Inflation

- Inflation was HIGHER than expected, printing 1.2% in the September quarter, taking the annual rate of inflation to 5.4%

- While this was down from 6% recorded in the June quarter, it was HIGHER than the RBA expected, prompting another rate rise to slow the economy and ease inflation

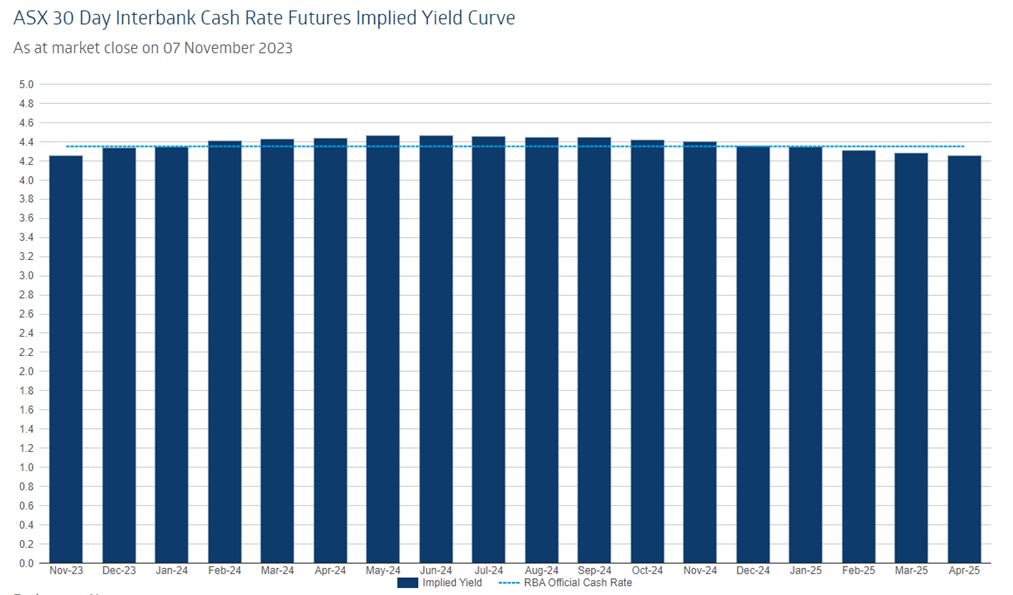

RBA Statement Summary – CASH RATE INCREASE TO 4.35% – Key takeaways from statement below:

- Inflation in Australia has passed its peak but is still too high

- CPI inflation is now expected to be around 3½ per cent by the end of 2024 and at the top of the target range of 2 to 3 per cent by the end of 2025

- Since its August meeting, the Board has received updated information on inflation, the labour market, economic activity and the revised set of forecasts. The weight of this information suggests that the risk of inflation remaining higher for longer has increased

- There are still significant uncertainties around the economic outlook. Services price inflation has been surprisingly persistent overseas and the same could occur in Australia.

- Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.

RBA Rate Tracker – Potential for one more increase?

https://www.asx.com.au/markets/trade-our-derivatives-market/futures-market/rba-rate-tracker

BIG FOUR cash rate predictions:

CBA

- Peak of 4.35% in November 2023

- Next cut Sept 2024

- Dropping to 2.85% by May 2025

Westpac

- Peak of 4.35% in November 2023

- Next cut Sept 2024

- Dropping to 2.85% by December 2025

NAB

- Peak of 4.35% by November 2023

- Next cut August 2024

- Dropping to 3.10% by March 2025

ANZ

- Peak of 4.35% in November 2023

- Next cut December 2024

- Dropping to 3.35% by June 2025