The median house price might grab headlines, but it can be a misleading measure of housing affordability in Australia today. In our increasingly polarised economy, with fewer middle-income earners and more people at the high and low ends of the income spectrum, the median no longer reflects what most Australians can afford.

Historically, the median home represented the “middle” of the market, accessible to various incomes. But today, as the Australian Bureau of Statistics (ABS) data shows, the landscape has shifted. The job market has evolved, moving away from middle-skilled roles—traditionally the backbone of the middle class—to a split between high-paying, knowledge-based roles and lower-paid, often less stable jobs. As a result, housing demand has polarised, with developers leaning toward high-end properties where profits are more predictable, leaving a shortage of affordable, mid-range housing.

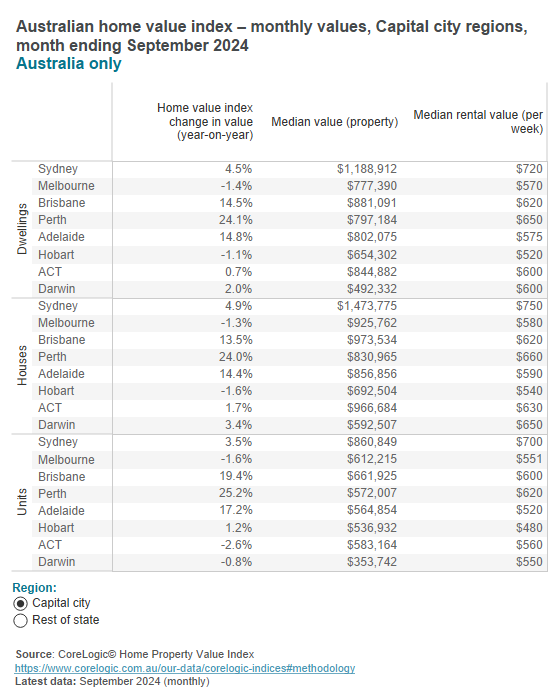

For those in high-cost areas like Sydney, affordability has become increasingly strained. House prices in Sydney now stand at around 14 times the median income, according to ABS data—significantly higher than the four times median income expected in the 1960s.

Given these dynamics, a more precise approach to assessing affordability is needed, one that moves beyond the broad brush of median prices. Focusing on specific property types, local suburb data, and comparing property prices to income ratios offers a clearer picture of today’s housing realities. Only by digging deeper into these factors can we begin to see the true scope of housing accessibility in modern Australia.