RBA Statement Summary

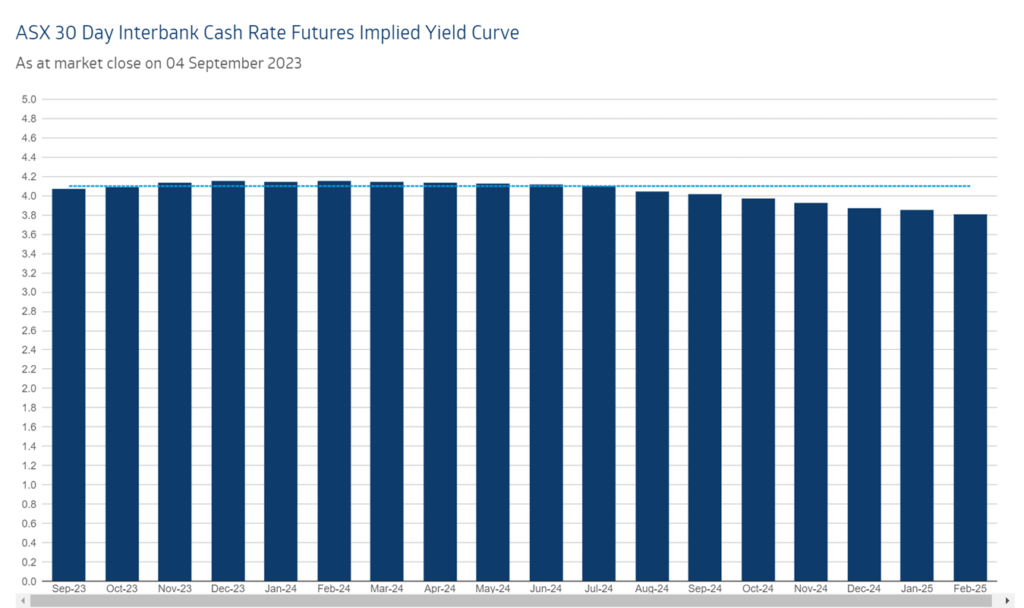

As noted today, the RBA has held the cash rate at 4.10% for the third month in a row. Key take aways from the RBA media release as follows:

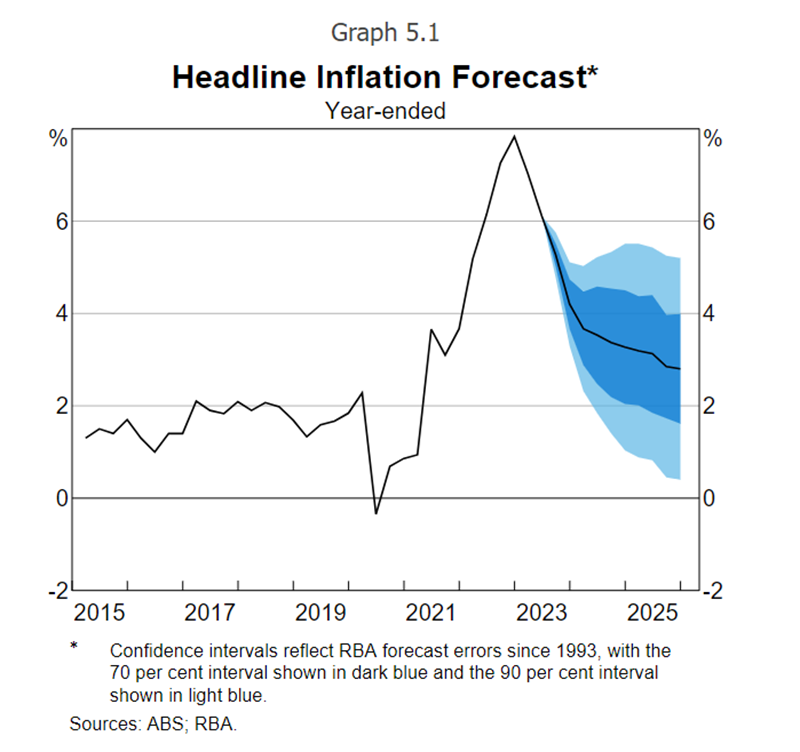

- Inflation in Australia has passed its peak and the monthly CPI indicator for July showed a further decline to 4.9%. But inflation is still too high and will remain so for some time yet.

- While goods price inflation has eased, the prices of many services are rising briskly. Rent inflation is also elevated. The central forecast is for CPI inflation to continue to decline and to be back within the 2–3 per cent target range in late 2025.

- High inflation is weighing on people’s real incomes and household consumption growth is weak, as is dwelling investment. Notwithstanding this, conditions in the labour market remain tight, although they have eased a little.

- Unemployment rate is expected to rise gradually to around 4½ per cent late next year. Wages growth has picked up over the past year but is still consistent with the inflation target, provided that productivity growth picks up.

- The outlook for household consumption also remains uncertain, with many households experiencing a painful squeeze on their finances, while some are benefiting from rising housing prices, substantial savings buffers and higher interest income.

- Globally, there is increased uncertainty around the outlook for the Chinese economy due to ongoing stresses in the property market.

Inflation

Inflation rose 4.9% in the 12 months to July, DOWN from 5.4% in the 12 months to June AND under market forecasts of 5.2%.

According to the RBA economic Outlook for August, the RBA believes inflation has peaked, which essentially means they believe rates have peaked – see graph below

https://www.rba.gov.au/publications/smp/2023/aug/economic-outlook.html

Cash Rate Expectations

Financial markets saying rates have peaked…

https://www.asx.com.au/markets/trade-our-derivatives-market/futures-market/rba-rate-tracker

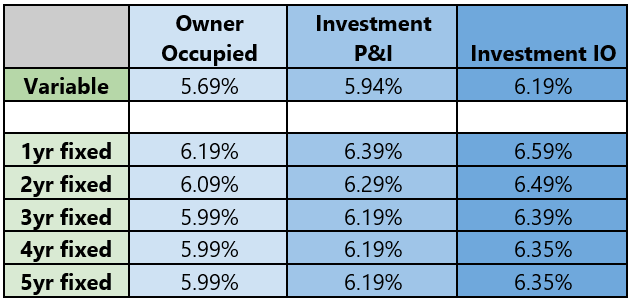

Residential Rate Card – Tier 1 Lenders

The best mortgage interest rates we are currently seeing available for new borrowings are as follows:

Property Market

From Core Logic – Full report here

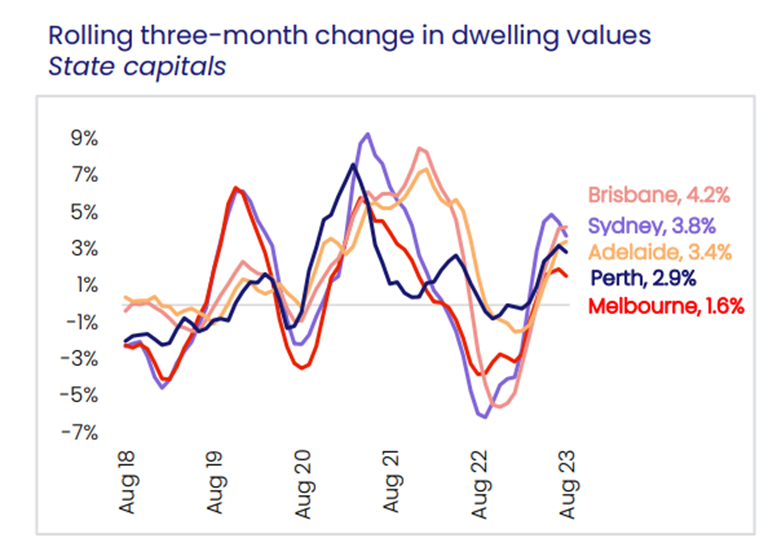

CoreLogic’s national Home Value Index (HVI) marked a sixth consecutive monthly rise, up 0.8% in August. The monthly gain was a slight acceleration from the 0.7% increase in July, interrupting a two-month trend of slowing capital gains.

CoreLogic Research Director, Tim Lawless, noted the trend in housing values, although generally positive, is diverse.

“Sydney has led the recovery trend to-date with a gain of 8.8% since values found a floor in January this year. Within the capital cities, it is generally house values rather than unit values that have showed a sharper recovery trend. Conditions across regional housing markets were mixed, with values down over the month across the non-capital city regions.”

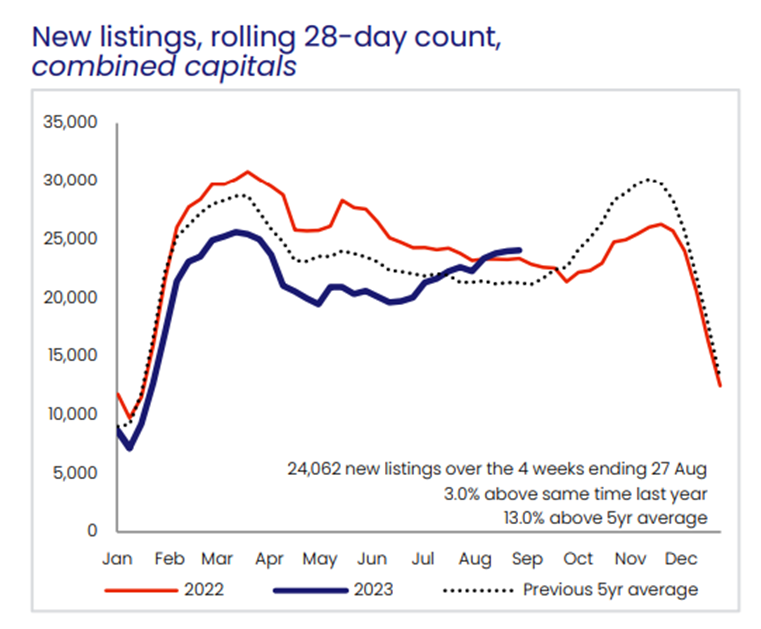

Listing Volumes

From Core Logic:

Lower than average advertised supply levels remain a key factor supporting upwards pressure on home values. Although the flow of new listings have lifted through winter, total advertised supply levels remain -15.5% lower than a year ago across the combined capitals and almost -19% below the previous five-year average.

Tim Lawless: “We have seen vendors becoming more active though winter, which is seasonally unusual,” Mr Lawless commented. “However most of this fresh stock is being absorbed by the market, with the count of total capital city listings rising by only 3.6% over the past two months, despite the flow of new listings jumping 12.9%.”

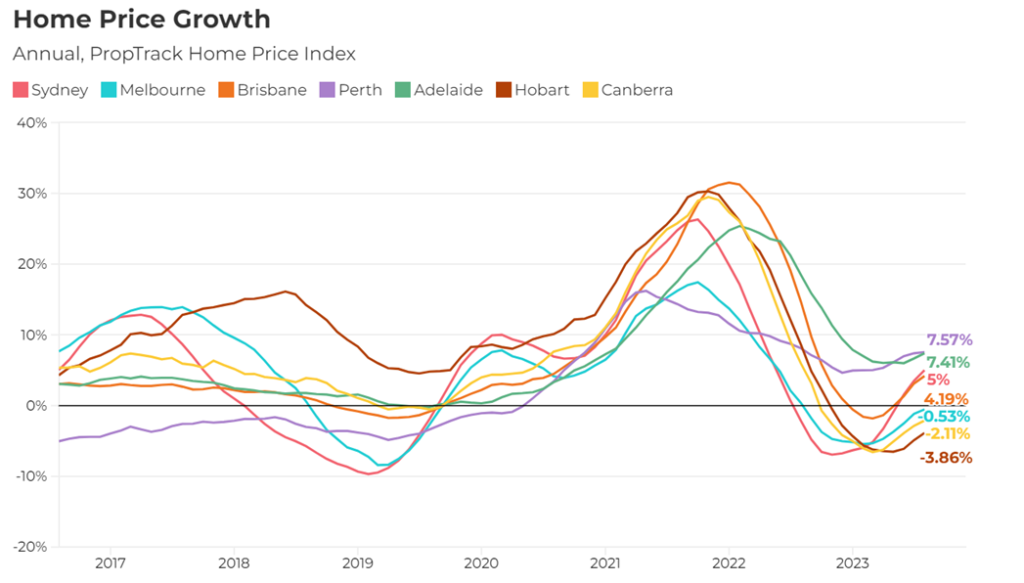

Key Findings From The August 2023 PropTrack Report

- Download the full report

- Prices in Sydney are now 6.19% higher than their trough in November 2022 and are now just 1.29% below the February 2022 peak

- National home prices have reversed much of the decline recorded in 2022, climbing 3.51% from the low in December 2022

- As has been the case for much of the year, regional areas saw slower growth than capital cities. Prices in the capitals are up 4.46% this year, compared to 1.20% for regional areas.

- With capital city markets taking the lead in the 2023 home price recovery and regaining the majority of 2022’s price falls, regional markets have now seen a larger decline from peak despite prices holding up better for much of 2022.