Despite ongoing high interest rates, Australia’s regional property markets have continued to outperform capital cities, with values rising 1.0% over the three months to January 2025, compared to a 0.7% decline in capital city values, according to CoreLogic.

However, the latest Regional Market Update highlights shifting growth patterns. Markets in Western Australia and Queensland—which have led regional growth for over a year—are now showing signs of slowing.

Meanwhile, previously weak markets in NSW and Victoria are stabilising, with some even showing a modest recovery.

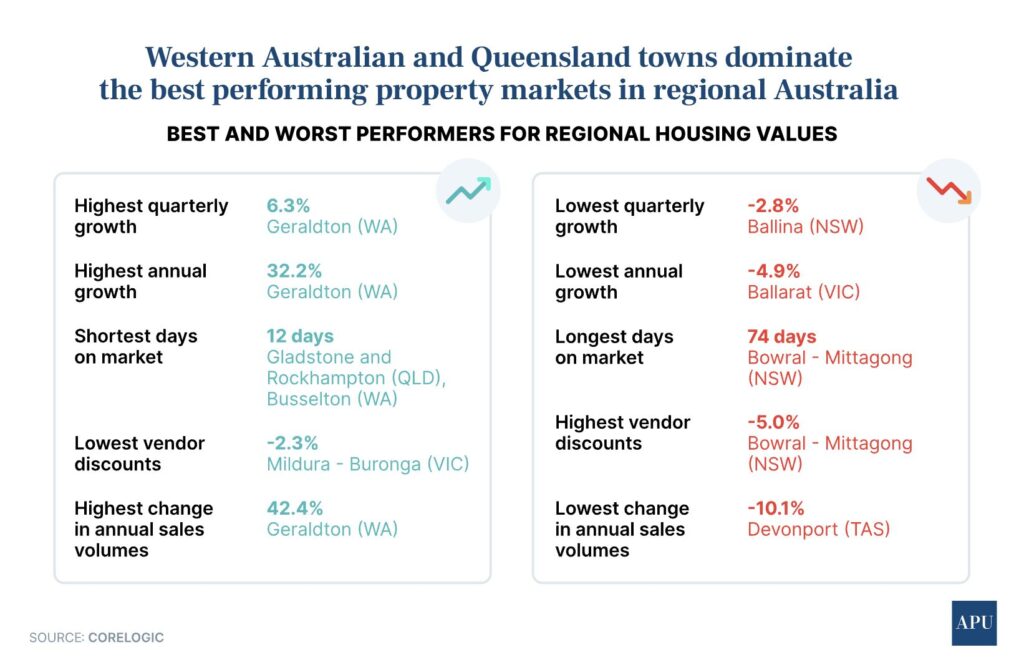

- Geraldton (6.3%), Albany (5.9%), and Mackay (5.7%) recorded the strongest growth in the last quarter, but CoreLogic warns that “momentum in most of these markets is shifting.”

- Bathurst in NSW saw a sharp turnaround, moving from a 1.8% decline in October 2024 to a 4.2% increase in January.

- Regional rental markets remain strong, with a 1.6% increase in rents over the quarter—outpacing capital cities.

As CoreLogic’s Kaytlin Ezzy explains, “Queensland and Western Australia markets have driven regional growth for more than a year; however, they are now clearly losing steam.”

At the same time, affordability pressures may be driving renewed interest in some previously underperforming regional areas.

While regional areas often offer lower entry prices and strong rental yields, their small populations and limited economic diversity can lead to volatility.

Mining-dependent towns like Mackay and Gladstone, for example, were recently identified as high cash-flow investment hotspots—but CoreLogic warns that their growth momentum is slowing.

As always, due diligence is key when assessing investment opportunities in regional markets.

Stay updated on the latest property trends—subscribe to our newsletter for more insights.