What’s going on with rates?

At the start of April, all major banks were predicting 1-3 cuts by year-end

At the end of April, some economists were talking about potentially 3 more hikes! (unlikely)

So what actually happened? Well, unfavourable inflation data was released at the end of April:

- Expectations were for 0.8% CPI over the March quarter AND 3.5% CPI on an annualised basis

- Realised data showed 1% CPI over the March quarter AND 3.6% CPI on an annualised basis

In summary…

Although the CPI was lower on an annualised basis (3.6% from March 23 to March 24 vs 4.1% from December 22 to December23), quarterly inflation accelerated over the March quarter (1% in the March quarter vs 0.6% in the December quarter) and, the data was higher than expected.

Why does this matter?

Well, the RBA has two key objectives:

- An inflation rate of between 2% and 3%, and;

- Full employment

If inflation isn’t falling as fast as expected, the thought is that the cash rate isn’t currently high enough to slow inflation down as much as required.

May Cash Rate decision

- The RBA Holds the Cash Rate at 4.35% on 7th May 2024

- The next meeting is on 18 June 2024

A summary of their statement is as follows:

- Inflation continues to moderate but is declining more slowly than expected

- Conditions in the labour market have eased but remain tighter than is consistent with full employment and target inflation

- Wage growth appears to have peaked

- The economic outlook remains uncertain

- The central forecast is for inflation to return to target in the second half of 2025

- Returning inflation to target within a reasonable timeframe remains the board’s highest priority

- The board will rely on the data and the evolving assessment of risks

What are the experts saying?

- Some economists are saying we need 2-3 hikes

- MOST economists are saying we are at the peak

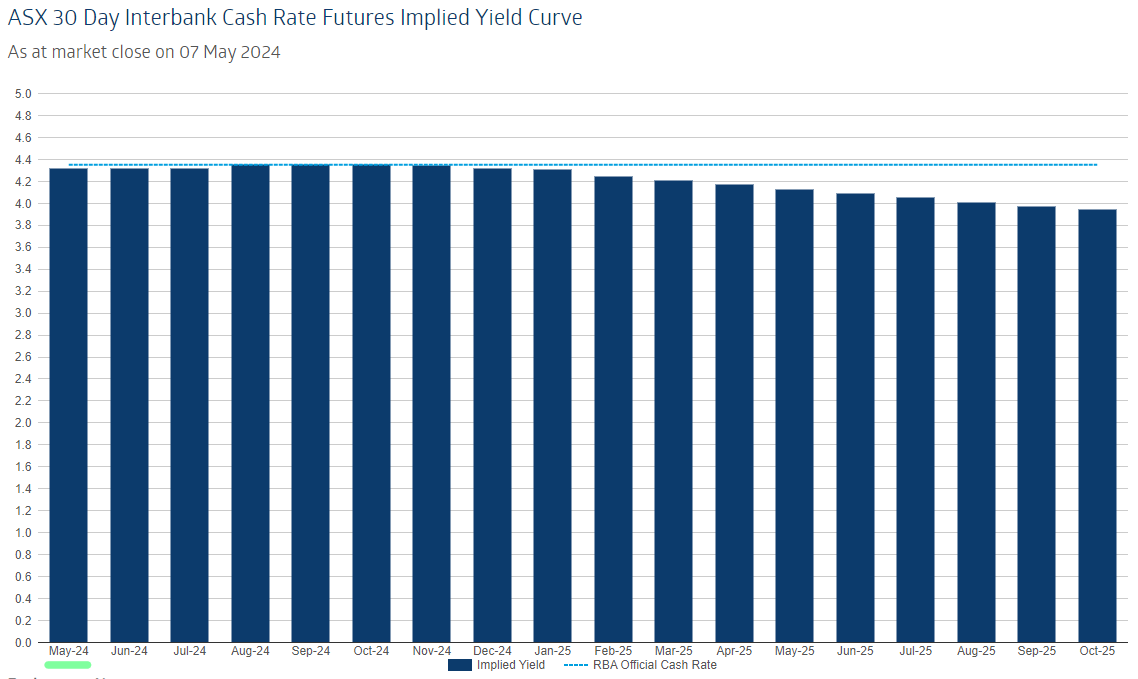

- Cash rate futures are not currently pricing in any hikes but are also not pricing in any cuts until May 25

Conclusion

- Don’t panic – bad news sells

- Rate cuts may not eventuate this year, but we don’t expect any further hikes

- Unless June inflation surprises to the upside

- Under the surface, households are hurting and business conditions are worsening

- The focus will be on the June quarter. If inflation is still too high over the next quarter, this will be the determining factor on whether they hike or not

- The federal budget is out on May 14. Ideally they keep a lid on spending so as to not push inflation, which could further delay cuts

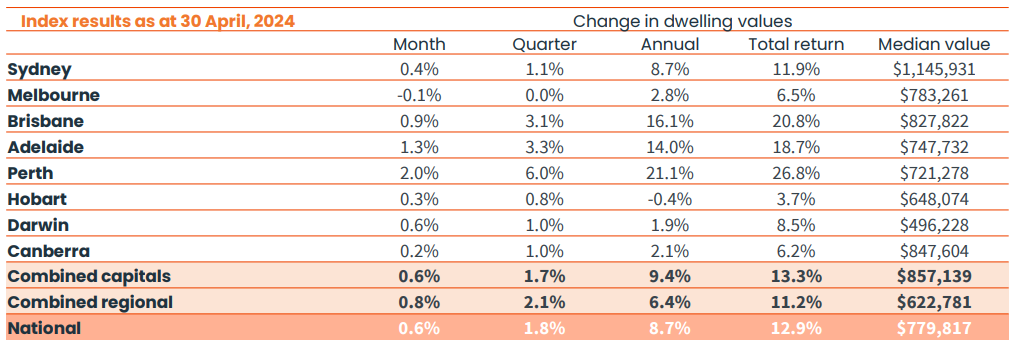

Property Market Update (From CoreLogic)

- National housing values rose 0.6% in April, driven by a lack of supply

- This takes the current trend into its 15th month of growth, with national values up 11.1% since January 2023

- The market is experiencing multi-speed conditions, with Perth, Brisbane, and Adelaide leading the other capitals

- Almost every capital city is experiencing stronger growth across the lower value range of the market

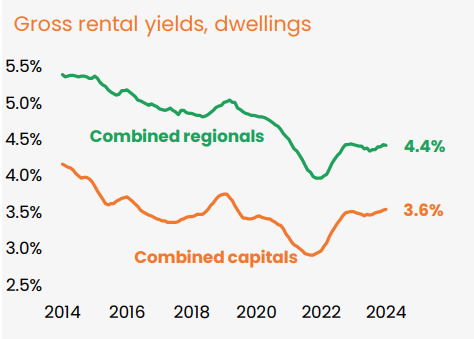

Rents

- Nationally, rents were up 0.8% in April (slightly lower than Feb 0.9% and March 1.0%)

- In April, the national gross rental yield rose to 3.75%, the highest reading since October 2019, up from a record low of 3.16% in Jan 2021