Recent headlines suggest Australia’s property market is in decline, with claims that falling values signal the end of the so-called “property boom.” But a closer look at the data tells a different story.

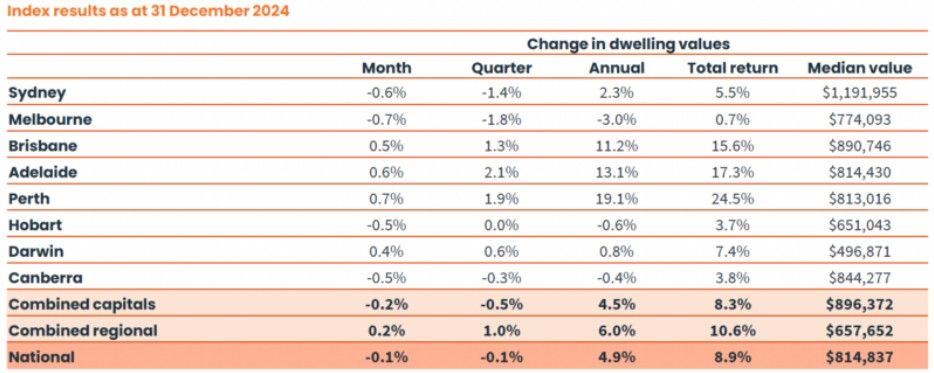

CoreLogic’s latest Home Value Index recorded a modest national decline of -0.1% in December—the first in nearly two years.

Yet, across 2024, property values rose by 4.9% nationally, with Brisbane, Adelaide, and Perth experiencing double-digit growth. While Sydney and Melbourne saw some softening, this is far from a crash.

Property markets in Australia are not uniform. Performance varies significantly based on location, price point, and property type.

The luxury segment, for example, has been more volatile, while demand remains strong for well-located properties with lifestyle appeal.

History shows that downturns in the Australian property market tend to be shorter and less severe than periods of growth. In times of softening prices, sellers often delay listing their properties, reducing supply and stabilising values.

At the same time, most homeowners continue to manage current interest rate settings, limiting the risk of forced sales.

Several factors suggest a broad market crash is unlikely. Housing shortages persist, population growth continues, and construction constraints limit new supply.

As inflation eases and interest rates eventually decline, borrowing capacity will improve, supporting renewed buyer confidence.

Periods of uncertainty often create opportunities. With fewer buyers in the market, strategic investors and homebuyers can secure quality assets before conditions strengthen again.

For ongoing market insights, subscribe to our newsletter below.