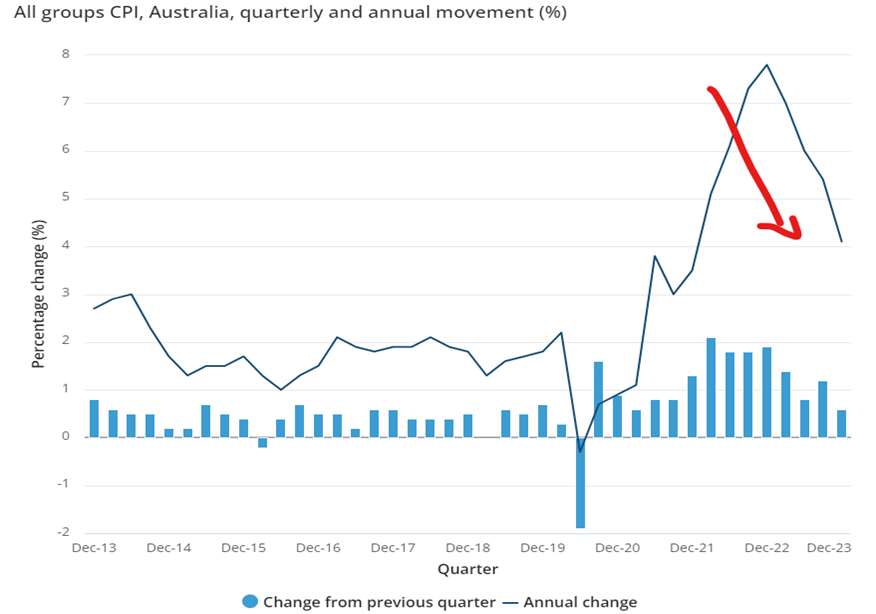

Inflation

- Inflation is coming down, which means rates are UNLIKELY to go up… (not impossible)

- RBA: “a further increase in interest rates cannot be ruled out.” (they have to say that though don’t they???)

- Quarterly CPI 👇

- Dec 22 – peaked at 7.8%

- Sept 23 – 5.4%

- Dec 23 – 4.1%

RBA Statement Summary – Key takeaways from their statement below:

- The Board decided to maintain the cash rate target at 4.35%

- Inflation is gradually decreasing but remains elevated

- Goods price inflation has decreased due to resolved global supply chain issues and lower domestic demand, while services price inflation remains high, indicating excess demand and strong cost pressures

- Higher interest rates are aiming to balance aggregate demand and supply in the economy, leading to gradual easing in labor market conditions

- Despite some positive indicators, economic outlook remains uncertain, with attention to inflation risks

- The central forecast predicts inflation to return to the target range of 2-3% by 2025

- The priority remains returning inflation to target within a reasonable timeframe to maintain price stability and full employment

- Although recent data shows easing inflation, it’s still high, and achieving target range may take time

- The Board will continue monitoring global and domestic economic trends, adjusting interest rates as necessary to achieve the inflation target

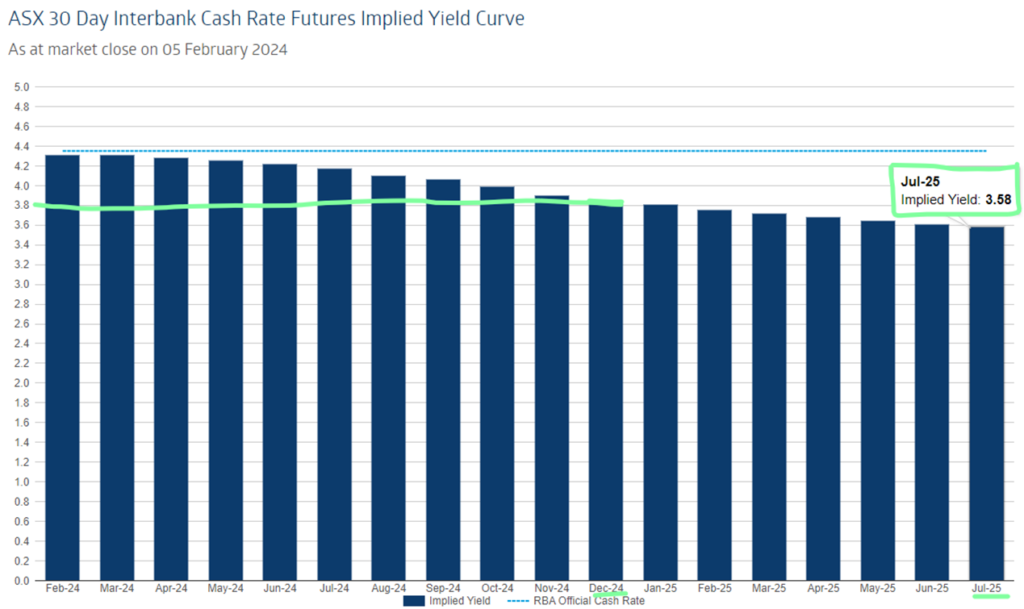

Cash Rate Expectations

- Financial markets are saying 3.8% by end of 2024 (2 cuts)

- 3.6% by July 2025…

Residential Rate Card

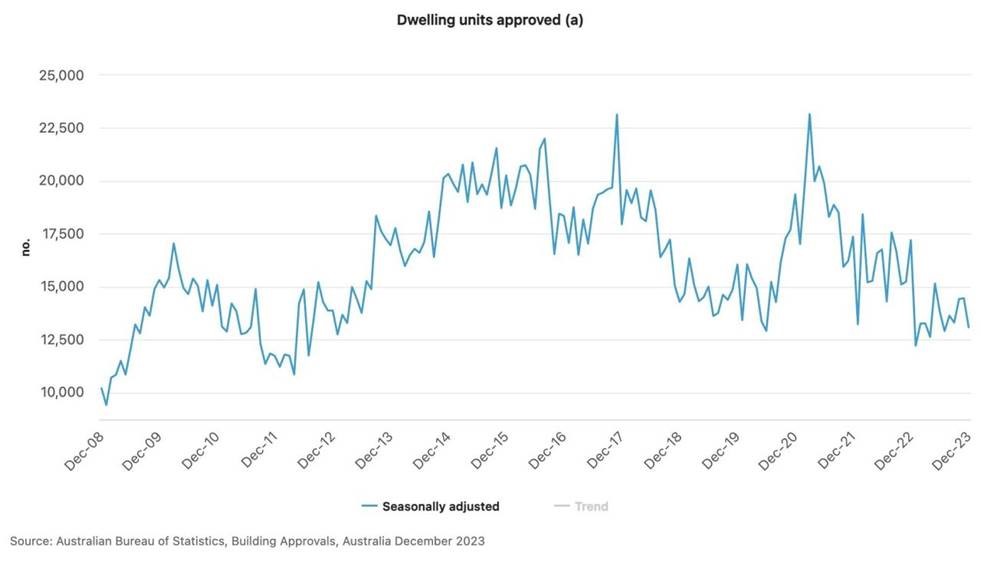

- The latest monthly data from the Australian Bureau of Statistics (ABS) showed a concerning 9.5 per cent drop in new dwelling approvals in December, with just 13,085 homes being approved across Australia.

- Commonwealth Bank of Australia (CBA) economists Stephen Wu and Harry Ottley commented that at just over 13,000 buildings approved, the level of approvals nationally “is near decade lows”.

- https://www.realestatebusiness.com.au/industry/27279-dwindling-building-approvals-threaten-to-worsen-australia-s-housing-crisis

- https://www.mortgagebusiness.com.au/property/18758-dwelling-approvals-remain-near-decade-lows

Property Market – From Core Logic – Full Report Here

- CoreLogic’s national Home Value Index (HVI) rose 0.4% in December which was a soft finish to the year. Overall in 2023, the HVI rose 8.1% in 2023 which was a significant turnaround from the 4.9% drop in 2022.

- CoreLogic Research Director Tim Lawless noted “After monthly growth in home values peaked in May at 1.3%, a rate hike in June and another in November, along with persistent cost of living pressures, worsening affordability challenges, rising advertised stock levels and low consumer sentiment, have progressively taken some heat out of the market through the second half of the year.”

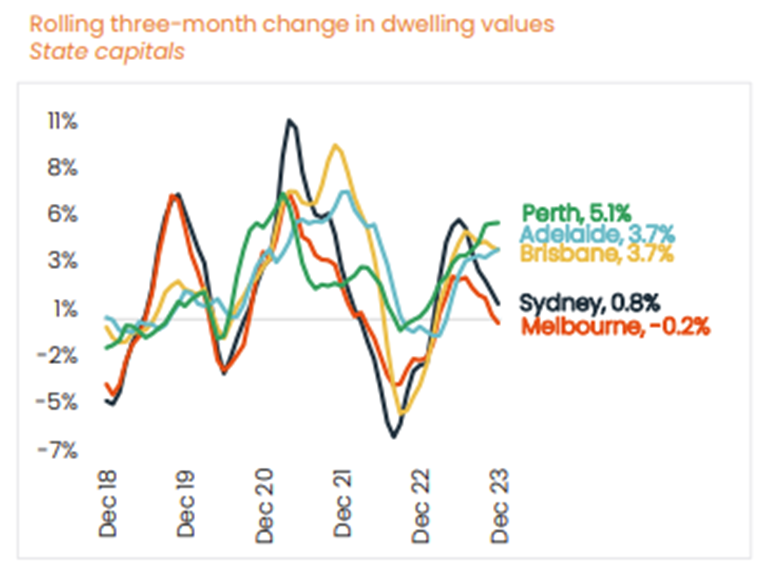

- Across Australia it was a housing growth results were diverse with changing housing values ranging from a 15.2% surge in Perth to a 1.6% fall in regional Victoria. The following table show the Perth, Adelade and Brisbane markets held up better in the tail end of the year

2024 Market Outlook

- The trends from late 2023 are indicating a mild start to 2024 however we may be looking at a year of two halves. High interest rates and weaker economic conditions are likely to weigh on housing activity

- Financial markets are pricing in a cash rate cut by June 2024 which is likely to re-stoke demand in the back end of this year. A reduction in rates will likely lead to a lift in consumer sentiment and a more positive trend in housing activity and values through the second half of the year

- Supply of new dwellings also continues to be hindered with Tim Lawless noting “The burgeoning undersupply of newly built housing is likely to keep a floor under housing prices to some extent over the coming year”