite easing, inflation remains too high for a rate cut. The RBA is expected to hold rates steady until early 2025.

Property Market Update

- National Growth Slows: CoreLogic’s Home Value Index (HVI) rose just 0.3% in October, with Perth (+1.4%) leading growth but offset by declines in Sydney (-0.1%), Melbourne (-0.2%), and Darwin (-1.0%).

- Sydney’s Upper-End Cools: Sydney home values declined for the first time since January 2023, driven by a -0.6% drop in the upper quartile, while lower-value homes showed resilience with a 0.5% rise.

- Increased Listings in Major Cities: Sydney and Melbourne are experiencing listing increases above 13% compared to the five-year average, giving buyers more options and possibly improving their negotiating power.

- Price Stability: Sydney and Melbourne prices stayed flat, while Brisbane saw a small increase of 0.2% last week. Overall, property prices are up 6.1% year-on-year.

Source: Property Update and CoreLogic Hedonic Home Value Index

Rental Market Update:

- Vacancies on the Rise: Vacancy rates have risen to 1.8%, up from last year’s 1.4%. Rates have increased across most capitals, except Hobart, with Brisbane (2.1%) and Adelaide (1.1%) seeing the largest rises. Despite the increase, vacancy rates remain below pre-COVID averages, with factors like reduced migration and more investor activity expected to further ease rental pressure.

- Slower Rental Growth: National rents rose just 0.2% in October, with annual growth slowing to 5.8%—the smallest rise since early 2021. This easing is helping to reduce inflation.

- Unit Rent Declines: Unit rents fell over the last three months in major cities like Sydney, Melbourne, and Canberra, while house rents also softened in places like Sydney and ACT.

- Easing Demand: Slower migration and larger household sizes are cooling rental demand, helping ease inflation pressures.

Source: Property Update, CoreLogic Hedonic Home Value Index, CoreLogic Monthly Housing Chart Pack – November 2024

Lending Data

- Housing Loans: Australian Bureau of Statistics (ABS) data shows new housing loans fell 0.3% in September to $30.2 billion, but rose 18.9% compared to last year; owner-occupier loans up 0.1% to $18.6 billion (+13.1% compared to last year), while investor loans dropped 1.0% to $11.6 billion (+29.5% compared to last year).

- Business Loans: Construction loans fell 8.2% to $2.98 billion (+28.3% compared to last year), while property purchase loans rose 2.9% to $7.08 billion (+20.8% compared to last year).

- Fixed vs Variable Loans: Fixed loans increased 26.0%, though 33.7% lower compared to last year, while variable loans fell 3.6%.