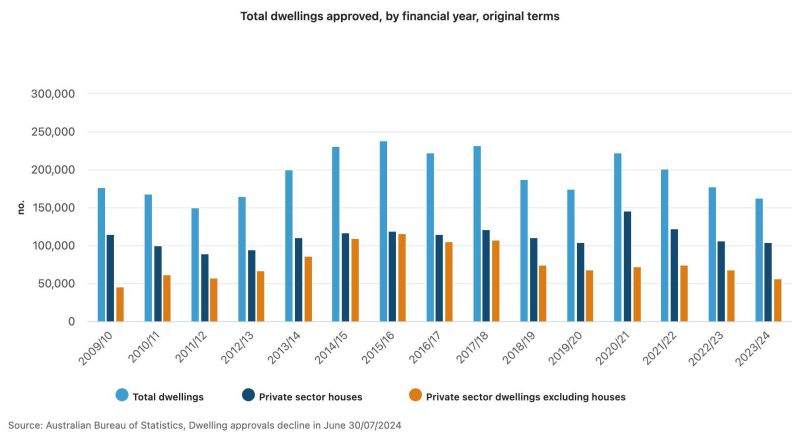

Housing approvals in Australia have dropped to their lowest in over a decade, with just 163,320 new homes getting the green light last financial year, according to the most recent Australian Bureau of Statistics data.

This figure is significantly below the federal government’s annual target of 240,000 new homes.

Housing Industry Association senior economist Tom Devit said that, since 2021/22, approvals for new homes have fallen by 18.7% and multi-unit approvals have tumbled by 17.8%, hitting the lowest levels since 2009/10.

He attributes the downturn to rising interest rates and high construction costs, especially in New South Wales and Victoria, noting that it mirrors a similar slump seen in 2011/12 (following the Reserve Bank of Australia’s previous rate hiking cycle).

“At that point, the RBA had already started dramatically cutting rates again,” he said.

Much like many other markets, property prices are influenced by supply and demand dynamics. So if supply doesn’t improve soon, it’s likely that home prices will continue to rise, exacerbating the housing affordability crisis.