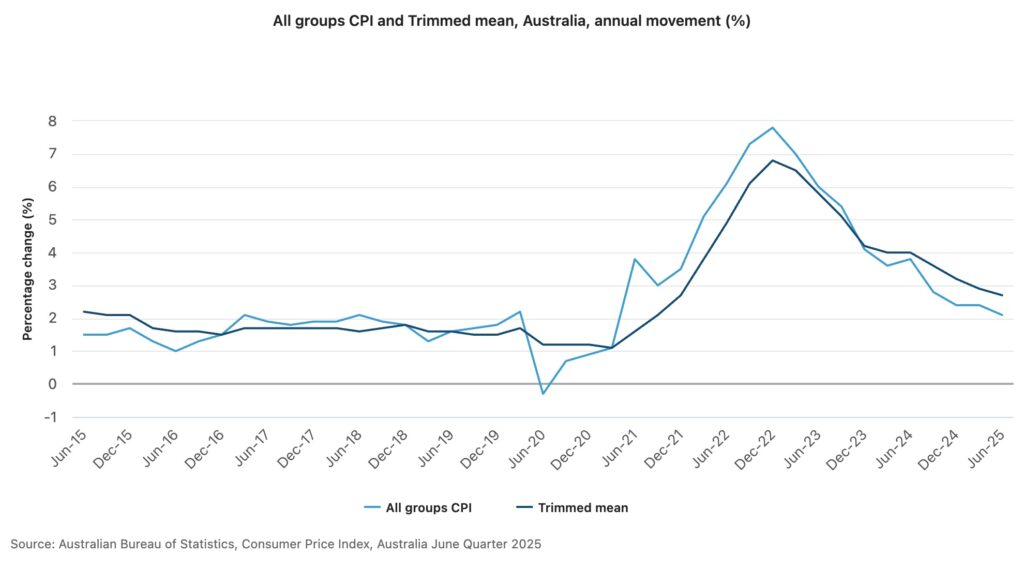

Australia’s fight against inflation appears to be turning a corner. New data from the June quarter shows annual headline inflation easing to 2.1%, down from 2.4% in March — a result that aligns closely with Reserve Bank forecasts and opens the door to interest rate cuts as early as August.

INFLATION NOW NEAR TARGET

The RBA’s preferred measure – the trimmed mean inflation rate – also declined, falling from 2.9% to 2.7%, a three-and-a-half-year-low, and just a touch above the central bank’s 2.6% forecast from May. These results confirm that inflation is returning to the RBA’s target band, offering long-awaited relief for borrowers and the broader economy.

According to Westpac chief economist Luci Ellis, this data removes the key barrier to a cash rate reduction:

“Today’s data removes any awkwardness posed by inflation remaining too high… further cuts in November, February 2026 and May 2026 also look increasingly likely.”

UNEMPLOYMENT CREEPS HIGHER

Just days before the inflation figures were released, national unemployment rose from 4.1% to 4.3% — a three-year high. While RBA Governor Michele Bullock described the jump as expected and within forecast ranges, it adds pressure on the central bank to cut rates.

Economists now believe the combination of cooling inflation and a softening labour market could justify a more accommodative monetary policy stance in the months ahead.

A TURNING POINT FOR INTEREST RATES

After holding rates steady in July, the RBA will meet again on August 11-12, and the market is increasingly pricing in a 25 basis point cut.

EY senior economist Paula Gadsby sees the inflation print as a green light:

“This gives the board the opportunity to cut the cash rate at the August meeting, as the risks around inflation are more balanced…”

WHAT SHOULD BORROWERS DO NOW?

This moment represents a key window of opportunity for proactive borrowers:

-

- Review your current rate. If you’ve stayed on a variable loan that hasn’t moved much despite rate fluctuations, now is the time to see if you’re still getting value.

-

- Consider refinancing. With the rate cycle shifting, a strategic refinance could lock in a better deal before broader market pricing adjusts.

-

- Speak to a lending expert. For those using more complex structures, like trusts, SMSFs, or private lenders, expert guidance is critical to ensure your loan structure remains flexible and tax-effective.

At Azura Financial, our team works with a wide panel of banks, non-bank lenders, and private funders to tailor solutions that go beyond interest rate comparisons.

Whether you’re navigating your first property purchase or rethinking your existing portfolio, now is the time to take action before the lending environment resets again.